Whale Loses $4.77 Million in Ethereum Short: A Shocking Liquidation Event

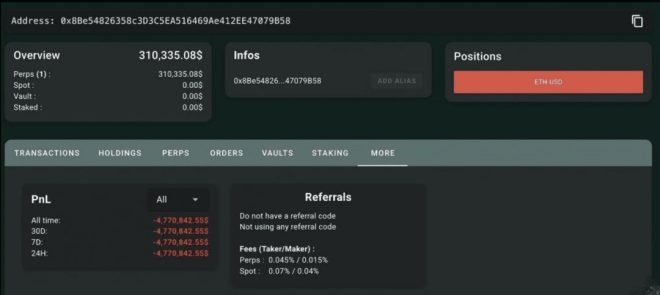

In a dramatic turn of events in the cryptocurrency market, a trader known as a "whale" has reportedly lost a staggering $4.77 million in a short position on Ethereum (ETH) within a mere eight hours. This incident marks one of the most significant liquidation shocks in recent months, showcasing the volatile nature of cryptocurrency trading and the risks involved with leveraged positions.

Understanding the Incident

The whale, who had initially entered the market with a $5 million position, saw their investment plummet to just $300,000 after the liquidation occurred. The sudden drop in value underscores the inherent dangers of short selling, particularly in the highly volatile cryptocurrency market where price fluctuations can be extreme and rapid.

Short Selling Explained

Short selling is a trading strategy that involves borrowing an asset and selling it at the current market price with the hope of buying it back later at a lower price. If the price drops as anticipated, the trader can repay the borrowed asset and pocket the difference. However, if the price rises, as it did in this case with Ethereum, the losses can be substantial and quick, especially when using leverage.

The Role of Leverage in Trading

Leverage allows traders to amplify their positions by borrowing funds to increase their investment size. While this can lead to significant profits if the market moves in the trader’s favor, it can also result in equally substantial losses. In this particular case, the whale’s leveraged position contributed to the rapid decline in their account balance, leading to a forced liquidation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Volatility and Its Impact

The cryptocurrency market is notorious for its volatility. Prices can swing dramatically within hours, driven by a variety of factors including market sentiment, regulatory news, and macroeconomic trends. In this instance, the whale’s loss serves as a potent reminder of how quickly fortunes can change in this digital landscape.

Lessons Learned

This incident highlights several crucial lessons for traders in the cryptocurrency space:

- Risk Management: Effective risk management strategies are essential for anyone engaging in trading, especially in high-volatility environments. Setting stop-loss orders and managing position sizes can help mitigate potential losses.

- Understanding Market Dynamics: Traders should be well-versed in the market conditions and factors influencing asset prices. Keeping abreast of news, trends, and market sentiment can provide valuable insights.

- The Dangers of Leverage: While leverage can enhance potential profits, it also increases risk. Traders need to weigh the benefits against the potential for substantial losses.

- Emotional Discipline: Trading decisions should be based on analysis rather than emotions. Panic selling or over-leveraging in response to market movements can lead to disastrous outcomes.

The Future of Ethereum

Despite the risks highlighted by this incident, Ethereum remains a leading cryptocurrency with a robust ecosystem. Its potential for smart contracts and decentralized applications (dApps) continues to attract investors and developers alike. As the market matures, it is likely that regulatory frameworks will also evolve, potentially providing a more stable environment for trading.

Conclusion

The loss of $4.77 million by a whale in Ethereum shorting serves as a cautionary tale for traders in the cryptocurrency market. It underscores the importance of risk management, understanding market dynamics, and the potential pitfalls of leverage. As the cryptocurrency landscape continues to evolve, both new and experienced traders must remain vigilant and educated to navigate the complexities of this digital frontier.

In the fast-paced world of cryptocurrencies, knowledge, strategy, and emotional control are key to achieving success while mitigating risks. This incident, while unfortunate for the trader involved, serves as a critical reminder of the realities of trading in this exciting yet unpredictable market.

JUST IN:

BREAKING: A whale loses $4.77M in $ETH Short Gone Wrong

GPAW GREP @PawtatoFinanceIn one of the biggest liquidation shocks of the month, a trader just lost over $4.77 million shorting Ethereum — in less than 8 hours.

From $5M to just $300k.

His ETH-USD… pic.twitter.com/qK0jI0ec1P— Optimist (@Optimist_ig) May 10, 2025

JUST IN: BREAKING: A whale loses $4.77M in $ETH Short Gone Wrong

In the wild world of cryptocurrency, the stakes are incredibly high, and the volatility can lead to shocking outcomes. Recently, a trader, often referred to as a “whale” in crypto parlance, faced one of the biggest liquidation shocks of the month. This trader just lost a staggering $4.77 million while shorting Ethereum ($ETH) in less than 8 hours. That’s right—$4.77 million gone in an instant. Imagine waking up to find your portfolio shrunk from $5 million to just $300,000. Ouch!

GPAW GREP @PawtatoFinance

This shocking event was reported by the popular Twitter account @PawtatoFinance, which keeps its followers updated on the latest happenings in the crypto space. Such enormous losses highlight the risks involved in trading cryptocurrencies, especially when using leverage. Leveraged trading can amplify gains, but it can also lead to catastrophic losses, as we’ve just seen.

Understanding the Liquidation Shock

Liquidation is a term that gets thrown around a lot in trading circles, but what does it really mean? In essence, when traders use borrowed funds (leverage) to make trades, their positions can be liquidated if the market moves against them. This means that the broker will automatically close their position to prevent further losses. In this case, it appears that the whale was betting against Ethereum, expecting its price to drop. Unfortunately for this trader, the market had other plans.

What Happened to Ethereum?

The cryptocurrency market is notoriously volatile, with prices that can swing dramatically in short periods. Ethereum, being one of the leading cryptocurrencies, is no exception. The whale’s strategy might have been based on technical analysis or market sentiment that suggested a downturn for Ethereum. However, the market often reacts unpredictably, leading to scenarios where traders find themselves on the losing end.

From $5M to Just $300K

The figures are staggering. A drop from $5 million to $300,000 in less than eight hours means that this whale was highly leveraged, taking positions that far exceeded their actual capital. For those unfamiliar, when you short a cryptocurrency, you are essentially betting that its price will fall. If it rises instead, your losses can pile up quickly. This is exactly what happened here, resulting in a massive liquidation event that wiped out most of the trader’s investment.

Lessons Learned from the Whale’s Loss

So, what can we learn from this jaw-dropping loss? Firstly, it’s crucial to understand the risks associated with high-leverage trading. While the potential for profit can be enticing, the dangers are equally real. Traders need to have a solid risk management strategy in place, including stop-loss orders to limit potential losses. Secondly, staying informed about market trends and news can provide critical insight that might help in making more educated trading decisions.

The Role of Market Sentiment

Market sentiment plays a significant role in the price movements of cryptocurrencies. Traders often react to news, social media trends, and market analysis, which can lead to sudden price changes. In this case, there may have been external factors that influenced the price of Ethereum, leading the whale to believe that shorting the asset was a sound strategy. However, as we’ve seen, the market can be unpredictable, and it’s essential to remain cautious.

The Community Reaction

The cryptocurrency community is buzzing with reactions to this liquidation shock. Many traders are expressing sympathy for the whale, while others are using the opportunity to remind everyone about the importance of responsible trading. It’s a reminder that even the most experienced traders can face significant losses in such a volatile market.

What’s Next for Ethereum?

After such a significant event, many are left wondering what the future holds for Ethereum. Will this be a temporary setback, or will it signal a more profound shift in market sentiment? Analysts will be keeping a close eye on Ethereum’s price movements in the coming days, as traders look for signs of recovery or further decline. As always, it’s essential to do your research and stay informed about the latest developments in the crypto space.

Final Thoughts

This incident serves as a stark reminder of the risks involved in cryptocurrency trading. While the potential for profits is alluring, traders must approach the market with caution and a well-thought-out strategy. For those looking to invest in Ethereum or any other cryptocurrency, it’s crucial to stay updated on market trends and news, understand the risks of leveraged trading, and always be prepared for the unexpected.

In the end, whether you’re a seasoned trader or just starting, the world of cryptocurrency can be thrilling yet treacherous. Keeping a level head and a strategic approach can help you navigate this fast-paced landscape.

“`

This article is designed to be engaging and informative, utilizing conversational language while also embedding relevant links for readers to explore further.