Ghana’s Gold Market Policy Shift: A Summary

In a significant move that could reshape the dynamics of the gold market in West Africa, Ghana has announced a directive requiring all foreign nationals involved in its gold sector to exit by April 30, 2025. This decision is garnering attention not only for its implications on Ghana’s economy but also for its potential impact on the broader regional market, particularly in relation to its neighbor Nigeria.

Understanding the Policy

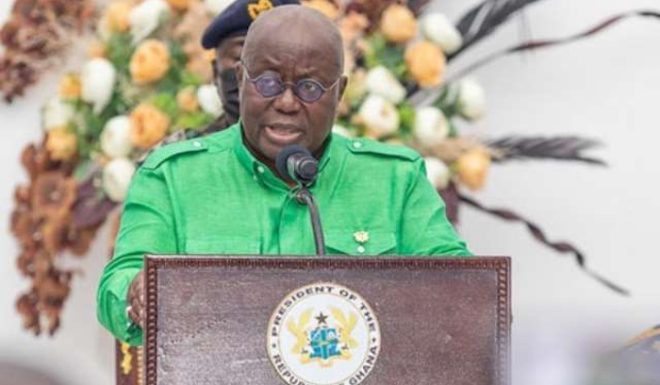

The announcement was made via a tweet from Nigeria Stories, highlighting the urgency and importance of this directive. Ghana’s government aims to consolidate its gold market by prioritizing local involvement and ensuring that the benefits of its rich mineral resources are more directly felt by its citizens. As one of the largest producers of gold in Africa, Ghana’s decision signals a shift towards protecting its national interests and fostering a more sustainable economic environment.

The Rationale Behind the Directive

Ghana’s move can be seen as a response to several factors:

- Economic Empowerment: By limiting foreign participation, Ghana aims to boost local businesses and create job opportunities for its citizens. The government seeks to ensure that the wealth generated from gold mining translates into broader economic benefits for the local population.

- Regulatory Compliance: The gold market has faced challenges related to illegal mining activities and environmental concerns. This policy could help regulate the sector more effectively, ensuring that all participants adhere to local laws and standards.

- National Security: The government may also view foreign involvement in the gold sector as a potential risk to national security, prompting a need for a more controlled and localized approach.

Implications for Foreign Nationals

Foreign nationals currently involved in Ghana’s gold market will face a pressing deadline to exit the sector by April 30, 2025. This move raises several questions for those businesses and individuals:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Operational Transition: Many foreign nationals will need to consider their exit strategies, which may involve selling their stakes, transferring operations to local partners, or relocating to other markets.

- Investment Risks: Existing investments may be at risk, prompting foreign investors to reassess the viability of their operations in Ghana given the new regulatory landscape.

- Market Reactions: As foreign entities begin to withdraw, the market may experience fluctuations in gold prices and investment levels, impacting both local suppliers and consumers.

Regional Impact on the Gold Market

The directive from Ghana is expected to have ripple effects throughout the West African region, particularly in Nigeria, which shares a border with Ghana and has its own burgeoning gold market. The implications may include:

- Increased Competition: With foreign nationals exiting Ghana, there may be increased competition among local businesses to fill the void left by departing entities. This could lead to a more competitive local market but may also challenge existing players to adapt quickly.

- Investment Shifts: Investors seeking opportunities in gold may redirect their focus towards Nigeria or other neighboring countries, potentially leading to increased exploration and mining activities in these regions.

- Collaborative Opportunities: Conversely, there may be opportunities for collaboration between Nigerian and Ghanaian businesses, particularly in areas such as logistics, technology, and resource sharing.

Conclusion

Ghana’s directive for foreign nationals to exit its gold market by April 30, 2025, represents a bold step towards enhancing local participation and ensuring that the benefits of its rich mineral resources are more equitably distributed among its citizens. While the policy aims to foster economic empowerment and regulatory compliance, it also poses challenges for foreign investors and could reshape the regional gold market landscape.

As the deadline approaches, stakeholders in the gold sector, both local and foreign, will need to navigate the complexities of this regulatory shift. For Nigeria, this development presents an opportunity to reassess its own gold market strategies, potentially leading to collaborative efforts that could benefit both nations. The future of Ghana’s gold market, and its impact on the region, is a topic worthy of close attention as these changes unfold.

Key Takeaways

- Ghana’s directive requires foreign nationals in the gold sector to exit by April 30, 2025.

- The policy aims to empower local businesses and create job opportunities while addressing regulatory and environmental concerns.

- Foreign nationals will face significant operational challenges as they navigate their exit strategies.

- The directive is expected to impact the broader West African gold market, with potential shifts in investment and collaboration opportunities.

This policy change serves as a crucial reminder of the complexities involved in natural resource management and the ongoing evolution of the gold market in West Africa. Stakeholders must remain vigilant and adaptive to thrive in this changing landscape.

JUST IN: Nigeria’s neighbor ,Ghana has instructed all foreign nationals involved in its gold market to exit the sector by April 30, 2025. pic.twitter.com/tvGaXXbUxA

— Nigeria Stories (@NigeriaStories) April 16, 2025

JUST IN: Nigeria’s neighbor, Ghana has instructed all foreign nationals involved in its gold market to exit the sector by April 30, 2025.

In a surprising move, Ghana has announced significant changes in its gold market regulations that will impact foreign nationals deeply involved in this lucrative sector. The directive states that all foreign nationals engaged in the gold market must exit the sector by April 30, 2025. This could have profound implications for the mining industry, local economies, and foreign investments in the region.

Understanding Ghana’s Decision

This directive comes amid a backdrop of increasing scrutiny over the activities of foreign nationals in the gold sector. Ghana, known for having the largest gold reserves in West Africa, is positioning itself to assert more control over its natural resources. The government aims to ensure that benefits from these resources are more equitably distributed among its citizens.

For many years, foreign companies and individuals have played a pivotal role in Ghana’s gold mining sector. However, concerns regarding environmental degradation, local community displacement, and insufficient returns from mining activities have been growing. The government’s decision to instruct foreign nationals to exit the gold market is seen as a way to address these issues and foster local ownership in the industry.

The Implications for Foreign Nationals

For foreign nationals currently operating in Ghana’s gold market, the implications of this decision are significant. Many of these individuals and companies have established operations, invested substantial capital, and built relationships within local communities. The exit deadline of April 30, 2025, gives them a little over two years to make adjustments, which can be a challenging task.

Those involved in the gold market will need to consider their options carefully. Some may choose to sell their operations to local investors, while others might decide to wind down their businesses entirely. The challenge lies in navigating the complexities of the local market, understanding regulatory requirements, and ensuring compliance with the new directives.

Local Impact and Economic Considerations

The decision to instruct foreign nationals to exit the gold market is likely to have mixed effects on Ghana’s economy. On one hand, it could lead to increased local participation, which may help boost employment opportunities for Ghanaians. The hope is that local ownership of gold mining operations will lead to more sustainable practices and better economic returns for the communities directly affected by mining activities.

However, on the other hand, this abrupt exit could lead to short-term economic instability. Foreign investments have historically brought in capital, technology, and expertise that significantly contribute to the growth of the mining sector. A sudden withdrawal might create a vacuum that local players may not be able to fill immediately, potentially leading to job losses and economic downturns in regions that rely heavily on mining.

Global Gold Market Reactions

The global gold market is already reacting to Ghana’s announcement. Investors and analysts are keeping a close eye on how this decision may influence gold prices and investment strategies. Ghana’s gold production has been a significant contributor to the global supply chain, and any disruption could have ripple effects throughout the market.

Moreover, this move may prompt other nations with rich mineral resources to consider similar policies, especially if they perceive that Ghana’s approach yields positive outcomes. Countries within the region are already assessing their own foreign investment policies as they strive to balance the benefits of foreign investment with the need for local empowerment.

What Lies Ahead for Ghana’s Gold Sector

As Ghana embarks on this new chapter for its gold sector, the focus will likely shift towards creating a more sustainable and equitable mining industry. The government may implement policies to support local miners, improve regulatory frameworks, and enhance the overall investment climate for domestic players.

Moreover, Ghana’s move could serve as a wake-up call for foreign investors to reconsider their strategies in emerging markets. It highlights the importance of building sustainable partnerships that benefit local communities while also providing returns for investors.

Conclusion

As we look to the future, Ghana’s decision to instruct all foreign nationals involved in its gold market to exit by April 30, 2025, marks a pivotal moment in the country’s mining landscape. It reflects a growing trend among resource-rich nations to reclaim control over their natural resources and ensure that local populations benefit from the wealth generated by these industries. The coming years will be critical in determining how this policy unfolds and what it ultimately means for Ghana, its people, and the global gold market.

For anyone involved in the gold sector, whether locally or internationally, this is a moment of reflection and strategic planning. The landscape of mining is changing, and adaptability will be key to thriving in this new environment. Keep an eye on updates from Ghana as this situation develops, as it will undoubtedly shape the future of the gold market in West Africa and beyond.