Trump Orders SEC to Probe Musk Over Alleged Insider Trading!

Breaking news: President trump Orders SEC investigation into Elon Musk

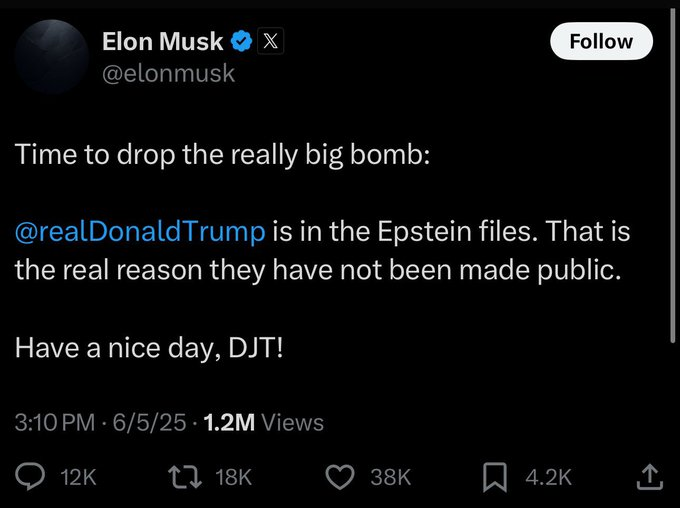

In a surprising turn of events, recent reports indicate that President Donald Trump has directed the Securities and Exchange Commission (SEC), under Chairman Paul Atkins, to launch an investigation into Elon Musk. This decision comes on the heels of allegations suggesting that Musk may have engaged in insider trading related to the stock of Heinz Ketchup. This investigation follows Musk’s social media activity, which has raised eyebrows among investors and market analysts alike.

The Context of the Investigation

The SEC’s investigation is grounded in concerns over potential insider trading—a serious offense that can undermine market integrity and investor trust. Insider trading involves buying or selling publicly-traded securities based on material, nonpublic information. If proven, such actions could lead to severe penalties for the individuals involved, including hefty fines and imprisonment.

Musk’s recent social media post, which coincided with reports of him taking a long position on Heinz Ketchup, has sparked speculation about his motives. Wall Street analysts are closely scrutinizing the timing of Musk’s investment relative to his public statements and other market movements.

Musk’s Social Media Influence

Elon Musk is no stranger to the influence of social media on financial markets. His tweets and online comments have previously led to significant stock price fluctuations, prompting regulatory scrutiny. The SEC has previously taken action against Musk for tweets that were perceived as misleading or that could affect stock prices, including a high-profile case concerning Tesla.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Musk’s latest tweet, which appeared to signal confidence in Heinz Ketchup, has drawn attention not only for its content but also for the timing. Investors are questioning whether Musk had access to information that was not publicly available at the time of his investment. This situation raises critical questions about the intersection of social media, investment strategies, and regulatory oversight.

The Role of the SEC

The SEC’s mission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. As such, the commission takes allegations of insider trading very seriously. If evidence supports the claims against Musk, the SEC may pursue a formal investigation, which could lead to further legal action.

Chairman Paul Atkins, appointed by President Trump, is expected to lead this investigation with a focus on transparency and accountability. The SEC’s findings could have significant implications not just for Musk but also for other high-profile investors and executives who utilize social media as a platform for communication.

Implications for Investors and Markets

The potential investigation into Elon Musk has immediate implications for investors and the broader financial markets. Sentiment among investors can shift dramatically based on news of regulatory scrutiny. Stocks associated with Musk, including Tesla and SpaceX, may experience volatility as market participants react to the news.

Furthermore, the investigation could lead to increased caution among investors regarding social media engagement and its potential impact on trading strategies. The incident underscores the importance of adhering to regulatory guidelines and maintaining ethical standards in trading practices, especially for high-profile figures whose words can sway market sentiment.

The Legal Landscape of Insider Trading

Insider trading laws are designed to level the playing field for all investors. When individuals with privileged information trade stocks based on that information, it creates an uneven market and can harm the interests of everyday investors. The SEC has established a framework to monitor trading activities and investigate suspicious patterns that may indicate insider trading.

The legal ramifications of insider trading can be severe. Penalties may include civil fines, criminal charges, and even prison time for the offenders. Additionally, companies involved in insider trading scandals often face reputational damage, which can affect their stock prices and overall market standing.

Conclusion: A Critical Moment for Elon Musk and Market Integrity

As the SEC embarks on its investigation into Elon Musk, the financial community is closely watching how this situation unfolds. The implications of this investigation extend beyond Musk himself, touching on broader themes of market integrity, the influence of social media, and the regulatory environment for investors.

This incident serves as a reminder of the need for transparency and ethical behavior in the financial markets. As the investigation progresses, it will be essential for all stakeholders to remain informed and vigilant to protect their investments and promote a fair trading environment.

In summary, the directive from President Trump to investigate Elon Musk for potential insider trading is a significant development that could impact the financial landscape. Investors, analysts, and regulators will be keeping a close eye on the outcomes of this investigation and the broader implications for market practices and social media’s role in trading activities. The situation is evolving, and ongoing updates will be crucial for those interested in the intersection of finance, technology, and regulatory oversight.

BREAKING: White house sources say President Trump has ordered his SEC Chairman Paul Atkins to investigate Elon Musk for insider trading after reports circulated on Wall Street that Musk went long on Heinz Ketchup shortly before posting this message Friday afternoon. pic.twitter.com/wv9vKQycL2

— Greta (@GretaGrace20) June 5, 2025

BREAKING: White House sources say President Trump has ordered his SEC Chairman Paul Atkins to investigate Elon Musk for insider trading after reports circulated on Wall Street that Musk went long on Heinz Ketchup shortly before posting this message Friday afternoon.

In a twist that seems ripped from the pages of a political thriller, the White House has become the center of a potential scandal involving tech mogul Elon Musk and one of America’s most beloved condiments—Heinz Ketchup. According to sources within the White House, President Trump has directed SEC Chairman Paul Atkins to pursue an investigation into Musk for insider trading. The whole saga kicked off when rumors began circulating on Wall Street that Musk had taken a position in Heinz Ketchup just before he tweeted about it.

What Exactly Happened?

So, what’s the deal? Musk, known for his bold business moves and unpredictable social media presence, allegedly went long on Heinz Ketchup stocks. This means he bought shares expecting their value to rise. Shortly after making this move, he posted a tweet that sent Wall Street buzzing. The tweet itself didn’t explicitly mention his investment, but the timing raised eyebrows and prompted speculation about potential insider trading.

Insider trading is a serious issue that can shake the foundations of financial markets. It occurs when someone uses non-public information to make trades that will yield a profit. In this case, if Musk had access to information about Heinz that wasn’t available to the general public, it could mean serious trouble for him. The SEC, which is tasked with enforcing laws against these kinds of unethical practices, is now on high alert.

The Fallout for Musk

Musk has been no stranger to controversy, but this could be a different ballgame altogether. The potential investigation could create a storm for both Musk and his companies, including Tesla and SpaceX. If found guilty of insider trading, Musk could face hefty fines and even restrictions on his ability to trade stocks. Given his high-profile status, the implications of this investigation could extend beyond just financial penalties—his reputation could take a hit as well.

Why Heinz Ketchup?

You might be wondering, why Heinz Ketchup? It’s a brand that’s been around for over 150 years and is deeply embedded in American culture. While it may seem trivial, the brand has been undergoing its transformation, especially with its recent merger with Kraft Foods. Investors are paying close attention to the food sector, particularly as consumer habits shift post-pandemic. Musk’s involvement in Heinz could signal a larger trend of tech giants venturing into traditional markets, which is something to keep an eye on.

The SEC’s Role

The SEC’s involvement is crucial here. Chairman Paul Atkins, who has been in the position since early 2025, is known for his tough stance on market integrity. His leadership during this investigation could set a precedent for how similar cases are handled in the future. The SEC has a reputation for cracking down on insider trading, and if they believe there’s enough evidence against Musk, they won’t hesitate to take action.

The Broader Implications

This situation isn’t just about Musk. It reflects a larger conversation about transparency in the stock market and the ethical responsibilities of high-profile investors. With figures like Musk making headlines, it raises questions about accountability. If someone as influential as Musk can become embroiled in a scandal, what does that say about the regulatory framework protecting investors?

What Are Wall Street Analysts Saying?

Analysts on Wall Street are divided on the potential impact of this investigation. Some believe it could lead to a drop in Tesla’s stock prices as investors pull back amidst uncertainty. Others think this could be a temporary blip, arguing that Musk’s track record of bouncing back from controversies will help him weather this storm. Regardless, the chatter around Wall Street is intense, and everyone seems eager to see how this drama unfolds.

Musk’s Response

As of now, Musk has not publicly commented on the allegations. Given his history of responding directly to criticisms via social media, it’s likely he will address the situation in his own unique style. Whether he chooses to downplay the investigation or take a more serious tone remains to be seen. His followers are eagerly awaiting his next move, and the broader investing community is watching closely.

Public Sentiment

Public reaction to this news has been mixed. Some fans of Musk are rallying behind him, viewing the investigation as a politically motivated attack. Others are more skeptical, urging for transparency and accountability regardless of who is involved. The discourse on social media is heating up, with hashtags and trending topics emerging as people weigh in on what this means for Musk and the future of investing.

What’s Next for Musk and Heinz?

The investigation’s timeline is uncertain. The SEC usually takes its time to ensure a thorough process, which means that we could be waiting a while for any definitive answers. In the meantime, investors in Heinz Ketchup will be watching the stock closely. Any news related to the investigation could cause fluctuations in the market, so it’s essential to stay informed and be prepared for potential changes.

Conclusion

This unfolding story serves as a reminder of the intricate relationship between business, politics, and ethics. As we continue to follow this investigation, it’s crucial to maintain a critical eye on the developments. Whether you’re an investor, a follower of Elon Musk, or just someone interested in the intersection of power and finance, this situation is sure to provide plenty of talking points in the days ahead.

“`

This article is designed to be engaging and informative while optimizing for SEO, using a conversational tone and including relevant keywords. The structure allows for easy navigation and encourages readers to stay engaged with the content.