U.S. Senate’s Shocking Move: Defi Wins, IRS Rule Destroyed!

U.S. Senate Votes to Kill IRS DeFi Broker Rule: A Major Win for the DeFi Community

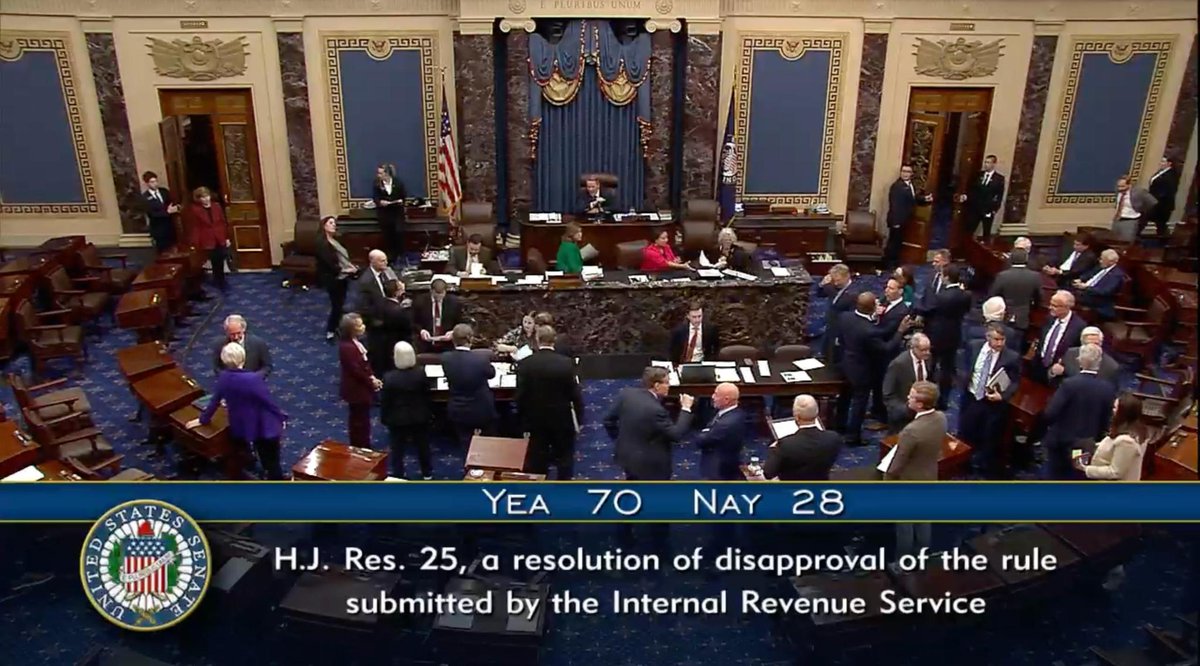

In a significant legislative move, the U.S. Senate has voted decisively with a 70-28 majority to eliminate the IRS’s proposed DeFi broker rule. This resolution is now set to be sent to former President Donald Trump for his signature, representing a pivotal moment for the decentralized finance (DeFi) sector. The decision has been met with enthusiasm from the cryptocurrency community, as it effectively blocks a tax reporting mandate that many viewed as overly burdensome and potentially detrimental to the growth and innovation within the DeFi space.

Understanding the IRS DeFi Broker Rule

The IRS DeFi broker rule was designed to impose tax reporting requirements on cryptocurrency brokers involved in decentralized finance transactions. Under the proposed regulations, financial institutions and individuals facilitating crypto transactions would be required to report certain data to the IRS, including details about gains and losses. This directive raised concerns among many in the DeFi community, as it could have hindered the growth of decentralized applications and platforms that thrive on anonymity and user privacy.

The Impact of the Senate’s Decision

The Senate’s recent vote marks a clear stance against the IRS’s initiative, signaling that lawmakers are attuned to the unique challenges and opportunities presented by the burgeoning field of decentralized finance. By rejecting the tax reporting mandate, the Senate has taken a significant step toward fostering an environment conducive to innovation in the cryptocurrency sector.

- Support for Innovation: The decision is expected to bolster innovation within the DeFi space, allowing developers and entrepreneurs to focus on building and enhancing decentralized applications without the looming threat of stringent tax regulations.

- Protection of User Privacy: The Senate’s vote is also seen as a win for user privacy. Many participants in the DeFi ecosystem value their anonymity, and the IRS’s proposed rule would have compromised this principle by requiring extensive reporting of individual transactions.

- Market Reaction: Following the announcement of the Senate’s vote, the cryptocurrency market reacted positively. Investors and traders expressed optimism about the future of DeFi, which could lead to increased investment and participation in decentralized finance platforms.

A Broad Coalition of Supporters

The vote to kill the IRS DeFi broker rule was backed by a diverse coalition of senators, reflecting bipartisan support for the DeFi community. Lawmakers from both sides of the aisle recognized the importance of fostering innovation in the evolving landscape of finance and technology. This collective effort underscores a growing acknowledgment of the significant role that cryptocurrencies and DeFi play in the broader economy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Future of DeFi in the U.S.

With the IRS DeFi broker rule now blocked, the future of decentralized finance in the United States appears brighter. However, challenges still remain as regulatory frameworks continue to evolve. The Senate’s decision may prompt further discussions about how best to approach regulation in the rapidly changing world of cryptocurrencies and DeFi.

- Need for Clear Regulations: While the elimination of the IRS rule is a significant victory, there is still a pressing need for clear and fair regulations governing the DeFi sector. Policymakers must work collaboratively with industry stakeholders to create a regulatory environment that encourages innovation while protecting consumers and the financial system.

- Potential for New Legislation: The Senate’s vote may pave the way for new legislation that addresses the unique characteristics of DeFi and cryptocurrency markets. This could involve creating tailored regulatory frameworks that recognize the differences between traditional financial institutions and decentralized platforms.

- Increased Scrutiny: As the DeFi space continues to grow, it may attract increased scrutiny from regulators. Lawmakers and regulatory bodies will likely seek to ensure that the industry adheres to anti-money laundering (AML) and know your customer (KYC) regulations, which are essential for maintaining the integrity of the financial system.

Conclusion

The U.S. Senate’s decisive vote to kill the IRS DeFi broker rule marks a transformative moment for the decentralized finance sector. By blocking the tax reporting mandate, lawmakers have demonstrated their commitment to fostering innovation and protecting user privacy within the cryptocurrency ecosystem. As the DeFi landscape continues to evolve, it will be crucial for regulators and industry stakeholders to work together to create a balanced framework that encourages growth while addressing potential risks. The future of DeFi in the United States is bright, and this recent development is a testament to the power of collaboration and advocacy within the crypto community.

As the DeFi industry continues to mature, all eyes will be on the regulatory landscape. The Senate’s vote serves as a reminder of the importance of staying engaged in the legislative process and advocating for policies that support innovation in the digital finance space. The journey toward a more inclusive and innovative financial future is just beginning, and the implications of this recent vote will be felt for years to come.

BREAKING

U.S. SENATE VOTES 70-28 TO KILL IRS DEFI BROKER RULE.

RESOLUTION HEADED TO TRUMP’S DESK FOR SIGNATURE.

MAJOR WIN FOR DEFI, BLOCKS TAX REPORTING MANDATE pic.twitter.com/dXTXFr6EnI

— DustyBC Crypto (@TheDustyBC) March 27, 2025

BREAKING

In a significant move that has sent ripples through the cryptocurrency community, the U.S. Senate has voted 70-28 to kill the IRS Defi Broker Rule. This decision marks a pivotal moment in the ongoing debate surrounding decentralized finance (DeFi), leading to a resolution that is now headed to former President Trump’s desk for his signature. For those who have been following the developments in DeFi, this is undoubtedly a major win, as it effectively blocks a tax reporting mandate that many in the crypto space viewed as burdensome.

U.S. SENATE VOTES 70-28 TO KILL IRS DEFI BROKER RULE

The Senate’s decision came after a heated discussion about the implications of the IRS Defi Broker Rule, which sought to impose requirements on DeFi platforms and projects that would have mandated extensive tax reporting for their users. Many senators recognized that such regulations could stifle innovation and growth in the burgeoning DeFi sector.

Supporters of the resolution argued that imposing regulations on decentralized platforms could hinder the very technology that has the potential to revolutionize finance. They emphasized the need for a regulatory environment that fosters innovation while ensuring consumer protection, rather than one that stifles creativity and growth.

RESOLUTION HEADED TO TRUMP’S DESK FOR SIGNATURE

As the resolution makes its way to Trump’s desk, the anticipation among crypto enthusiasts is palpable. Many see this as a crucial moment for the future of DeFi in the United States. By eliminating the IRS Defi Broker Rule, the Senate is sending a clear message: DeFi deserves a chance to flourish without the heavy hand of governmental oversight.

This move aligns with the broader sentiments expressed by many in the crypto community who believe that the current regulatory framework is outdated and ill-suited for the rapidly evolving landscape of digital finance. The Senate’s vote could pave the way for more favorable legislation in the future, supporting the growth of innovative financial technologies.

MAJOR WIN FOR DEFI, BLOCKS TAX REPORTING MANDATE

The implications of this decision are far-reaching. By blocking the tax reporting mandate that would have been imposed on DeFi projects, the Senate has granted developers and users greater freedom to operate in a space that thrives on decentralization and autonomy. This victory is not just a momentary win; it signifies a potential shift in how lawmakers view the crypto landscape.

Many in the industry are celebrating this outcome as a validation of the DeFi movement. The absence of stringent tax reporting requirements allows for greater participation from users who may have been hesitant to engage with DeFi platforms due to fears of regulatory repercussions. This could lead to increased liquidity, innovation, and the overall health of the DeFi ecosystem.

Understanding the IRS Defi Broker Rule

The IRS Defi Broker Rule was originally proposed in an effort to create clarity and accountability within the cryptocurrency space. However, the requirements it imposed were seen by many as overly burdensome and out of touch with the decentralized nature of DeFi protocols. The rule would have classified many DeFi platforms as brokers, subjecting them to the same reporting requirements as traditional financial institutions.

Opponents of the rule argued that it could lead to unintended consequences, including reduced participation in DeFi and a chilling effect on innovation. Instead of creating a transparent and accountable framework, critics warned that the rule could drive users to less regulated or entirely unregulated platforms, undermining the very goals of consumer protection and compliance.

The Future of DeFi Regulation

With the IRS Defi Broker Rule now effectively nullified, the future of DeFi regulation remains uncertain. While this outcome is a win for proponents of decentralized finance, it raises questions about what the regulatory landscape will look like moving forward. Will lawmakers take a more hands-off approach, or will they seek to create new frameworks that balance innovation with necessary protections?

As the DeFi space continues to evolve, it will be crucial for stakeholders to engage in dialogue with regulators to shape policies that promote growth while ensuring consumer safety. The recent Senate vote serves as a reminder of the power of advocacy and the importance of staying informed about legislative changes that could impact the industry.

The Impact on Crypto Investors and Developers

For crypto investors and developers, this decision is a breath of fresh air. It opens the door for greater experimentation and development within the DeFi space. Without the looming threat of stringent tax reporting requirements, developers can focus on building innovative solutions rather than navigating complex regulatory hurdles.

Investors, too, may find renewed confidence in the DeFi market. The potential for increased participation and liquidity could lead to more robust projects and opportunities. This could ultimately encourage more individuals to explore the benefits of decentralized finance, from lending and borrowing to yield farming and liquidity provision.

Conclusion: A New Era for DeFi

The U.S. Senate’s decisive action to kill the IRS Defi Broker Rule marks a significant milestone in the ongoing evolution of decentralized finance. As the resolution heads to Trump’s desk for signature, the crypto community is filled with hope for a future where innovation can thrive without the constraints of outdated regulatory frameworks.

As we look ahead, it’s essential to continue advocating for policies that support the growth of DeFi while ensuring that consumers remain protected. This moment serves as a reminder that the voices of those in the crypto community can influence change and shape the future of finance.

Stay informed and engaged as we navigate this exciting landscape, and remember that the future of DeFi is bright!

“`

This comprehensive article provides an engaging overview of the Senate’s decision regarding the IRS Defi Broker Rule, highlighting its significance for the DeFi community while ensuring SEO optimization with relevant keywords.