BREAKING: TensorTrade Ignites Controversy in Algorithmic Trading!

Introduction to TensorTrade: A Revolutionary Python Library for Algorithmic Trading

In the ever-evolving landscape of financial technology, algorithmic trading has emerged as a significant player, leveraging advanced data analysis and automation to execute trades at unprecedented speeds. Recently, a groundbreaking development in this field has come to light: TensorTrade, an open-source Python library designed specifically for trading using Reinforcement Learning (RL). This innovative framework offers traders and developers an efficient, flexible, and scalable approach to building sophisticated trading systems.

What is TensorTrade?

TensorTrade is a comprehensive Python library that aims to simplify the integration of Reinforcement Learning into trading strategies. It provides a robust and modular architecture that enables users to create, test, and deploy algorithmic trading agents with ease. The library is designed to facilitate the development of trading systems that can learn from past market behavior and adapt to changing market conditions.

Key Features of TensorTrade

1. Open-Source Framework

As an open-source library, TensorTrade encourages collaboration and community input, allowing developers to contribute to its ongoing improvement. This transparency fosters innovation and ensures that the library remains up-to-date with the latest advancements in Reinforcement Learning and trading methodologies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

2. Reinforcement Learning Integration

At the core of TensorTrade is its focus on Reinforcement Learning, a subset of machine learning that enables agents to learn optimal trading strategies through trial and error. By employing RL techniques, users can build agents that learn from their experiences, adjusting their strategies based on the rewards they receive from their actions in the market.

3. Modular Architecture

TensorTrade’s modular design allows users to customize various components of their trading systems, including environments, agents, and strategies. This flexibility enables traders to tailor their systems to specific market conditions, asset classes, or trading styles, enhancing the overall effectiveness of their strategies.

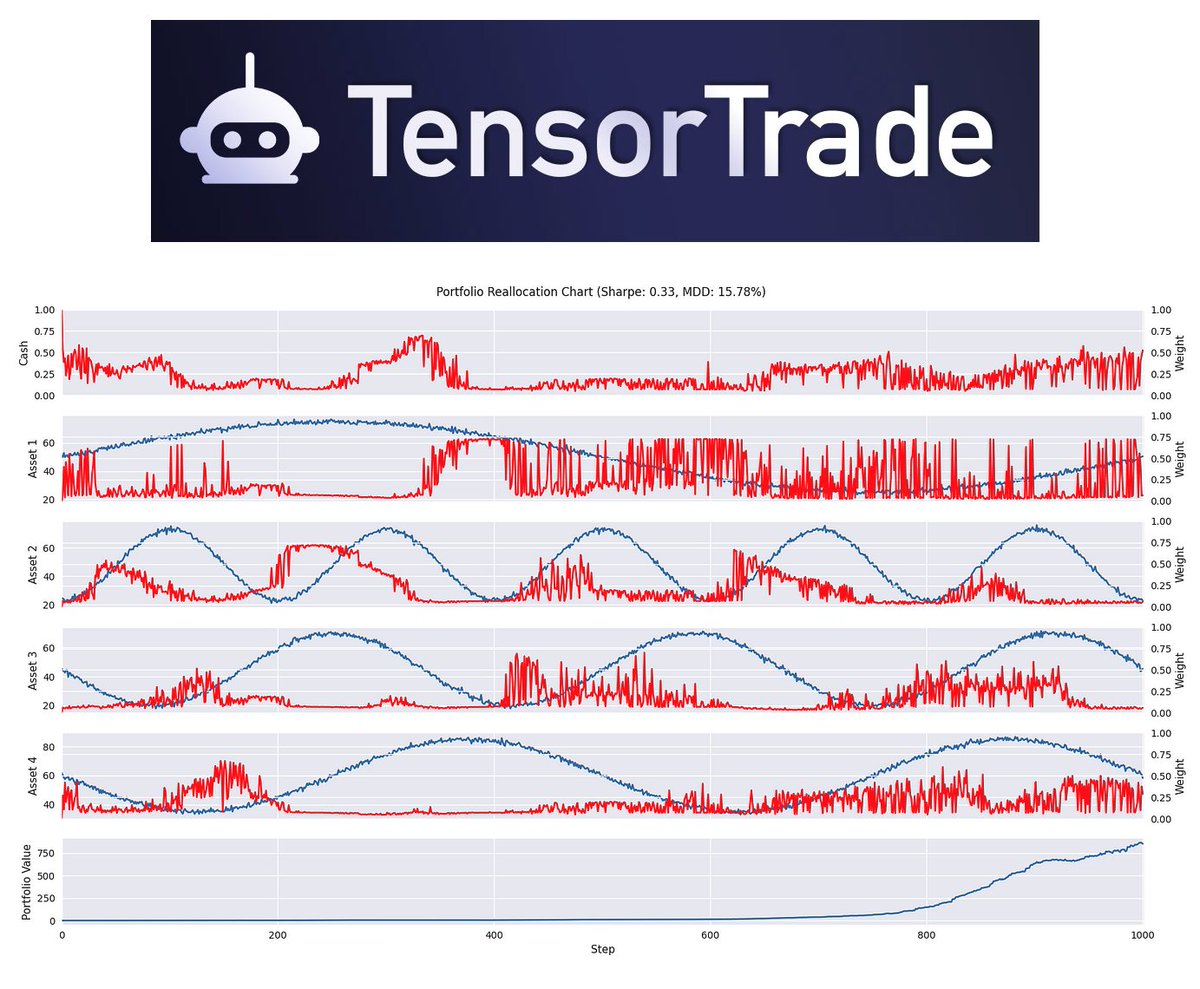

4. Backtesting and Simulation

One of the critical aspects of algorithmic trading is the ability to backtest strategies against historical data. TensorTrade provides built-in capabilities for simulating trading environments, allowing users to evaluate their agents’ performance before deploying them in live markets. This feature helps traders identify potential weaknesses in their strategies and make necessary adjustments.

5. Support for Multiple Data Sources

TensorTrade is designed to work with various data sources, including cryptocurrency exchanges, stock markets, and Forex platforms. This versatility enables traders to develop strategies across different asset classes, making it a valuable tool for a wide range of trading applications.

Why Choose TensorTrade for Algorithmic Trading?

Enhanced Learning Capabilities

The integration of Reinforcement Learning in TensorTrade allows trading agents to develop more sophisticated strategies compared to traditional rule-based systems. By continuously learning from their environment, these agents can adapt to changing market conditions and optimize their performance over time.

Community-Driven Development

As an open-source project, TensorTrade benefits from a vibrant community of developers and traders who contribute to its ongoing development. This collaborative environment fosters innovation and allows users to share insights, strategies, and improvements, creating a wealth of knowledge that can be leveraged by all.

Flexibility and Customization

The modular architecture of TensorTrade allows for extensive customization, enabling users to design and implement trading strategies that align with their specific goals and risk tolerance. This flexibility makes TensorTrade suitable for both novice traders looking to experiment with algorithmic trading and seasoned professionals seeking to optimize their existing strategies.

Robust Backtesting Tools

With its built-in backtesting and simulation features, TensorTrade allows users to rigorously evaluate their trading strategies against historical data. This capability is crucial for identifying the strengths and weaknesses of various approaches, ultimately leading to more informed decision-making when deploying strategies in live markets.

Getting Started with TensorTrade

For those interested in exploring TensorTrade, getting started is straightforward. The library is well-documented, providing comprehensive guides and tutorials to help users navigate its features. Here are some steps to begin your journey with TensorTrade:

1. Installation

TensorTrade can be easily installed using Python’s package manager, pip. Users can simply execute the following command in their terminal:

pip install tensortrade<br />

```<br />

<br />

#### 2. Explore Documentation<br />

<br />

Once installed, users can access the official TensorTrade documentation, which offers detailed explanations of the library's components, usage examples, and best practices for building trading agents.<br />

<br />

#### 3. Build Your First Trading Agent<br />

<br />

With the documentation as a guide, users can start building their first trading agent by defining the trading environment, selecting an RL algorithm, and customizing their agent's parameters. The modular nature of TensorTrade allows for easy experimentation with different configurations.<br />

<br />

#### 4. Backtest and Optimize<br />

<br />

After constructing a trading agent, users can leverage the backtesting tools within TensorTrade to evaluate their strategy's performance. This process involves simulating trades based on historical data and analyzing the results to identify areas for improvement.<br />

<br />

#### 5. Deploy and Monitor<br />

<br />

Once satisfied with the agent's performance, traders can deploy their strategies in live markets. TensorTrade's architecture supports real-time monitoring, enabling users to track their agent's performance and make adjustments as necessary.<br />

<br />

### Conclusion<br />

<br />

TensorTrade marks a significant advancement in the field of algorithmic trading, offering a powerful and flexible framework for developing trading agents that leverage Reinforcement Learning. Its open-source nature, modular architecture, and robust backtesting capabilities make it an invaluable tool for traders of all experience levels. As the financial markets continue to evolve, TensorTrade stands out as a crucial resource for those looking to harness the power of AI in their trading strategies. Whether you're an aspiring trader or a seasoned professional, TensorTrade provides the tools you need to succeed in the dynamic world of algorithmic trading.

BREAKING: A new Python library for algorithmic trading.

Introducing TensorTrade: An open-source Python framework for trading using Reinforcement Learning (AI) pic.twitter.com/GdtZCPu1We

— Quant Science (@quantscience_) April 28, 2025

BREAKING: A new Python library for algorithmic trading.

Big news, everyone! The world of algorithmic trading just got a major upgrade with the introduction of TensorTrade. This open-source Python framework is designed specifically for trading using Reinforcement Learning (AI). If you’re a trader or someone interested in using AI to enhance your trading strategies, you’re in for a treat. TensorTrade is here to revolutionize how we approach trading!

What is TensorTrade?

TensorTrade is an innovative Python library that allows users to implement and experiment with reinforcement learning in the context of trading. It combines the flexibility of Python with powerful AI techniques, enabling traders to create sophisticated trading algorithms that can learn and adapt over time. Unlike traditional trading systems, TensorTrade empowers you to harness machine learning models that continually improve their performance based on market data.

What’s really exciting is that TensorTrade is open-source. This means that not only can you use it for your own trading strategies, but you can also contribute to its development, share your discoveries, or customize it to fit your unique needs. It’s like a community-driven project that is set to grow and evolve with the contributions of its users!

The Power of Reinforcement Learning in Trading

You might be wondering, why reinforcement learning? Well, it’s a fascinating area in the field of machine learning where an agent learns to make decisions by taking actions in an environment to maximize a reward. In the trading context, the agent can learn from historical market data, testing various strategies, and adjusting its approach based on what works best. This adaptive learning process can lead to smarter trading decisions that traditional algorithms might miss.

TensorTrade utilizes this principle by allowing users to define their trading environments, strategies, and reward mechanisms. Whether you’re trading stocks, cryptocurrencies, or forex, the framework is versatile enough to handle different types of market scenarios. You can create custom indicators, define your own profit and loss calculations, and much more!

Getting Started with TensorTrade

So, how do you get started with TensorTrade? First off, you’ll need to have a basic understanding of Python and some familiarity with machine learning concepts. Don’t worry if you’re new to these topics; there are plenty of resources available to help you along the way.

To install TensorTrade, you can easily do so using pip, Python’s package installer. Just run the following command in your terminal:

pip install tensortradeOnce you have TensorTrade installed, you can begin exploring its features. The library comes with several built-in environments and strategies to help you start trading right away. You can also dive into the documentation provided on their official website, which offers tutorials and examples to guide you through the setup process.

Building Your First Trading Strategy

When you’re ready to build your first trading strategy, you’ll want to define the environment in which your agent will operate. This involves setting up the market data, and your trading strategy, and defining the reward system. TensorTrade provides a flexible structure that allows you to easily modify these components.

For instance, you can choose to use historical price data to simulate trades, or you can connect to live market feeds to trade in real-time. The choice is yours! You can even implement various reinforcement learning algorithms like Deep Q-Learning or Proximal Policy Optimization, to find the best fit for your trading style.

Community and Collaboration

One of the best parts about TensorTrade being an open-source project is the community that surrounds it. You’re not just using a tool; you’re joining a network of like-minded traders and developers who share insights, improvements, and strategies.

Engaging with the community can help you learn faster, discover new techniques, and even collaborate on projects. Whether you’re sharing your breakthroughs on forums, contributing to the codebase, or just seeking advice, you’ll find that the TensorTrade community is supportive and eager to help.

Advantages of Using TensorTrade

Now that you have a taste of what TensorTrade can do, let’s highlight some of its key advantages:

- Open Source: As mentioned, being open-source means you can customize and enhance the library as needed.

- Flexibility: TensorTrade is designed to be adaptable, allowing you to implement various trading strategies and algorithms.

- Community Support: The active community means you’re never alone on your trading journey.

- Advanced AI Techniques: Leverage the power of reinforcement learning to create smarter trading algorithms.

- Extensive Documentation: The comprehensive documentation makes it easy for newcomers to get started and for experienced users to delve deeper.

Challenges and Considerations

While TensorTrade is a powerful tool, it’s essential to approach it with the right mindset. Algorithmic trading, especially with reinforcement learning, can be complex. It requires a solid understanding of both trading principles and machine learning techniques.

Moreover, market conditions can change rapidly, and what works today may not work tomorrow. Always be prepared to adapt your strategies and keep learning. It’s also crucial to perform thorough backtesting before deploying any trading algorithm in a live environment to minimize risks.

The Future of Algorithmic Trading

As we look ahead, algorithmic trading is poised to become even more sophisticated with advancements in AI and machine learning. TensorTrade is at the forefront of this evolution, providing traders with the tools they need to stay competitive in an ever-changing market landscape.

Whether you’re a seasoned trader or just starting, embracing technologies like TensorTrade can significantly enhance your trading capabilities. The ability to automate and optimize your trading strategies using AI is not just a trend; it’s becoming a standard in the industry.

Join the Revolution!

If you’re interested in algorithmic trading, now is the time to dive into TensorTrade. The framework offers an exciting opportunity to leverage AI in your trading strategies while being part of a vibrant community of innovators and traders. Don’t just watch from the sidelines; jump in, experiment, and see how TensorTrade can transform your trading experience!

For more information on TensorTrade, check out their official website and start your journey into the world of AI-driven trading today!

“`