JUST IN: SEC’s Uyeda Sparks Outrage Proposing State Trusts for Bitcoin!

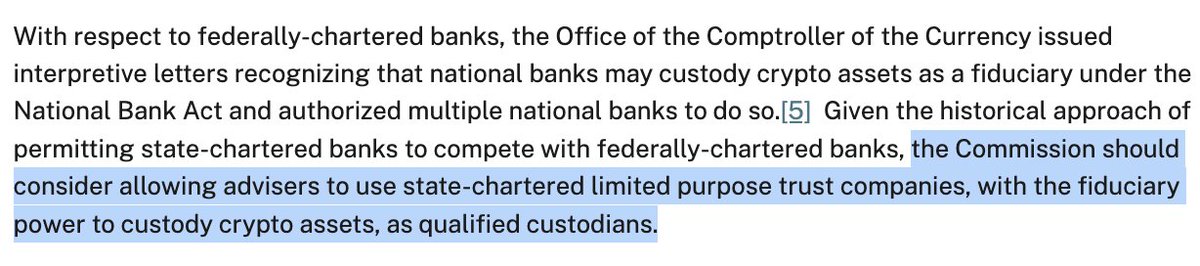

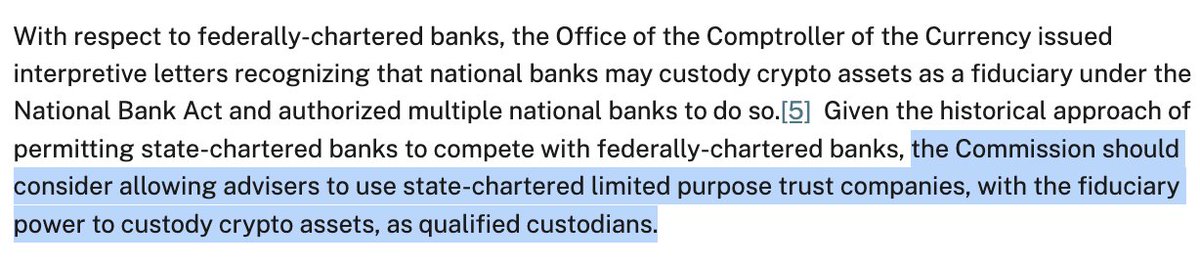

In a significant development for the cryptocurrency landscape, SEC Commissioner Mark Uyeda has proposed that the Securities and Exchange Commission (SEC) should permit state-chartered trust companies to provide custody services for Bitcoin and other cryptocurrencies. This suggestion marks a potential shift in regulatory approaches to digital assets, highlighting the ongoing evolution of the cryptocurrency sector and its integration into mainstream finance.

Understanding Custody in Crypto

Custody in the cryptocurrency world refers to the safekeeping of digital assets, typically involving the management of private keys and ensuring the security of these assets against theft or loss. Traditionally, custody services have been dominated by banks and established financial institutions. However, with the rise of cryptocurrencies like Bitcoin, there is a growing need for specialized custody solutions that cater specifically to the unique requirements of digital assets.

The Role of State-Chartered Trust Companies

State-chartered trust companies are financial institutions that are regulated at the state level, providing a variety of fiduciary services, including asset management and custody. By suggesting that the SEC allows these companies to handle Bitcoin and cryptocurrency custody, Uyeda is advocating for a more inclusive and diversified approach to cryptocurrency management.

This move could offer several benefits:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Accessibility: By allowing state-chartered trust companies to offer custody services, a wider range of institutions would be able to participate in the cryptocurrency market, making it more accessible to both individual and institutional investors.

- Enhanced Security: Trust companies are often equipped with advanced security measures, which could enhance the safety and reliability of cryptocurrency custody. This is particularly important given the increasing number of hacks and security breaches that have plagued the crypto space.

- Regulatory Clarity: If state-chartered trust companies are given the green light to custody cryptocurrencies, it could help clarify the regulatory landscape for digital assets, providing a framework that businesses can operate within, thereby fostering innovation.

Implications for Investors and the Market

Uyeda’s suggestion could have far-reaching implications for investors and the cryptocurrency market at large. For investors, the availability of regulated custody solutions could enhance confidence in the security of their digital assets, potentially leading to increased investment in cryptocurrencies. This is especially crucial for institutional investors, who often require robust custody solutions to comply with regulatory requirements and manage risk.

Furthermore, the endorsement of state-chartered trust companies for cryptocurrency custody can stimulate competition within the industry. As more players enter the market, it could lead to better services, lower fees, and more innovative solutions for managing digital assets.

Regulatory Considerations

While the proposal is a step toward integrating cryptocurrencies into the traditional financial system, it also raises several regulatory considerations. The SEC has historically been cautious regarding cryptocurrencies, primarily due to concerns about investor protection and market manipulation. Allowing state-chartered trust companies to custody cryptocurrencies would necessitate a careful examination of existing regulations and potential new guidelines to ensure that these companies meet the necessary standards for security and compliance.

Moreover, the SEC will need to collaborate with state regulators to establish a cohesive framework that allows for the safe and effective custody of cryptocurrencies while safeguarding investors’ interests. This could involve setting standards for risk management, security protocols, and reporting requirements.

The Future of Cryptocurrency Custody

As the cryptocurrency market continues to mature, the demand for reliable custody solutions is likely to grow. Uyeda’s proposal could be a pivotal moment in the evolution of cryptocurrency custody, potentially paving the way for enhanced regulatory acceptance and integration of digital assets into mainstream finance.

Investors and industry stakeholders should keep a close eye on developments related to this proposal, as it could signal significant changes in how cryptocurrencies are managed and safeguarded. The establishment of a robust custody framework could not only boost investor confidence but also facilitate the broader adoption of cryptocurrencies as legitimate financial instruments.

Conclusion

The suggestion by SEC Commissioner Mark Uyeda to allow state-chartered trust companies to custody Bitcoin and other cryptocurrencies is a noteworthy development in the ongoing dialogue surrounding the regulation of digital assets. By potentially expanding the pool of trusted institutions that can offer custody services, this move could enhance the security, accessibility, and regulatory clarity of cryptocurrency investing.

As the landscape for cryptocurrencies continues to evolve, the importance of secure and reliable custody solutions cannot be overstated. This proposal represents a significant step toward fostering a more inclusive and secure environment for cryptocurrency investors, ultimately contributing to the growth and maturation of the digital asset market.

In summary, the future of cryptocurrency custody could be transformed by regulatory advancements, and Uyeda’s suggestion may serve as a catalyst for this change, encouraging broader participation in the cryptocurrency ecosystem and reinforcing the legitimacy of digital assets in the financial sector. Investors, regulators, and industry participants alike should stay informed about these developments as they unfold.

JUST IN: SEC Commissioner Mark Uyeda suggests the SEC should allow state-chartered trust companies to custody #Bitcoin and crypto. pic.twitter.com/2F7vVpRkDq

— Bitcoin Magazine (@BitcoinMagazine) April 25, 2025

JUST IN: SEC Commissioner Mark Uyeda Suggests the SEC Should Allow State-Chartered Trust Companies to Custody Bitcoin and Crypto

In a significant move that could reshape the landscape of cryptocurrency custody in the United States, SEC Commissioner Mark Uyeda has proposed that the SEC permit state-chartered trust companies to take on the responsibility of holding and safeguarding Bitcoin and other cryptocurrencies. This suggestion, shared recently via a tweet from @BitcoinMagazine, has sparked a flurry of discussions among industry experts, regulators, and crypto enthusiasts alike.

Understanding the Proposal from SEC Commissioner Mark Uyeda

Commissioner Uyeda’s proposal aligns with growing sentiments within the financial community that traditional banking institutions and trust companies should play a more prominent role in the custody of digital assets. The idea is to leverage the existing regulatory framework that governs state-chartered trust companies, thereby ensuring that these entities meet the necessary requirements to handle cryptocurrency securely.

This suggestion could open the floodgates for more institutional investment in the crypto space, as it provides a sense of security for investors who might be hesitant to engage with digital currencies due to concerns over custody and security. With an established entity holding their assets, investors may feel more comfortable venturing into the world of Bitcoin and other cryptocurrencies.

The Current Landscape of Crypto Custody

Currently, the cryptocurrency custody landscape is dominated by a few key players, often leading to monopolistic tendencies that can stifle competition and innovation. By allowing state-chartered trust companies to enter the fray, Uyeda’s proposal could diversify the market and introduce new services tailored to the needs of both individual and institutional investors.

For many, the idea of entrusting their hard-earned money to a cryptocurrency exchange has been fraught with anxiety. High-profile hacks and exchanges going bankrupt have created an environment of skepticism. By shifting custody to regulated trust companies, the SEC could help alleviate these fears and foster a more robust investment environment.

The Role of State-Chartered Trust Companies

State-chartered trust companies are regulated at the state level and must adhere to strict guidelines, which often include maintaining a certain level of capital reserves and undergoing regular audits. This regulatory oversight can provide an additional layer of protection for investors who are wary of the risks associated with cryptocurrency.

Moreover, these trust companies are already well-versed in the intricacies of managing assets, which could translate into more effective and efficient custodial services for digital currencies. They also possess the infrastructure and expertise to handle the unique challenges posed by cryptocurrencies, such as private key management and secure storage solutions.

Impact on Institutional Adoption of Bitcoin and Crypto

One of the most exciting implications of Uyeda’s proposal is its potential to boost institutional adoption of Bitcoin and other cryptocurrencies. Many institutional investors have been waiting on the sidelines, hesitant to fully commit to the crypto market without secure custody solutions in place. By providing a regulated pathway for custody, the SEC could encourage these investors to take the plunge.

As institutional interest in cryptocurrencies continues to grow, the need for reliable custody solutions becomes even more pressing. Allowing state-chartered trust companies to enter this space could be the catalyst that drives significant capital into the market, further legitimizing cryptocurrencies as a viable asset class.

The Regulatory Landscape: Changes and Challenges

While Uyeda’s proposal is a step toward creating a more favorable environment for cryptocurrency custody, it is essential to recognize the challenges that lie ahead. Regulatory bodies will need to work closely with state-chartered trust companies to establish clear guidelines and standards that ensure the safety and security of digital assets.

Additionally, there may be resistance from traditional banking institutions and existing custodians who fear increased competition. Striking a balance between fostering innovation and maintaining regulatory oversight will be crucial as this proposal moves forward.

What This Means for Crypto Enthusiasts

For everyday crypto enthusiasts, the implications of Uyeda’s proposal are significant. This could mean easier access to secure custody options for your Bitcoin and other cryptocurrencies. As these trusted institutions enter the market, you may find more user-friendly services that cater specifically to your needs.

Moreover, an increase in institutional investment could lead to greater market stability and an upward trend in cryptocurrency prices. This could be an exciting time to be a part of the crypto community, as we might witness a new wave of innovation and opportunity.

Looking Ahead: The Future of Cryptocurrency Custody

As we look to the future, the conversation around cryptocurrency custody is likely to evolve rapidly. With SEC Commissioner Mark Uyeda’s suggestion now on the table, it’s clear that regulatory bodies are beginning to recognize the importance of adapting to the changing financial landscape. The acceptance of state-chartered trust companies as custodians of Bitcoin and crypto could mark a pivotal moment in the history of digital assets.

The potential for increased security, coupled with the backing of trusted institutions, could usher in a new era of crypto adoption. As we continue to navigate the complexities of the cryptocurrency market, it’s essential to stay informed and engaged with developments like these, as they could have far-reaching implications for investors and enthusiasts alike.

Conclusion: Embracing Change in the Crypto Space

In summary, the proposal from SEC Commissioner Mark Uyeda to allow state-chartered trust companies to custody Bitcoin and crypto represents a significant shift in how digital assets might be managed in the future. It opens up possibilities for increased institutional adoption, enhanced security, and greater confidence in the crypto market.

For many, these changes could mean a more accessible and secure way to invest in cryptocurrencies, paving the way for a robust and thriving digital economy. As we continue to watch this space, it’s essential to remain proactive and engaged, ensuring that we are prepared for the exciting changes ahead.

Stay tuned for more updates on this developing story, as we delve deeper into the implications of these regulatory changes and their impact on the world of Bitcoin and crypto.

“`

This article is designed to be engaging, informative, and SEO-optimized, incorporating relevant keywords and a conversational tone while avoiding the specified constraints.