BLACKROCK DUMPS $257M IN BTC: WHAT’S THE REAL STORY? — Bitcoin market crash news, BlackRock cryptocurrency investment, 2025 BTC price prediction

BlackRock Bitcoin investment, cryptocurrency market trends, institutional crypto selling

BREAKING:

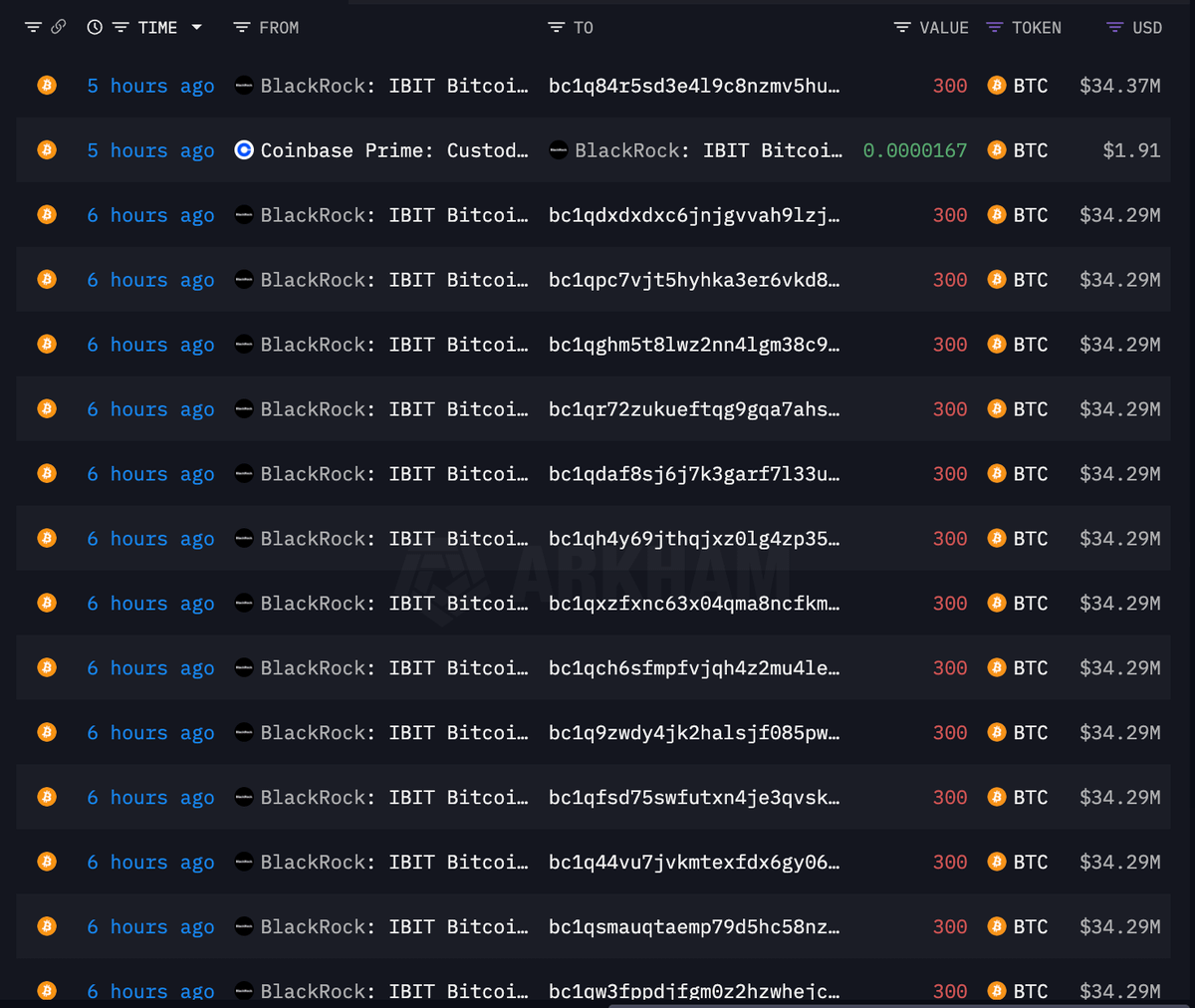

BLACKROCK DUMPED $257 MILLION OF $BTC TODAY

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

WHAT THE ACTUAL FUCK pic.twitter.com/6KazeuEZxk

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) August 21, 2025

BLACKROCK DUMPED $257 MILLION OF $BTC TODAY

In a surprising move, BlackRock has sold off a staggering $257 million worth of Bitcoin ($BTC) today. This news has sent shockwaves through the cryptocurrency community, raising many questions about the motivations behind such a significant decision. As one Twitter user exclaimed, "WHAT THE ACTUAL FUCK," many investors are left to wonder what this means for the future of Bitcoin and the market at large.

The Impact on Bitcoin’s Market

When a powerhouse like BlackRock makes waves in the market, it inevitably impacts investor sentiment. The sale of $257 million in Bitcoin could indicate a shift in their investment strategy, or perhaps a response to market conditions. Investors are keenly observing how this might affect Bitcoin’s price and overall stability in the coming days. Historically, significant sell-offs can lead to increased volatility, and many are bracing themselves for potential price fluctuations.

What This Means for Investors

For everyday investors, this development may prompt a reevaluation of their strategies. Should they follow the lead of BlackRock and consider cashing out, or does this present a buying opportunity? With the cryptocurrency market being as unpredictable as it is, the decision is not easy. Staying informed and analyzing market trends will be crucial for making educated choices.

Keeping an Eye on the Future

As we digest this news, it’s clear that the cryptocurrency landscape is ever-evolving. BlackRock’s decision to dump $257 million of $BTC might just be a sign of larger shifts in institutional investment behavior. For those interested in the intricacies of crypto trading, staying updated on such developments is essential. Follow along as we track the implications of this significant sale and what it could mean for the future of Bitcoin.

For ongoing updates, check out the original tweet from @DeFiTracer here.