Wall Street’s Bold Bet: Are Hedge Funds Tanking ETH? — shorting cryptocurrency, hedge fund strategies 2025, Ethereum market volatility

hedge fund short positions, Ethereum market analysis, cryptocurrency investment trends

JUST IN:

WALL STREET HEDGE FUNDS ARE SHORTING ETH

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

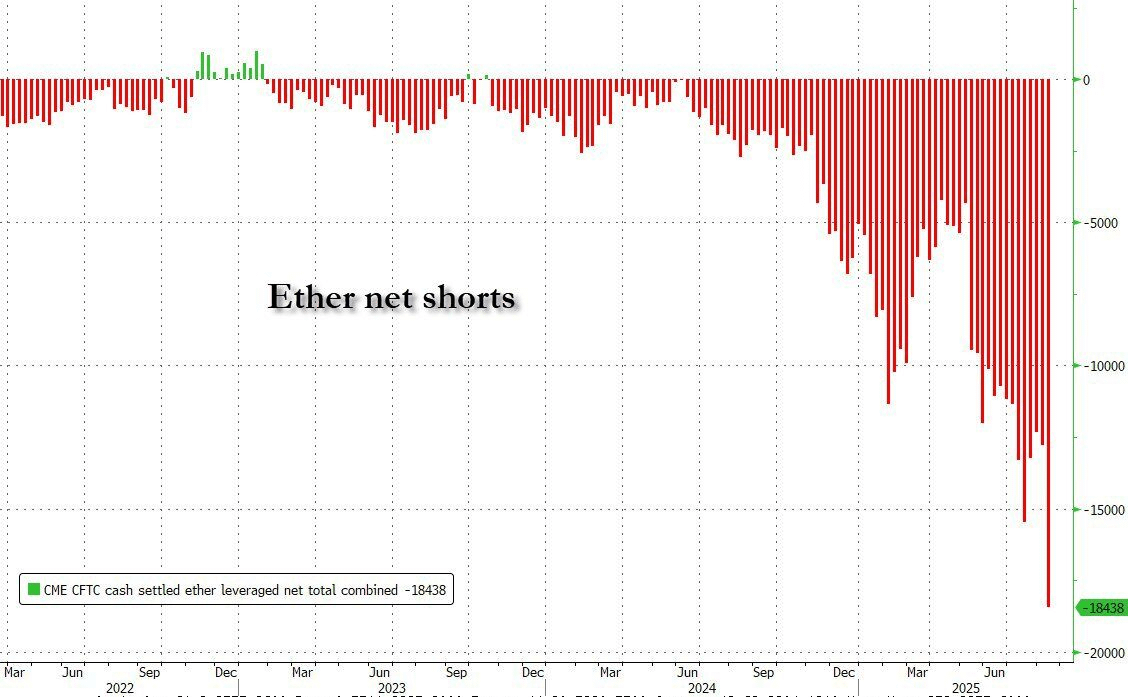

THEIR NET SHORT POSITIONS JUST HIT A RECORD HIGH

THE MOTHER OF ALL SHORT SQUEEZES IS COMING pic.twitter.com/JLaysZAtcD

— Rekt Fencer (@rektfencer) August 18, 2025

WALL STREET HEDGE FUNDS ARE SHORTING ETH

Wall Street hedge funds are making headlines as they ramp up their short positions on Ethereum (ETH). Recent reports indicate that their net short positions have hit a record high, sparking conversations about the potential implications for the cryptocurrency market. If you’re following the crypto scene, this could be a game-changer.

THEIR NET SHORT POSITIONS JUST HIT A RECORD HIGH

The surge in short positions signals that many hedge funds are betting against ETH, anticipating a decline in its value. This trend could create a volatile environment for traders and investors alike. As more hedge funds enter the shorting game, the likelihood of a significant market reaction increases. The tension is palpable, and many are left wondering how this will affect the price of Ethereum in the coming weeks.

THE MOTHER OF ALL SHORT SQUEEZES IS COMING

The buzz around “the mother of all short squeezes” is growing. A short squeeze occurs when a heavily shorted asset experiences a rapid price increase, forcing short sellers to buy shares to cover their positions, which can drive the price even higher. This scenario could lead to substantial gains for those who choose to go long on Ethereum at this juncture. If you’re a trader, now might be the time to reassess your strategies.

The cryptocurrency market is notorious for its unpredictability, and the actions of hedge funds can significantly impact price movements. Keeping a close eye on these developments is crucial for anyone involved in crypto trading. Stay informed, and make smart decisions as the situation unfolds.

For real-time updates and insights, be sure to follow credible sources and platforms that cover cryptocurrency trends. The landscape is always shifting, and knowledge is your best asset.