Bitcoin Plummets: $100M Liquidated—What’s Next? — Bitcoin market crash, cryptocurrency liquidation news, Ethereum price drop 2025

cryptocurrency market trends, Bitcoin price analysis, Ethereum investment strategies

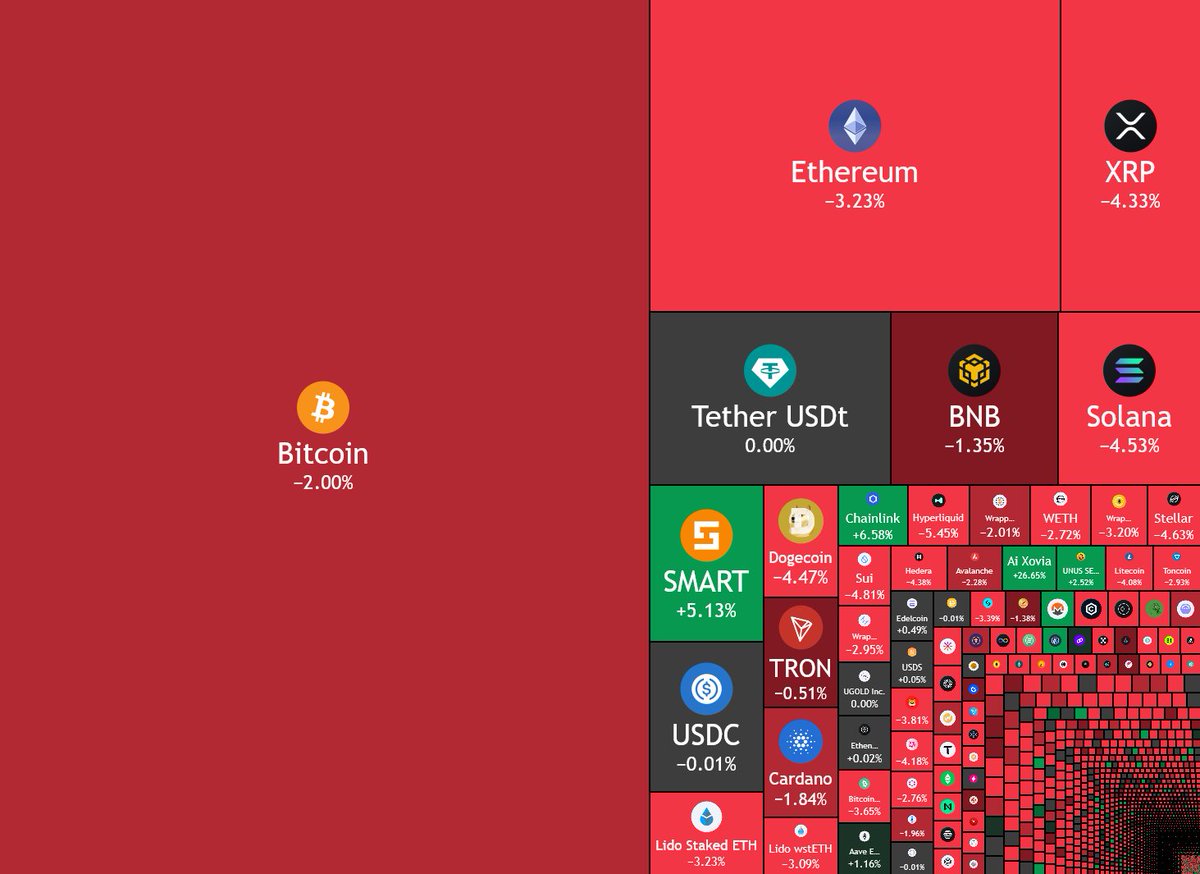

BREAKING: Over $100m in long positions were just liquidated in the past hour!

This as Bitcoin falls below $116k & ETH below $4.3k.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Rough week ahead? pic.twitter.com/dLBeH3of4o

— Coin Bureau (@coinbureau) August 18, 2025

Over $100m in Long Positions Liquidated

In a dramatic twist in the cryptocurrency market, over $100 million in long positions were liquidated within just one hour. This sudden market movement has left many traders in shock as Bitcoin tumbles below $116,000 and Ethereum dips below $4,300. The volatility of cryptocurrencies is no stranger to investors, but such a swift liquidation raises concerns about what lies ahead.

Bitcoin and Ethereum’s Unexpected Drop

As Bitcoin falls below the significant threshold of $116,000, it has prompted discussions among traders and analysts alike. Ethereum’s decline below $4,300 compounds the worries. Investors are now left pondering: is a rough week ahead? The impact of these liquidations can ripple through the market, affecting not just the prices of Bitcoin and Ethereum but also the wider cryptocurrency landscape.

Understanding Liquidations

Liquidations occur when a trader’s position is automatically closed due to insufficient margin to cover potential losses. In this case, the market’s rapid decline triggered a wave of forced sell-offs, leading to the staggering $100 million liquidation. It’s a stark reminder of the risks involved in trading cryptocurrencies, particularly with high leverage.

What This Means for Investors

For those invested in cryptocurrencies, this situation serves as a cautionary tale. It underscores the importance of risk management and keeping a close watch on market trends. The recent liquidation could be a precursor to more volatility, so staying informed and prepared is crucial for navigating these turbulent waters.

Stay updated with the latest developments in the cryptocurrency market to make informed decisions. The landscape can change rapidly, and being proactive is essential for any investor.