Inflation Shock: PPI Soars to 3.7%—What’s Next? — Producer Price Index news, inflation rate surge 2025, economic indicators update

producer price inflation, economic indicators analysis, inflationary trends impact

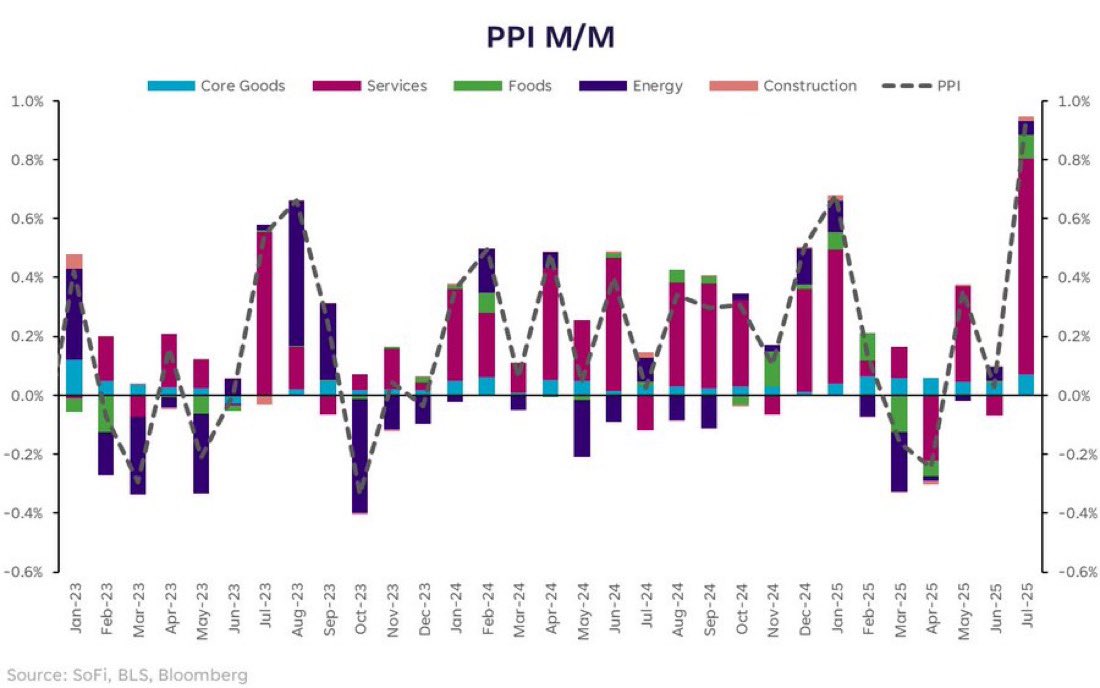

BREAKING: Producer Price Inflation (PPI) just spiked to 3.7% YoY (vs. 2.9% expected, 2.6% prior) — biggest monthly jump since March 2022.

PPI measures the average change over time in the selling prices received by domestic producers for their output. pic.twitter.com/e2qaXM9NCD

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Maine (@TheMaineWonk) August 14, 2025

BREAKING: Producer Price Inflation (PPI) Just Spiked to 3.7% YoY

In a surprising economic update, Producer Price Inflation (PPI) has surged to 3.7% year-over-year, which is significantly higher than the 2.9% that analysts had anticipated. This increase marks the largest monthly jump since March 2022. Understanding PPI is crucial as it reflects the average change over time in the selling prices received by domestic producers for their output.

This recent spike in PPI could have wide-ranging implications for both consumers and businesses alike. Higher producer prices often translate to increased costs for consumers, which can lead to inflationary pressures throughout the economy. If you want to stay informed about fluctuations in the market, you can follow updates from economic analysts and organizations that specialize in these metrics.

What Does This Mean for Consumers and Businesses?

For consumers, a rise in PPI typically signals that prices for goods and services may soon increase. If businesses face higher production costs, they are likely to pass these costs onto customers. This means we could see higher prices at the grocery store and in other sectors. For businesses, especially those operating on thin margins, this increase may necessitate adjustments in pricing strategies or cost-cutting measures.

Keeping an Eye on Economic Indicators

Monitoring PPI and other economic indicators is essential for understanding the health of the economy. For those interested in delving deeper into economic trends and their potential impacts, resources like the U.S. Bureau of Labor Statistics provide comprehensive data and analysis.

As we navigate these economic changes, being informed can help you make better financial decisions. Whether you’re a consumer or a business owner, understanding the implications of rising PPI is more important than ever. For more updates on economic metrics, keep an eye on reliable news sources and economic reports.