Is Saylor’s Bitcoin Gamble a Genius Move or a Disaster? — Bitcoin investment news, Crypto market update, Major Bitcoin purchase 2025

Breaking news: Saylor’s Bitcoin Investment

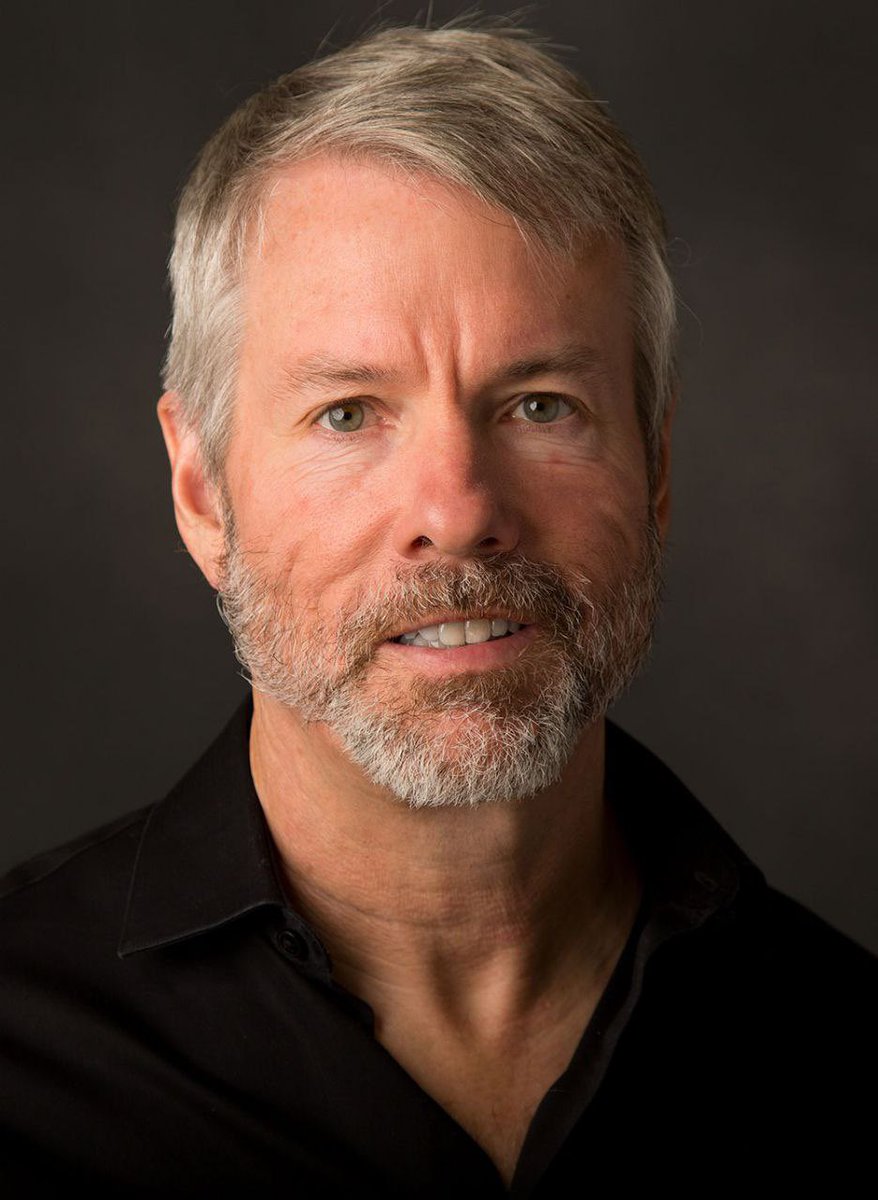

In a significant move, entrepreneur Michael Saylor has purchased 4,225 Bitcoin for a staggering $472.5 million. This strategic investment underscores Saylor’s confidence in Bitcoin’s future and highlights his commitment to cryptocurrency. As Bitcoin continues to gain traction in the financial landscape, Saylor’s bold acquisition signals a growing trend among investors looking to capitalize on digital assets. This news, shared by Ash Crypto, emphasizes the increasing interest in Bitcoin as a store of value. Stay updated on cryptocurrency trends and strategies as more investors follow Saylor’s lead in loading up on Bitcoin.

BREAKING:

SAYLOR’S STRATEGY HAS BOUGHT

4,225 BITCOIN FOR $472.50 MILLION.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

HE IS LOADING UP !! pic.twitter.com/1fJhehMoNs

— Ash Crypto (@Ashcryptoreal) July 14, 2025

BREAKING:

In a move that has rocked the cryptocurrency world, Michael Saylor’s strategy has led to the purchase of 4,225 Bitcoin for an astounding $472.50 million. This news has sent waves through the crypto community, as Saylor continues to position himself as a major player in the Bitcoin market. With this latest acquisition, it’s clear that he is loading up on Bitcoin like never before, raising eyebrows and sparking discussions about the future of cryptocurrency investments.

SAYLOR’S STRATEGY HAS BOUGHT

Saylor, the co-founder of MicroStrategy, has been a vocal advocate for Bitcoin, often emphasizing its potential as a hedge against inflation and a store of value. By investing such a colossal amount in Bitcoin, he is signaling his unwavering belief in the cryptocurrency’s future. This latest purchase adds to MicroStrategy’s already substantial Bitcoin holdings, which have made the company a prominent figure in the crypto space. The strategy seems straightforward: acquire as much Bitcoin as possible while prices are still relatively low compared to their potential future value.

4,225 BITCOIN FOR $472.50 MILLION

So, what does this mean for the market? First, it highlights the increasing institutional interest in Bitcoin. Saylor’s strategy is not just about personal investment; it’s also about setting a precedent for other companies and investors. As more institutional players like MicroStrategy enter the market, we could see a significant impact on Bitcoin’s value. This could lead to greater adoption and a more robust market overall.

Furthermore, this massive purchase could influence retail investors as well. When they see a high-profile figure like Saylor loading up on Bitcoin, it might encourage them to consider investing too. This is crucial, especially as Bitcoin continues to gain acceptance across various sectors, from finance to technology.

HE IS LOADING UP !!

In addition to the financial implications, Saylor’s bold move underscores a broader trend: the ongoing shift towards digital currencies. As global economies face uncertainty, more individuals and companies are looking to Bitcoin as a reliable asset. Saylor’s strategy exemplifies this transition, as he continues to load up on Bitcoin, showcasing his commitment and confidence in its future.

Moreover, the timing of this purchase is noteworthy. With Bitcoin’s price often fluctuating, many analysts are keenly watching market trends and potential regulatory changes that could affect cryptocurrency. Saylor’s significant investment may signal that he believes the current environment is favorable for such a large-scale acquisition.

This bold investment strategy is closely watched by both enthusiasts and skeptics alike. As the cryptocurrency landscape evolves, Saylor’s actions could serve as a blueprint for others looking to navigate this dynamic market. The question remains: how will this investment play out in the long run? Only time will tell, but one thing is clear: Saylor is doubling down on Bitcoin, and the world is taking notice.

For more updates on cryptocurrency and investment strategies, be sure to follow reputable sources in the industry to stay informed about the latest trends and insights.