BREAKING: FedNow’s ISO 20022 Unleashed! What’s Next for XRP? XRP — FedNow launch news, ISO 20022 integration update, XRP market impact 2025

The recent activation of FedNow’s “ISO 20022” standard marks a significant milestone in the evolution of digital finance. This development, highlighted by JackTheRippler on Twitter, signals enhanced interoperability for payment systems, particularly benefiting cryptocurrencies like XRP. As the financial landscape shifts towards more efficient and standardized transaction methods, the implications for businesses and consumers are profound. With FedNow’s integration of ISO 20022, instant payments and streamlined transactions become more accessible, fostering innovation in the financial sector. Stay updated on this groundbreaking news and its potential impact on digital currencies and payment technologies.

XRP

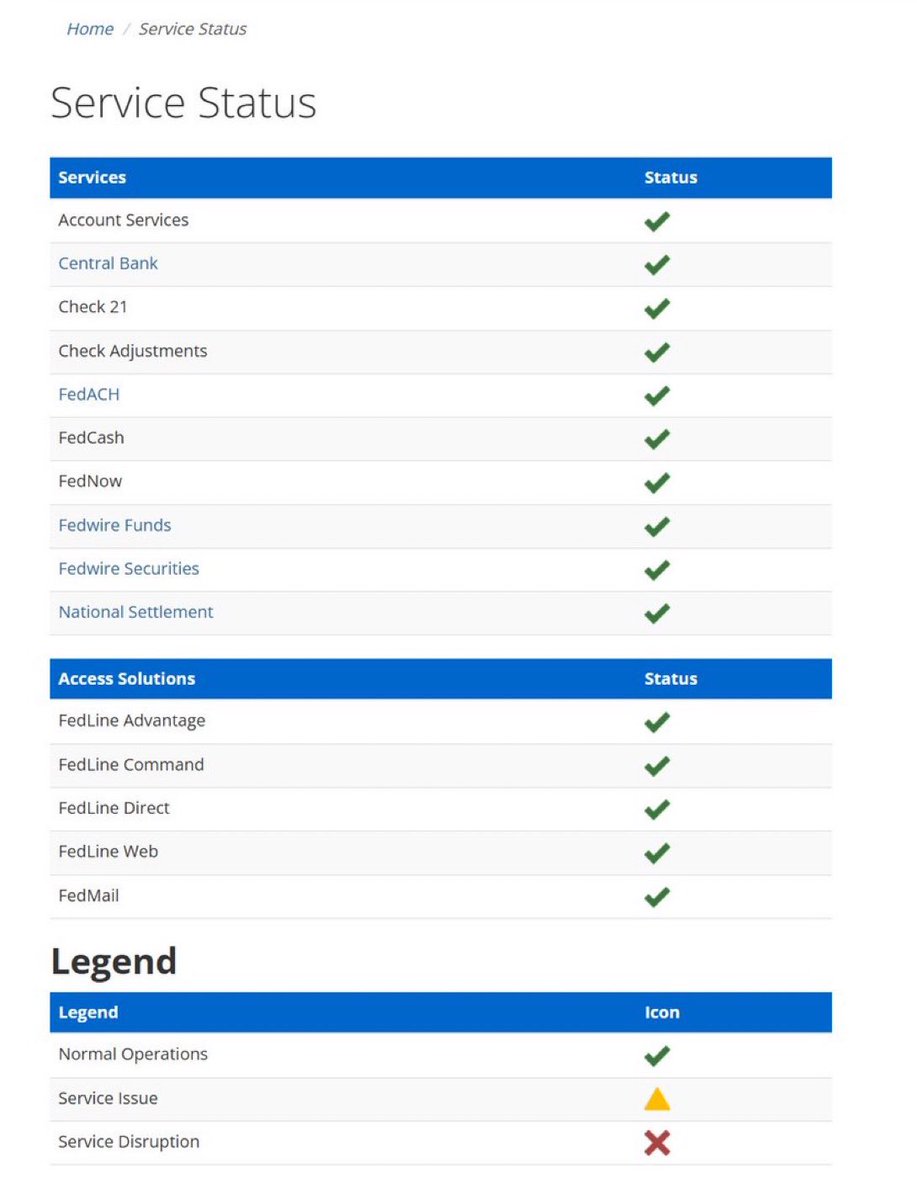

BREAKING: FedNow “ISO 20022” has been activated behind the scenes! #XRP pic.twitter.com/wywQX9QNAx

— JackTheRippler © (@RippleXrpie) July 14, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: FedNow “ISO 20022” has been activated behind the scenes!

If you’ve been keeping an eye on the latest developments in the world of finance, you might have come across the buzz surrounding the activation of FedNow and its integration with ISO 20022. This is a significant milestone, especially for those who follow digital currencies like XRP. But what does this all mean? Let’s dive into the details.

Understanding FedNow and ISO 20022

FedNow is a new payment service developed by the Federal Reserve, designed to facilitate real-time payments across the U.S. This means that when you send money, it can be received instantly, making transactions much more efficient. Now, the integration of ISO 20022 into FedNow adds a layer of sophistication to this service. ISO 20022 is a global standard for electronic data interchange between financial institutions. It allows for richer data to be shared alongside payment transactions, which can improve compliance and reduce errors.

Imagine sending money from one bank to another, and instead of just a simple transaction notification, the receiving bank gets all the necessary details about the payment. This clarity can streamline processes and enhance the user experience. The integration of these two systems is a game-changer, especially for businesses and consumers looking for transparency and speed in their transactions.

The Role of XRP in This Ecosystem

Now, let’s talk about XRP and its potential role in this new landscape. XRP, created by Ripple, has been making waves in the financial sector for its ability to facilitate cross-border payments quickly and at a low cost. With the activation of FedNow and ISO 20022, there’s a growing conversation around how XRP could be utilized alongside these systems to enhance payment solutions even further.

The real-time capabilities of FedNow, coupled with the efficiency of XRP, could revolutionize how we think about digital payments. Imagine a world where your international transactions are as fast and seamless as local ones. That’s the kind of future that the integration of these technologies is hinting at.

Why This Matters for Everyday Users

You might be wondering, “How does this affect me?” Well, if you use digital payments, whether for personal transactions or business purposes, this development could lead to faster and more reliable payment experiences. With the ability to process transactions in real-time and exchange detailed information, you can expect fewer delays and issues when sending or receiving money.

Moreover, as more financial institutions adopt these standards, it’s likely that you’ll see a broader acceptance of cryptocurrencies like XRP in everyday transactions. This could pave the way for a more inclusive financial ecosystem where digital currencies become a standard part of how we do business.

Keep an Eye on the Future

As we move forward, the activation of FedNow and its alignment with ISO 20022 will be worth watching closely. These changes are not just technical upgrades; they represent a shift towards a more interconnected and efficient financial world. Whether you’re a tech enthusiast, a business owner, or just someone who uses digital payments, understanding these developments can help you stay ahead in an ever-evolving landscape.

Stay tuned for more updates as this story unfolds—it’s an exciting time in the world of finance, and you won’t want to miss what comes next!