Fidelity Blocks GNS Buy Orders: A Repeat of 2021’s Controversy?

Fidelity Blocks Buy Orders for GNS Shares Amid Controversy

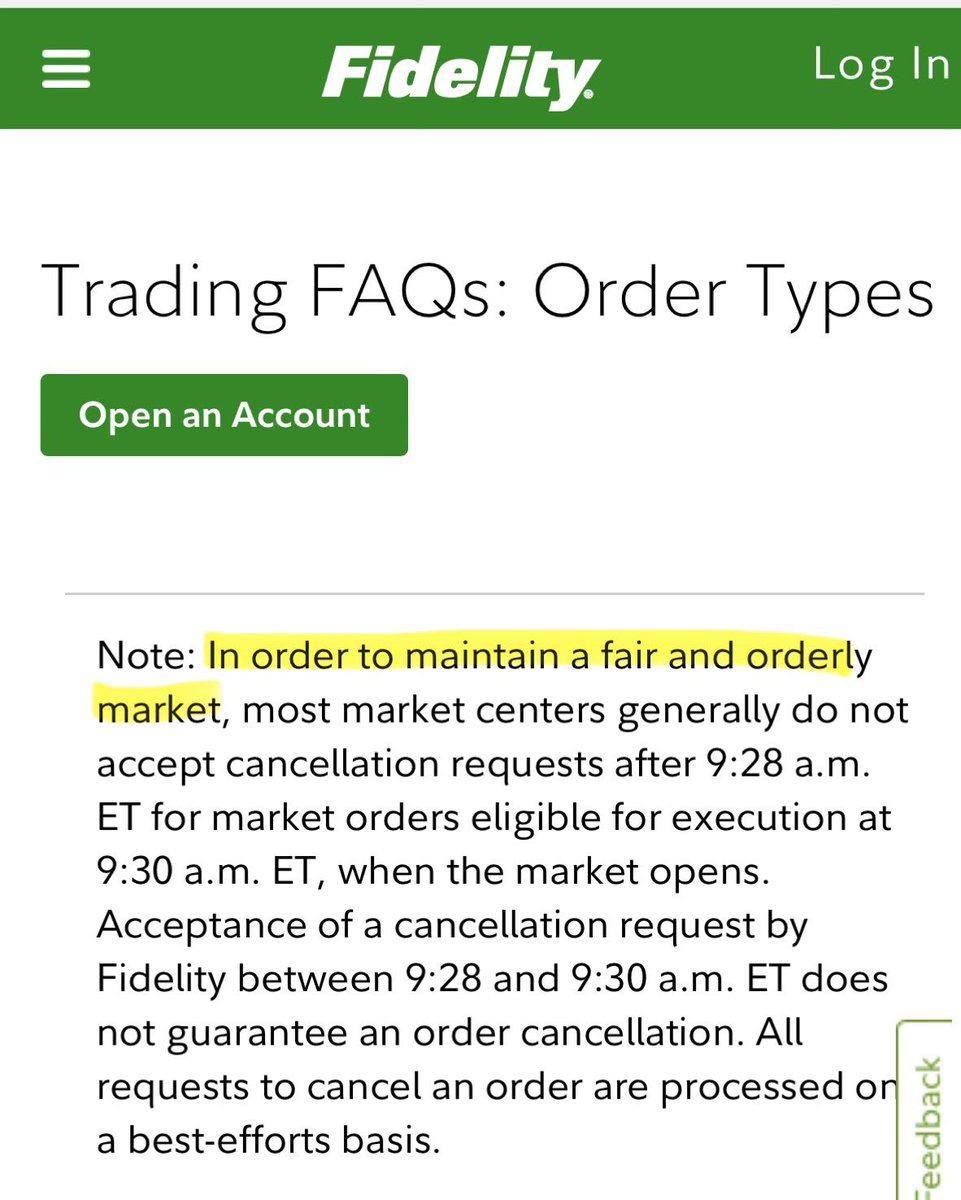

In a recent development that has caught the attention of investors and financial enthusiasts alike, Fidelity has reportedly blocked buy orders for Genius Group (GNS) shares, citing a need for “fair and orderly markets.” This action has raised eyebrows as it echoes past incidents involving trading restrictions on popular stocks like GameStop (GME) and AMC in 2021. During those events, brokerage firms like Robinhood and Charles Schwab faced backlash for restricting buy orders, leading to widespread criticism and discussions about market manipulation and investor rights.

The Current Situation with GNS

The decision by Fidelity to restrict GNS buy orders has sparked a wave of speculation and concern among shareholders and potential investors. Many are drawing parallels to the GME and AMC incidents, which were characterized by heightened volatility and retail investor enthusiasm. The similarity in circumstances has led to fears that the market may be witnessing a repeat of history, where brokerage firms impose restrictions that could hinder investors’ ability to trade freely.

Genius Group is reportedly preparing to file a lawsuit regarding allegations of naked shorting, a practice that involves selling shares that have not been borrowed or are not available for borrowing. This legal action could further fuel the ongoing debate about market integrity and the practices of established financial institutions. Naked shorting has been a contentious issue in the stock market, often leading to significant price distortions and investor losses.

Understanding Naked Short Selling

Naked short selling occurs when an investor sells shares without first borrowing them or ensuring they can be borrowed. This practice can lead to an excess of shares being sold than actually exist, creating artificial downward pressure on a stock’s price. It is illegal in many jurisdictions due to the potential for market manipulation. Genius Group’s decision to pursue legal action highlights the growing concerns over market practices and the need for regulatory oversight.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The implications of naked shorting can be profound, affecting not just the targeted companies but also the broader market sentiment. When a company like Genius Group experiences such practices, it can lead to significant volatility and distrust among investors, particularly retail investors who may feel they are at a disadvantage against institutional players.

The Role of Brokerage Firms

The role of brokerage firms in the stock market is to facilitate trades between buyers and sellers. However, when firms restrict buy orders—like what Fidelity has done with GNS—it raises questions about their responsibilities and the ethical implications of their actions. Many investors feel that such restrictions can hinder their ability to participate fully in the market, particularly during times of heightened activity and interest in a stock.

The backlash against brokerage firms during the GME and AMC incidents led to increased scrutiny from regulators and lawmakers, with discussions about the need for reforms to protect retail investors. The recent actions by Fidelity may reignite these discussions, prompting calls for greater transparency and accountability in the trading process.

Historical Context: GME and AMC

The 2021 trading frenzy surrounding GME and AMC was driven by a surge of interest from retail investors, many of whom coordinated their buying efforts through social media platforms like Reddit. This collective action led to dramatic price increases, attracting the attention of both institutional investors and regulators. When brokerage firms imposed buy restrictions, it sparked outrage and allegations of market manipulation, which many believed favored institutional investors at the expense of retail traders.

The fallout from these events has led to ongoing investigations and discussions about the need for regulatory reforms to ensure a fair trading environment for all participants. The situation with GNS may serve as a catalyst for renewed scrutiny of brokerage practices and the need for clear regulations regarding trading restrictions.

Investor Sentiment and Reactions

The news of Fidelity blocking buy orders for GNS shares has generated a range of reactions from investors. Many retail traders view this action as another example of institutional overreach and a lack of support for retail investors. Social media platforms are abuzz with discussions, as traders share their thoughts and strategies regarding GNS and the broader market implications.

The potential lawsuit filed by Genius Group adds another layer of complexity to the situation. If successful, it could set a precedent for how naked short selling is addressed in the future and potentially reshape the regulatory landscape for trading practices.

Conclusion: The Future of Trading Practices

The unfolding situation with Fidelity and Genius Group highlights the ongoing challenges and complexities within the financial markets. As brokerage firms navigate the fine line between maintaining orderly markets and allowing free trading, the potential for conflict with retail investors remains a pressing issue.

As more details emerge regarding the lawsuit and the actions of Fidelity, the implications for market practices and investor rights will likely come under increased scrutiny. Investors, regulators, and market participants will be watching closely to determine how these events may reshape the landscape of stock trading and investor participation in the future.

In summary, the actions taken by Fidelity against GNS highlight a critical moment in the ongoing dialogue about trading practices in the stock market. With the potential for legal challenges ahead and the lessons learned from past incidents like GME and AMC, the financial community is poised for a pivotal period that could redefine investor engagement and regulatory oversight in the years to come.

DEVELOPING Fidelity Cites “Fair and Orderly Markets” But Reportedly Blocks Buy Orders for GNS Shares

We Saw This with $GME & $AMC in 2021 When Brokers Like Robinhood and Schwab Restricted Buy Orders

– Genius Group is days away from filing a lawsuit for Naked Shorting $GNS pic.twitter.com/XR8LdIwxWz

— X Market News (@xMarketNews) July 3, 2025

DEVELOPING Fidelity Cites “Fair and Orderly Markets” But Reportedly Blocks Buy Orders for GNS Shares

In a surprising turn of events, Fidelity Investments has reportedly decided to block buy orders for Genius Group (GNS) shares, citing the need for “fair and orderly markets.” This move has raised eyebrows across the investment community, especially as it echoes similar actions taken by brokerage firms like Robinhood and Charles Schwab during the infamous meme stock frenzy of 2021. Back then, we saw traders rallying behind stocks like GameStop ($GME) and AMC Entertainment ($AMC), only to be met with restrictions that left many feeling frustrated and powerless.

Understanding the Current Situation

The news regarding Fidelity’s decision comes at a time when retail investors are increasingly vocal about their rights and the fairness of trading practices. The move to limit buy orders for GNS shares feels particularly poignant considering the backlash faced by brokers in the past. Social media has been buzzing with reactions, and many investors are raising concerns about transparency and the implications for market integrity. The community is wondering just how far this will go and what it means for everyday traders trying to navigate the complexities of the stock market.

We Saw This with $GME & $AMC in 2021 When Brokers Like Robinhood and Schwab Restricted Buy Orders

Flashback to 2021: the stock market was on fire, with retail investors pushing stocks like GameStop and AMC to dizzying heights. Brokers like Robinhood and Schwab faced immense backlash after they restricted buy orders, leaving many investors feeling betrayed. The incident sparked outrage, with accusations of market manipulation and calls for regulatory changes. As history repeats itself with GNS, many are left wondering if we are witnessing a déjà vu scenario.

During the 2021 events, the chaos was palpable. Users flocked to forums and social media to share strategies, tips, and their frustrations. The passion of retail investors was undeniable, and it led to a massive surge in market activity. However, the sudden restrictions created a divide between institutional players and everyday traders. This time around, with Fidelity blocking buy orders for GNS, the stakes feel just as high.

Genius Group is Days Away from Filing a Lawsuit for Naked Shorting $GNS

Adding another layer to this unfolding drama, Genius Group is reportedly preparing to file a lawsuit against certain entities for naked short selling of its shares. Naked short selling is when a trader sells shares without ensuring they can be borrowed, creating a situation where more shares are sold than are actually available. This practice can lead to significant downward pressure on a stock’s price, raising serious questions about market fairness and transparency.

As Genius Group gears up for this legal battle, the implications for investors and the stock market as a whole could be profound. If successful, the lawsuit could not only affect the price of GNS shares but also spark broader discussions about market manipulation and the role of regulatory bodies in protecting investors. It’s a situation that’s worth keeping an eye on, especially for those who are invested in GNS or are considering jumping in.

The Ripple Effects of Restricted Buy Orders

When brokers restrict buy orders, the effects can ripple through the entire market. For investors, it creates a sense of uncertainty and distrust. The fear of missing out on potential gains can be exacerbated by the feeling that the playing field is uneven. Retail investors often find themselves at a disadvantage when faced with such restrictions, leading to significant emotional and financial stress.

Moreover, the conversation around stock trading is shifting. With the rise of social media platforms, retail investors are more interconnected than ever. They share information, strategies, and frustrations, creating a community that can mobilize quickly. This interconnectedness means that any action taken by a brokerage firm, like Fidelity’s recent decision, can lead to widespread backlash and even coordinated responses from investors.

What Does This Mean for Retail Investors?

The blocking of buy orders for GNS shares by Fidelity raises several important questions for retail investors. How can they protect their investments in an environment where brokerages have the power to restrict trading? What recourse do they have when facing perceived injustices in the market? These questions are crucial as retail trading continues to evolve and grow in popularity.

As an investor, staying informed is key. Understanding the dynamics at play can help you make more informed decisions. Whether it’s keeping an eye on news regarding GNS or being aware of the potential ramifications of trading restrictions, knowledge is power. Engaging with the community, sharing insights, and learning from others can also provide support during turbulent times.

The Role of Regulatory Bodies

In light of these recent events, the role of regulatory bodies comes into sharp focus. Are they doing enough to protect retail investors? The events surrounding GNS and the earlier restrictions on GME and AMC stocks have ignited discussions about the need for stronger regulations and oversight. Many investors are calling for increased transparency and accountability from brokerages and regulatory agencies alike.

This conversation is not just academic; it has real implications for the future of trading. As more retail investors enter the market, the demand for fair practices will only grow. Regulatory bodies will need to respond to these calls for change, or risk losing the trust of the very investors they are meant to protect.

Conclusion: Staying Vigilant in a Changing Market

The recent developments with Fidelity blocking buy orders for GNS shares serve as a reminder of the complexities of the stock market. As retail investors continue to navigate these waters, staying informed and engaged is crucial. Whether it’s following the lawsuit against naked short selling or advocating for fair trading practices, every action counts in shaping the future of investing.

As we move forward, it’s essential to keep the lines of communication open within the investment community. Sharing insights, experiences, and strategies can empower individual investors and foster a sense of solidarity. After all, the market is constantly changing, and being prepared can make all the difference.