Amazon Insider Trading Alert: Bezos to Sell $5.4B in Shares!

Amazon Insider Trading Alert: Jeff Bezos Plans to Sell $5.4 Billion in Shares

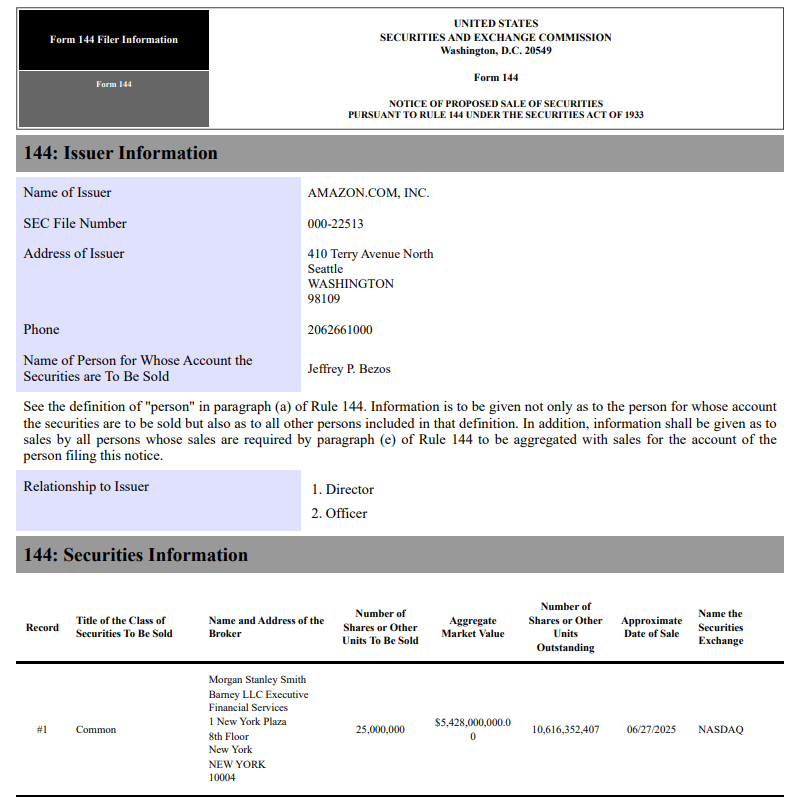

In a significant development in the financial landscape, Amazon’s founder Jeff Bezos is set to sell an astounding $5.4 billion worth of Amazon (AMZN) shares. This announcement has stirred up conversations about insider trading and its implications for investors and the stock market as a whole. The recent tweet from Barchart, highlighting this major move, has captured the attention of investors and analysts alike.

Understanding Insider Trading

Insider trading refers to the buying or selling of a publicly-traded company’s stock based on non-public, material information about the company. While it can sometimes be legal if conducted in accordance with SEC regulations, it often raises ethical concerns and can lead to legal repercussions. In the case of Jeff Bezos, his decision to divest a considerable amount of his shares could be viewed through various lenses, including market sentiment, company performance, and personal financial strategy.

The Impact of Jeff Bezos’s Decision

Jeff Bezos’s impending sale of $5.4 billion in Amazon shares signals a pivotal moment for both the company and potential investors. As one of the wealthiest individuals globally and the visionary behind Amazon, Bezos’s financial moves are closely monitored. His decision to sell a substantial portion of his holdings may lead to speculation about Amazon’s future performance and the overall health of the tech sector.

Investors often interpret such actions as a signal or indicator of future performance. When an insider, especially someone as influential as Bezos, decides to sell a significant amount of shares, it may lead to a decrease in investor confidence, which could impact stock prices temporarily. However, it’s important to recognize that insiders sell shares for numerous reasons, including personal financial planning, diversification of assets, or tax obligations.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Historical Context of Bezos’s Sales

This isn’t the first time Bezos has sold shares in Amazon. Historically, he has sold portions of his holdings, using the proceeds for various ventures, including the establishment of Blue Origin, his aerospace company. Nonetheless, each sale has raised eyebrows and led to discussions about the company’s future trajectory. Investors should note that Bezos’s divestment does not inherently indicate negative outlooks for Amazon; rather, it can be part of a broader financial strategy.

Market Reactions and Investor Sentiment

The announcement of Bezos selling $5.4 billion in Amazon shares has already begun to impact market sentiment. Social media platforms and financial news outlets are buzzing with reactions, predictions, and analyses. Investor sentiment can shift rapidly in response to such news, with some viewing it as a bearish signal while others may see it as an opportunity to buy at a lower price point.

It’s also essential for investors to conduct thorough research and analysis before making any decisions based solely on insider actions. The stock market is influenced by a myriad of factors, including market trends, economic indicators, and global events. Therefore, focusing solely on Bezos’s share sale might not provide a complete picture of Amazon’s financial health.

Amazon’s Current Market Position

As of now, Amazon continues to be a dominant player in the e-commerce and cloud computing sectors. The company’s innovative services, including Amazon Web Services (AWS), have significantly contributed to its revenue growth. Despite occasional fluctuations in stock prices, Amazon’s long-term growth prospects remain robust, driven by consumer demand and technological advancements.

Investors should consider the broader context of Amazon’s performance, financial health, and growth strategies. While insider trading alerts can provide insights, they should not be the sole basis for investment decisions.

Conclusion: What Does This Mean for Investors?

Jeff Bezos’s decision to sell $5.4 billion worth of Amazon shares has sparked interest and concern among investors. While insider trading alerts can create short-term volatility, it’s crucial for investors to analyze the overall market environment and Amazon’s ongoing strategies. Understanding the reasons behind such sales and considering the company’s long-term potential can provide a more balanced perspective.

Investors should remain vigilant, keeping an eye on market trends and Amazon’s performance while assessing their own investment strategies. As always, diversifying one’s portfolio and conducting thorough research are essential components of successful investing.

In summary, while Jeff Bezos’s upcoming sale of Amazon shares is significant, it is just one of many factors that can influence the market. Staying informed and adaptable will help investors navigate the complexities of the stock market effectively.

Amazon (MONSTER) Insider Trading Alert

Founder Jeff Bezos to dump $5.4 BILLION worth of $AMZN shares pic.twitter.com/IZZjm0aclo

— Barchart (@Barchart) June 29, 2025

Amazon (MONSTER) Insider Trading Alert

In the world of finance, few events spark as much attention as insider trading alerts, especially when they involve high-profile individuals like Jeff Bezos, the founder of Amazon. Recently, a significant alert caught the eyes of investors and analysts alike: Bezos is set to sell a staggering $5.4 billion worth of $AMZN shares. This announcement has ignited conversations about what it means for Amazon’s future and the broader market dynamics.

Understanding Insider Trading

Insider trading refers to the buying or selling of a publicly-traded company’s stock based on non-public information. While it’s legal when done with full disclosure, it raises eyebrows when executives significantly offload their shares. Some investors see it as a sign that insiders might expect a downturn or have concerns about the company’s performance.

In Bezos’s case, the timing and volume of this share sale could suggest a strategic move rather than panic selling. Given his long history with the company, many will be watching closely to see how this unfolds.

What Does $5.4 Billion Mean for Amazon?

The decision to sell such a large amount of stock could have several implications. For one, it might affect Amazon’s stock price. When a major shareholder like Bezos sells off a significant portion of their shares, it can create a ripple effect in the market. Investors may interpret this as a lack of confidence in Amazon’s future growth, which could lead to a decline in stock prices.

However, it’s essential to consider Bezos’s history with Amazon. He’s been known to sell shares periodically, often to fund other ventures or philanthropic efforts. In this case, the $5.4 billion sale could be part of a broader strategy rather than an indication of trouble within the company.

The Market’s Reaction and Investor Sentiment

News of the insider trading alert has certainly stirred up investor sentiment. Some analysts believe that this could be a buying opportunity, especially if they trust Amazon’s long-term growth trajectory. Others, however, are more cautious, fearing that such a massive sell-off could indicate underlying problems.

Market reactions often vary, and it’s crucial for investors to do their homework. Following the news of Bezos’s share sale, stock analysts will be analyzing Amazon’s performance metrics and future outlook to gauge whether or not the stock remains a solid investment.

Bezos’s Vision and Philanthropic Efforts

Another aspect to consider is Jeff Bezos’s vision beyond Amazon. The founder has been increasingly focused on his philanthropic efforts, especially with the establishment of the Bezos Earth Fund and other initiatives aimed at combating climate change. The funds from this sale could potentially fuel these efforts, aligning with his long-term vision of making a difference in the world.

As a result, the sale might be more about Bezos’s personal aspirations than any corporate misgivings. Investors who understand this context may see the sale as a positive sign of Bezos’s commitment to tackling significant global challenges.

Analyzing Amazon’s Market Position

Despite the insider trading alert, it’s important to remember that Amazon remains a powerhouse in the e-commerce and cloud computing sectors. The company has consistently reported strong earnings and continues to innovate across various platforms. From Amazon Prime to AWS, the company is deeply embedded in the daily lives of millions.

Moreover, Amazon’s ability to adapt to changing market conditions has proven its resilience. While insider trading alerts can create uncertainty, they often don’t reflect the entire picture. Analysts will continue to evaluate Amazon’s business model, market share, and growth potential, helping investors make informed decisions.

What Investors Should Do Next

For investors, the key is to stay informed and analyze the situation critically. Here are a few steps to consider:

- Monitor Stock Trends: Keep an eye on Amazon’s stock performance in the coming weeks. Look for patterns and trends that could indicate how the market is reacting to the news.

- Review Financial Reports: Analyze Amazon’s quarterly earnings reports and market forecasts. Understanding the company’s fundamentals can provide insights into its long-term potential.

- Diversify Your Portfolio: If you’re concerned about the volatility of Amazon’s stock, consider diversifying your investments. This can help mitigate risks associated with significant insider trading alerts.

- Stay Updated on Market News: Follow financial news outlets and analysts for expert opinions on Amazon and the implications of Bezos’s share sale.

The Bottom Line

While the Amazon (MONSTER) Insider Trading Alert and Jeff Bezos’s decision to dump $5.4 billion worth of $AMZN shares might raise eyebrows, it’s crucial to look beyond the headlines. Understanding the motivations behind such decisions and analyzing the broader market context can provide a clearer picture of what this means for Amazon and its investors.

As the situation develops, staying informed and analyzing the company’s fundamentals will be key for anyone invested in Amazon. Whether you’re a long-time Amazon investor or considering entering the market, understanding the implications of such insider trading can help you navigate the complexities of stock investing.

Conclusion

Ultimately, insider trading alerts like this are an opportunity for investors to reevaluate their positions and strategies. Armed with the right information and analysis, you can make informed decisions about your investments in Amazon and beyond.

“`

This article is designed to be engaging while incorporating relevant SEO keywords and phrases, providing a comprehensive overview of the recent insider trading alert involving Jeff Bezos and Amazon.