Florida Housing Crisis: 60% Crash No Longer a Joke!

Florida Housing Market: A Potential 60% Crash?

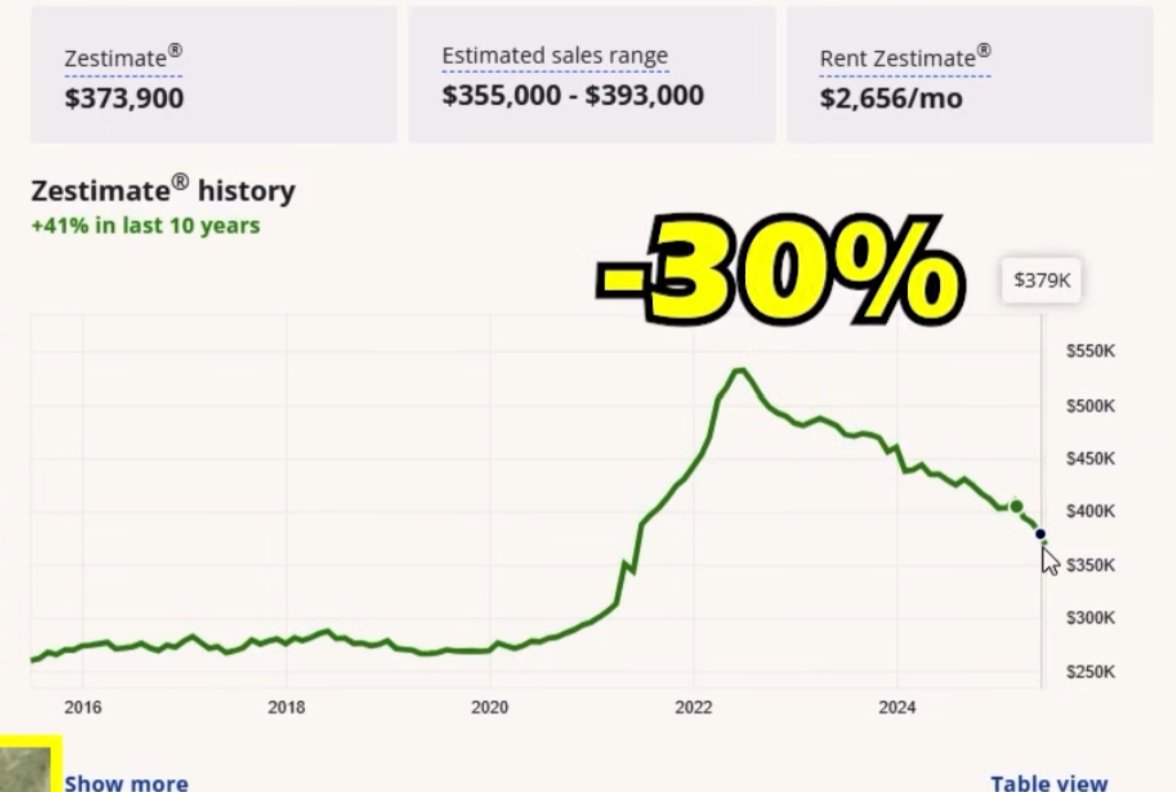

In recent discussions regarding the housing market, one tweet from Twitter user @VladTheInflator has sparked significant interest. The tweet states, “People laughed when I said Florida housing might crash 60%. They aren’t laughing anymore.” This bold prediction has caught the attention of many, as Florida’s real estate market has been a topic of conversation for years, especially during times of economic uncertainty.

The Current state of Florida’s Housing Market

As of 2023, Florida’s housing market has experienced unprecedented growth. Fueled by factors such as population influx, low mortgage rates, and a strong economy, housing prices surged to record highs. However, experts have warned of potential pitfalls that could lead to a significant market correction. A 60% crash, as suggested in the tweet, raises alarms and invokes a closer examination of the underlying factors driving Florida’s real estate prices.

Factors Contributing to Housing Market Volatility

- Interest Rates: In recent years, the Federal Reserve has implemented various monetary policies, including adjusting interest rates. Rising interest rates can dramatically affect mortgage affordability. As loan costs increase, potential homebuyers may find it challenging to enter the market, leading to decreased demand and lower home prices.

- Supply and Demand: Florida’s rapid population growth has led to an increased demand for housing. However, as construction costs rise and supply chain issues persist, the availability of new homes has not kept pace with this demand. This imbalance can create a bubble that may eventually burst.

- Economic Factors: The overall economy plays a crucial role in the housing market. Factors such as unemployment rates, consumer confidence, and inflation can significantly influence buying behavior. Economic downturns can lead to job losses and reduced spending, further impacting housing demand.

- Natural Disasters and Climate Change: Florida is prone to hurricanes and flooding, which can impact property values. Homebuyers are becoming increasingly aware of climate-related risks, and properties in high-risk areas may see a decline in desirability and value.

Historical Context: Housing Market Corrections

To understand the potential for a 60% crash in the Florida housing market, it’s essential to look at historical trends. The 2008 financial crisis serves as a stark reminder of how quickly housing markets can shift. During that period, many states, including Florida, saw home values plummet due to rising foreclosure rates and the bursting of the housing bubble.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

While the current market conditions differ from those of the past, the cyclical nature of real estate suggests that corrections are possible. Experts often caution against overvaluation, and the rapid price increases seen in Florida could indicate a looming correction.

Expert Opinions on the Florida Housing Market

Several real estate analysts and economists weigh in on the potential for a market crash. While some agree with the sentiment expressed in the tweet, others offer a more tempered perspective.

- Optimistic View: Some professionals believe that Florida’s economy is resilient enough to withstand shocks. With continuous population growth and a strong job market, they argue that the housing demand will remain robust, preventing a significant downturn.

- Cautious Approach: On the other hand, many experts advise caution. They point to the aforementioned factors—rising interest rates, economic uncertainty, and climate risks—as reasons for potential instability in the housing market. They suggest that while a 60% crash may be extreme, a significant correction could still occur.

The Importance of Market Monitoring

In light of these discussions, it becomes crucial for potential homebuyers, investors, and homeowners to stay informed about the housing market. Regularly monitoring economic indicators, interest rates, and local market trends can help individuals make informed decisions.

Moreover, engaging with real estate professionals who understand the nuances of the Florida market can provide valuable insights. Conducting thorough research and considering long-term implications can be vital for anyone looking to navigate the complex landscape of real estate.

Conclusion: Preparing for Uncertainty in the Florida Housing Market

As Florida’s housing market continues to evolve, the possibility of a significant downturn remains a topic of discussion. The tweet from @VladTheInflator serves as a reminder to remain vigilant and aware of the factors influencing the market. While some may dismiss the idea of a 60% crash, the importance of preparing for potential corrections cannot be overstated.

In summary, the Florida housing market is at a crossroads. While the current trends suggest a strong demand for housing, various economic indicators and external factors could lead to a shift in the market landscape. Homebuyers, investors, and stakeholders must remain proactive, informed, and prepared for whatever changes may lie ahead in this dynamic market.

By understanding the complexities of the housing market and staying updated on relevant developments, individuals can better position themselves to navigate potential challenges and capitalize on opportunities in the ever-changing real estate environment.

People laughed when I said Florida housing might crash 60%.

They aren’t laughing anymore. pic.twitter.com/MI9RjashDm

— Darth Powell (@VladTheInflator) June 28, 2025

People laughed when I said Florida housing might crash 60%

It’s not every day that a bold prediction about the housing market makes waves, but when the tweet from Darth Powell went viral, it certainly caught many eyes. “People laughed when I said Florida housing might crash 60%. They aren’t laughing anymore.” This statement resonates deeply with the current state of the Florida housing market, and it’s worth diving into the details. Why would someone predict such a dramatic downturn, and what does it mean for homeowners, buyers, and investors?

Understanding the Florida Housing Market

Florida has been a hotspot for real estate, with its sunny weather, beautiful beaches, and no state income tax attracting people from all over the country. Over the past decade, the state has seen a massive surge in property prices. In many areas, homes appreciated at rates that left many wondering if the market was overheating. But as the saying goes, what goes up must come down, and many analysts have been watching for signs of a correction.

The Factors Leading to the Predicted Crash

So, what led to the prediction that Florida housing might crash 60%? Several key factors are at play:

- Interest Rates: The Federal Reserve has been steadily increasing interest rates to combat inflation. Higher interest rates mean higher mortgage costs, which can deter buyers and lead to decreased demand for homes.

- Inventory Levels: During the pandemic, there was a frenzy of buying, but as inventory levels begin to rise, it creates a buyer’s market. More homes for sale typically means prices must adjust downward.

- Economic Uncertainty: Global events, inflation, and job market fluctuations create a sense of economic uncertainty that can make potential buyers hesitant. If people are unsure about their financial future, they’re less likely to make large purchases.

What Does a 60% Crash Look Like?

Now, if we entertain the idea of a 60% drop in housing prices, it’s essential to visualize what that means for the average homeowner. For example, a home valued at $400,000 could see its value plummet to $160,000. This drastic change would not only impact homeowners but also neighborhoods, economies, and the overall health of the real estate market.

Reactions from Homeowners and Investors

When the prediction first surfaced, it was met with skepticism. Many homeowners believed that their investments were safe and that Florida’s appeal would keep prices high. However, as realities set in, that laughter turned into concern. Homeowners who had recently purchased properties at peak prices found themselves in precarious situations, potentially owing more on their mortgages than their homes were worth. Investors, too, are beginning to reassess their portfolios as the market shifts.

The Impact on First-Time Homebuyers

First-time homebuyers are often the most affected in a fluctuating market. For those who had been waiting for prices to stabilize, a significant drop could be seen as a golden opportunity. On the flip side, if a crash occurs, it could lead to a longer-term stagnation in the market, making it challenging for buyers to find affordable options. The fear of buying into a declining market can keep many potential buyers on the sidelines.

Potential Recovery Scenarios

What happens if the market does experience a significant downturn? There are various recovery scenarios to consider. For one, if prices drop, it could attract a new wave of buyers looking for bargains, which could help stabilize the market. Alternatively, if the economic factors causing the downturn persist, it could lead to a prolonged period of low prices, making recovery a slow process.

Advice for Homeowners and Investors

For those currently holding properties in Florida, it’s crucial to stay informed and be proactive. Here are some tips:

- Stay Informed: Keep track of local real estate trends and economic indicators. Knowledge is power, especially in a fluctuating market.

- Evaluate Your Financial Situation: If you’re considering selling, evaluate your financial goals and the current market conditions before making any decisions.

- Consider Renting: If selling isn’t an attractive option right now, consider renting your property. It can provide cash flow and give you time to wait for market recovery.

The Bigger Picture: Lessons from History

Historically, real estate markets have gone through cycles of boom and bust. The 2008 financial crisis serves as a stark reminder of how quickly the market can shift. Many people lost their homes and savings, leading to a long, painful recovery. Understanding these cycles can help current homeowners and investors prepare for the future.

Conclusion: Navigating the Unknown

As we look to the future of the Florida housing market, the prediction of a potential 60% crash serves as both a warning and a lesson. While it’s easy to dismiss bold claims, the reality is that markets are unpredictable, and preparation is key. Whether you’re a homeowner, a potential buyer, or an investor, staying informed, being flexible, and planning for various scenarios will help you navigate these uncertain times.

Ultimately, the words of Darth Powell remind us that the housing market, much like life, is full of ups and downs. While some may laugh off predictions, others are left to deal with the ramifications. It’s essential to approach the market with caution, awareness, and a willingness to adapt to whatever comes next.

“`

This article is designed to be engaging, informative, and optimized for SEO, incorporating the requested keywords and providing valuable insights into the Florida housing market’s current state.