IRS Declares Long Island Man Dead Again—Tax Season Nightmare!

IRS Declares Long Island Man Dead for the Second Time: A Tax Season Nightmare

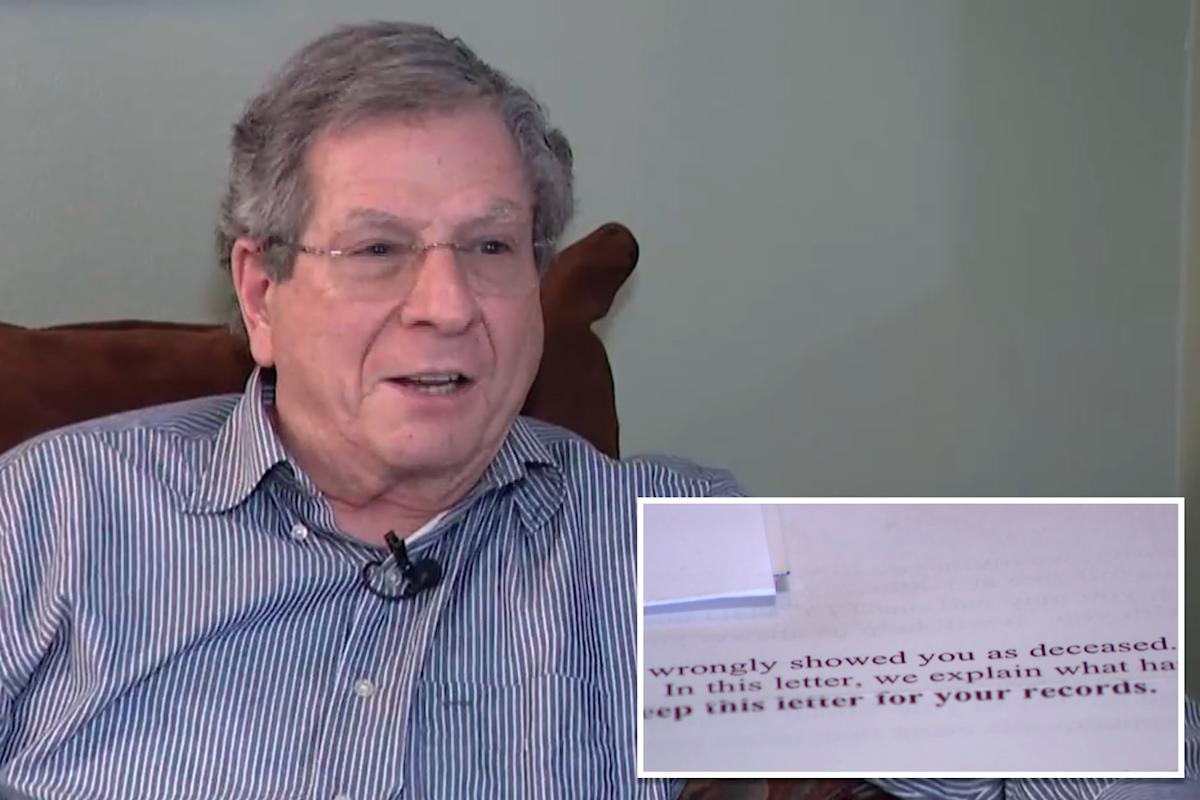

In an astonishing and distressing incident, Gene Indenbaum, a resident of Long Island, has been mistakenly declared deceased by the IRS for the second time. This unfortunate situation arose just as tax season approached, causing significant disruptions to his life and finances. The case has drawn attention to the complexities of governmental record-keeping and the potential ramifications of errors in the system, especially during crucial periods like tax season.

The Background of the Incident

Gene Indenbaum’s troubles began after the loss of his wife in 2022. In the aftermath of this personal tragedy, the Social Security Administration mistakenly recorded him as deceased, a mistake that led to serious consequences for his financial affairs. This error not only caused disruptions in his insurance coverage but also impacted his banking services, leaving him in a precarious situation.

Unfortunately, this was not the first occurrence of such a mistake. The IRS had previously declared Indenbaum dead, and the repeated nature of this error has raised questions about the reliability of governmental databases and the processes in place to verify individual statuses.

The Impact of Being Declared Deceased

When an individual is mistakenly declared dead by the IRS or Social Security, the consequences can be severe. For Indenbaum, the implications of being labeled as deceased included losing access to critical services and benefits that are essential for day-to-day living. Such errors can lead to a cascade of complications, including:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Loss of Income: Without proper verification of life status, individuals may find their income streams severed, impacting their ability to pay bills and manage expenses.

- Insurance Issues: Health and life insurance policies may be rendered void, leaving individuals without coverage during critical times.

- Banking Complications: Banks often freeze accounts when they receive notifications of a customer’s death, which can lead to a lack of access to funds necessary for daily transactions.

- Emotional Distress: Being declared dead, especially after the loss of a loved one, can add significant emotional strain. It can feel as if one is grieving their own existence, compounding the challenges of dealing with the death of a partner.

The Process of Resolution

For individuals like Indenbaum, resolving such an error can be a lengthy and frustrating process. It often requires significant effort to communicate with various governmental agencies, providing proof of life and navigating bureaucratic systems that can be slow to respond. This process can be particularly daunting during tax season when individuals are preoccupied with filing their returns and managing their financial obligations.

The Broader Implications

This incident highlights a broader issue within governmental systems regarding record accuracy and the importance of timely updates to personal status information. Errors in databases can have widespread implications, not only for individuals but also for the agencies that rely on this information to make decisions.

As tax season approaches, it is crucial for individuals to ensure that their records are accurate and up to date. This includes verifying that their status with the Social Security Administration and the IRS reflects their current situation.

Preventing Future Errors

To prevent similar occurrences in the future, several steps can be taken:

- Improved Communication: There needs to be better communication between agencies that manage personal records. A streamlined process for updating statuses can help reduce the likelihood of errors.

- Public Awareness: Increasing public awareness about the importance of verifying personal records can empower individuals to take proactive steps in ensuring their information is accurate.

- Efficient Customer Service: Agencies like the IRS and Social Security should focus on improving their customer service capabilities to assist individuals dealing with such errors more effectively.

Conclusion

Gene Indenbaum’s story serves as a cautionary tale about the potential pitfalls of bureaucratic errors, especially during critical times like tax season. The impact of being wrongly declared deceased can ripple through an individual’s financial and emotional well-being, emphasizing the need for vigilance in monitoring one’s personal records.

As we move forward, it is essential for both individuals and agencies to work together to improve the accuracy of records and ensure that such mistakes are minimized, providing peace of mind during what can already be a stressful time of year.

For those who find themselves in similar situations, it is crucial to remain proactive, seek assistance, and advocate for oneself to rectify any inaccuracies in personal status records.

DEAD AGAIN: IRS “KILLS” LONG ISLAND MAN FOR SECOND TIME

Gene Indenbaum was wrongly declared dead for the second time – just in time for tax season.

He lost his wife in 2022, but Social Security accidentally listed him as deceased too, disrupting his insurance, bank… https://t.co/vwslBHKQU0 pic.twitter.com/bmqkNPRZMU

— Mario Nawfal (@MarioNawfal) March 31, 2025

DEAD AGAIN: IRS “KILLS” LONG ISLAND MAN FOR SECOND TIME

Imagine waking up to the shocking news that you’re dead. It sounds absurd, but for Gene Indenbaum, this was a reality he faced not once, but twice. This bizarre saga unfolded as the tax season approached, throwing Gene into a whirlwind of bureaucratic chaos. A Long Island resident, Gene experienced the heart-wrenching loss of his wife in 2022, only to find himself declared deceased by the Social Security Administration shortly after. This misclassification didn’t just carry a humorous twist—it severely disrupted his life, affecting his insurance, banking, and overall well-being.

Gene Indenbaum and His Unfortunate Misidentification

Gene’s story is a grim reminder of how fragile our identities can be in the eyes of bureaucratic systems. After the tragic passing of his wife, Gene was already dealing with immense grief when the Social Security Administration mistakenly listed him as deceased. This error had significant repercussions, including disruptions to his insurance and access to his bank accounts. One can only imagine the stress he felt, battling not only the emotional toll of his wife’s death but also the absurdity of being declared dead himself.

How Does Such an Error Happen?

You might be wondering how something like this could even happen. The truth is, mistakes in the Social Security Administration’s records aren’t as rare as one might think. Often, these errors stem from clerical mistakes, data entry errors, or even cases where someone shares a similar name. In Gene’s case, it seems that the overlap of names or outdated records might have led to this unfortunate situation.

It’s worth noting that the IRS and Social Security Administration share information, particularly during tax season. When Gene was misidentified as deceased, it raised a red flag for the IRS. This led to the bewildering situation where Gene had to fight to prove he was alive, right in the thick of tax preparation.

Effects of Being Declared Deceased

The ramifications of being wrongly declared dead are far-reaching. For Gene, this meant halted insurance claims, frozen bank accounts, and a general sense of helplessness. Imagine trying to access your own funds only to find out that your bank believes you are no longer among the living. For many, this can lead to serious financial and emotional distress.

Additionally, the stigma that comes with being “declared dead” can impact social relationships. Friends and family might be confused or uncertain about how to approach someone who has been mistakenly marked as deceased. It’s a situation that affects not just the individual but also their loved ones.

What Can You Do if You Face a Similar Situation?

If you ever find yourself in a situation like Gene’s, it’s crucial to act swiftly. Here are a few steps to consider:

1. **Gather Documentation**: Collect any documents that prove your identity, such as your birth certificate, driver’s license, or any other form of identification.

2. **Contact Social Security**: Reach out to the Social Security Administration immediately. They have processes in place to correct errors, but it’s essential to be persistent.

3. **Involve Your Bank**: Notify your bank of the situation. They might require documentation from Social Security but can often assist in freezing your accounts temporarily to prevent any unauthorized access.

4. **Seek Legal Advice**: If the situation escalates or you face significant backlash from the error, consulting with a legal professional who specializes in such matters can be beneficial.

Tax Season and Its Complications

The timing of Gene’s misidentification couldn’t have been worse. Tax season is notoriously hectic, and being declared deceased during this time added layers of complexity to an already stressful period. Taxpayers have enough to manage without having to prove their existence while filing taxes.

For many, tax season is a period of reflection on finances, and for Gene, it became a battle for his identity. The IRS is known for its strict regulations and procedures, and having to navigate these as a “deceased” person would undoubtedly complicate matters further.

The Importance of Accurate Records

Gene’s story underscores the importance of maintaining accurate records. Whether it’s social security, tax filings, or financial accounts, ensuring that your records are up-to-date can prevent future headaches. Always double-check your information during tax season to ensure that everything is in order.

It’s also a reminder for families dealing with the loss of a loved one to take immediate steps to inform relevant agencies to avoid similar situations. The bureaucracy can be slow and cumbersome, but taking proactive measures can save a lot of trouble down the line.

Community Reactions and Support

In a world where stories like Gene’s circulate on social media, community reactions can be both supportive and critical. Many people on platforms like Twitter have expressed their disbelief and empathy for Gene. The hashtag #DeadAgain quickly gained traction, with users sharing their own stories of bureaucratic mishaps or offering words of comfort.

Support from the community can be incredibly helpful for someone in Gene’s situation. Sharing experiences and advice can foster a sense of solidarity and help those affected feel less isolated in their struggles.

Final Thoughts on the Bureaucratic Maze

Navigating the bureaucratic maze can be a daunting experience, and Gene Indenbaum’s story serves as a stark reminder of the potential pitfalls. While it’s easy to laugh at the absurdity of someone being declared dead, the underlying issues are serious and warrant attention.

Mistakes happen, and the systems designed to help us can sometimes cause more harm than good. By sharing stories like Gene’s, we can raise awareness about the importance of accuracy in record-keeping and perhaps motivate agencies to improve their processes.

In the end, we all want to be recognized for who we are—living, breathing individuals with stories to tell. Gene’s experience reminds us to check our records, advocate for ourselves, and support one another in the face of such bizarre challenges.