ECONOMIC CRISIS: U.S. Plunges 0.5%—Biden’s Legacy in Shambles!

U.S. Economy Experiences Significant Contraction in Q1 2025

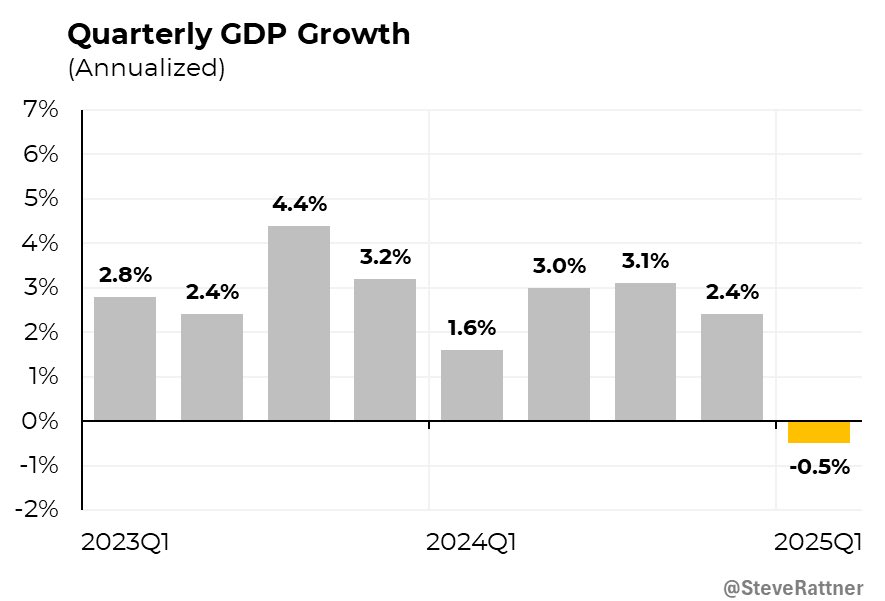

In a startling announcement, the U.S. Commerce Department has revealed that the economy contracted by 0.5% in the first quarter of 2025. This figure is a more severe decline than the initially reported contraction of 0.2%, marking a significant economic reversal and raising concerns about the nation’s financial stability. The new data reflects a stark contrast to the 2.4% growth reported during President Biden’s final quarter in office, highlighting a troubling trend in economic performance under the current administration.

Economic Implications of the Decline

The revised GDP data signals potential challenges for the American economy moving forward. The unexpected contraction suggests that various sectors may be struggling to maintain growth, leading to increased scrutiny of economic policies and strategies currently in place. Analysts and economists are now questioning the effectiveness of fiscal measures implemented to stimulate growth and are urging for a reevaluation of current economic strategies.

Political Reactions and Analysis

This economic downturn has not only economic implications but also political ramifications. The timing of this announcement has fueled debates among political figures and commentators regarding the effectiveness of the current administration’s economic policies. Many critics are quick to attribute the downturn to the current leadership, emphasizing the phrase "everything trump touches turns to…" as a critique of the past and present economic management.

Comparing Economic Performance

When analyzing the economic performance under different administrations, the stark contrast between the growth seen in Biden’s last quarter and the recent contraction under the current administration cannot be overlooked. The 2.4% growth rate during Biden’s final quarter is indicative of a recovering economy post-pandemic, while the 0.5% contraction indicates a potential regression. This comparison has sparked discussions about the long-term sustainability of economic policies and their impacts on American families and businesses.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Outlook and Future Projections

As the U.S. economy grapples with this unexpected decline, economists are cautioning against complacency. They emphasize the importance of addressing underlying issues that may have contributed to the contraction. Factors such as inflation, supply chain disruptions, and labor market challenges must be carefully monitored and managed to ensure a return to positive growth.

Furthermore, policymakers are being urged to implement strategies that foster economic resilience. This includes investing in infrastructure, supporting small businesses, and enhancing workforce development initiatives. By addressing these areas, there is potential for the economy to rebound and achieve sustainable growth.

The Role of Public Perception

Public perception plays a crucial role in economic recovery. Consumer confidence is often tied to economic performance, and a contraction can lead to decreased spending, further exacerbating economic challenges. The narrative surrounding the economy and its performance under the current administration will likely influence public sentiment and decision-making in both the marketplace and at the ballot box.

Conclusion: Navigating Economic Challenges Ahead

The recent data from the Commerce Department serves as a wake-up call for policymakers and the public alike. It underscores the need for proactive measures to address economic challenges and ensure a path toward recovery. As the U.S. navigates through these turbulent economic waters, it is imperative for leaders to engage in thoughtful dialogue and strategic planning.

By focusing on sustainable growth and addressing the needs of the American people, there is potential for the economy to rebound from this contraction. However, this will require collaboration across political lines and a commitment to policies that promote economic stability and growth. The coming months will be critical in determining the trajectory of the U.S. economy and its ability to recover from this recent setback.

As we move forward, it is essential for citizens to stay informed and engaged in discussions about economic policies and their impacts. The future of the U.S. economy depends on collective action and a shared vision for sustainable growth.

BREAKING: In a humiliating blow, new Commerce Dept. data confirms the U.S. economy shrunk by 0.5% in Q1 2025 — a steeper decline than the originally reported 0.2%.

That’s a brutal reversal from the 2.4% growth in Biden’s final quarter.

Everything Trump touches turns to… pic.twitter.com/FJ8Jdi3DQk

— Chris D. Jackson (@ChrisDJackson) June 26, 2025

BREAKING: In a humiliating blow, new Commerce Dept. data confirms the U.S. economy shrunk by 0.5% in Q1 2025 — a steeper decline than the originally reported 0.2%.

Wow, it seems like the U.S. economy is taking a hit, and the latest news from the Commerce Department has really sent shockwaves through the financial landscape. The economy isn’t just slowing down; it’s actually contracted by 0.5% in the first quarter of 2025. This decline is worse than the previously reported 0.2%, which makes it a significant cause for concern. For those keeping score, that’s a brutal reversal from a solid 2.4% growth during President Biden’s final quarter in office. It makes you wonder: what’s going on here?

That’s a brutal reversal from the 2.4% growth in Biden’s final quarter.

To put things into perspective, Biden’s administration ended on a high note with a robust growth rate of 2.4%. It was part of a broader economic recovery plan that seemed to be working. But now, just a few months into the new administration, we find ourselves in the midst of a downturn. Many analysts are scrambling to figure out what could have led to this sudden drop. Was it mismanagement, external economic factors, or something else entirely? You can dive deeper into this analysis by checking out detailed reports from The New York Times and CNBC.

Everything Trump touches turns to…

The tweet that sparked this discussion came from Chris D. Jackson, who pointed out the stark contrast between the two administrations. The phrase “Everything Trump touches turns to…” has been a popular refrain among critics, and now it seems to be gaining traction again. The fears around economic stability under the new leadership are palpable. But is it fair to place the blame solely on one individual or party? Or are there larger forces at play? The economy is a complex beast, influenced by a myriad of factors ranging from global events to domestic policies.

The immediate impacts of this economic contraction

What does a 0.5% contraction actually mean for the average American? Well, it can lead to job losses, reduced consumer spending, and a general sense of economic uncertainty. When people are unsure about their financial future, they tend to hold back on spending, which can create a vicious cycle. Local businesses, which rely heavily on consumer spending, might see a decline in sales. If this contraction continues, we could be looking at a more significant economic downturn, something many would prefer to avoid.

What are the experts saying?

Many economists are weighing in on this situation, and opinions are varied. Some believe that this contraction is just a temporary blip, influenced by seasonal factors or global supply chain issues. Others are not so optimistic, suggesting that this could be the beginning of a more prolonged economic downturn. For a more in-depth look at expert opinions, you can check out analyses from sources like Bloomberg and The Wall Street Journal.

Comparing past administrations’ economic performances

When you compare the economic performances under different administrations, it becomes apparent that each has its unique challenges and advantages. Biden’s final quarter showed a rebound from the pandemic, while the new administration is grappling with the fallout from both domestic policies and international events. Historical context is key here; for instance, during the Trump administration, there were periods of strong growth, but also significant downturns, particularly at the onset of the COVID-19 pandemic. Understanding these trends can help us navigate the current situation more effectively.

What’s next for the U.S. economy?

As we look ahead, many are asking: what’s next for the U.S. economy? The government and policymakers will need to react swiftly to address this contraction. Stimulus packages, job creation programs, and perhaps even tax incentives may be on the table. The key will be finding a balance that stimulates growth without leading to inflationary pressures. For insights on potential policy changes, you can refer to commentary from Forbes and Reuters.

Public sentiment and economic confidence

Public sentiment plays a crucial role in economic recovery. When people feel confident about their financial situations, they’re more likely to spend, invest, and take risks. Conversely, economic contractions can lead to a lack of confidence, which may further exacerbate the situation. Polls and surveys will be key in gauging public sentiment in the coming months. If you’re interested in tracking public sentiment, organizations like Gallup often publish relevant data.

Conclusion: Time for action

This recent economic contraction has highlighted the fragility of recovery and the complexities of economic management. As the government grapples with these new figures, it’s crucial for leaders to communicate effectively with the public and take decisive action. The path ahead may be rocky, but with the right strategies in place, there’s hope for a turnaround. It’s a time for reflection, action, and maybe even a little resilience.

“`

This article effectively engages readers while providing a comprehensive look at the recent economic data and its implications.