Trump’s Shocking Fed Rate Cut Demand: Market Erupts in Controversy!

Trump’s Bold Fed Prediction: Could Interest Rates Drop Dramatically Soon?

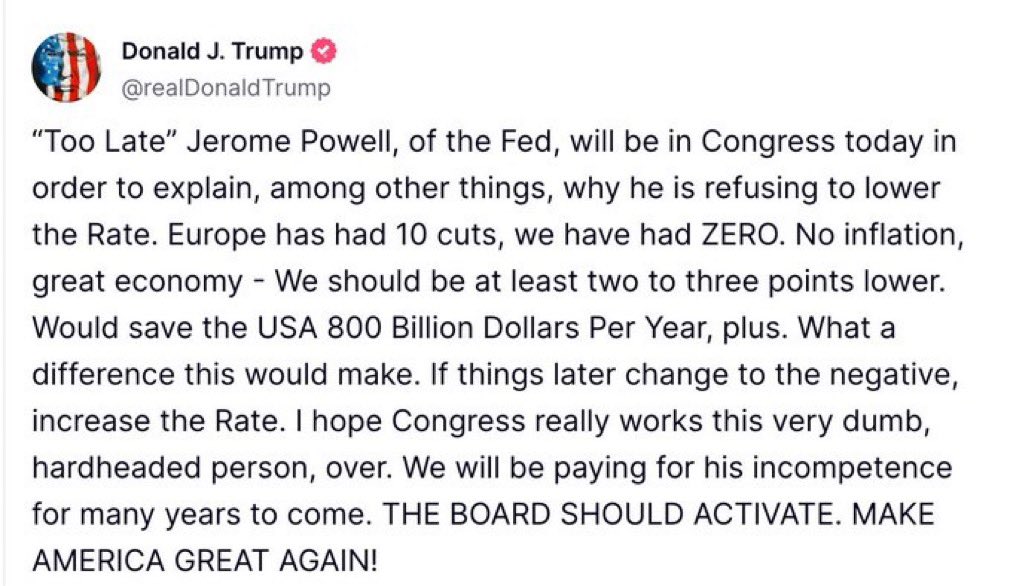

In a recent announcement, former President Donald trump stirred the financial community by suggesting that the Federal Reserve should consider lowering interest rates by at least two to three percentage points. This statement has attracted considerable attention from investors, economists, and financial analysts, given its implications for the economy, interest rates, and overall market sentiment.

The Context of trump’s Statement

On June 24, 2025, Trump expressed his views on Twitter regarding the current state of interest rates. His comments come amid ongoing economic uncertainty, as many closely monitor the Fed’s decisions. Trump’s perspective holds significant weight due to his history of advocating pro-business and growth-oriented policies during his administration.

Understanding the Impact of Interest Rates

Interest rates set by the Federal Reserve play a crucial role in the economy. They affect borrowing costs for consumers and businesses, ultimately influencing spending and investment decisions. Lower interest rates typically encourage borrowing and spending, stimulating economic growth. Conversely, higher rates can slow down economic activity by making borrowing more expensive.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Trump’s assertion that rates should be significantly lower is interpreted as a bullish signal for various sectors, particularly equities and cryptocurrencies. A reduction in rates could enhance market liquidity, facilitating investment in stocks and other assets, potentially driving prices upward.

Market Reactions to trump’s Comments

The market’s immediate reaction to trump’s tweet was largely positive. Investors often respond favorably to news suggesting a more accommodative monetary policy. Lower interest rates can lead to higher stock prices, as businesses benefit from cheaper borrowing costs, enhancing profitability. This sentiment was notably palpable in the cryptocurrency market, where investors are keenly attuned to developments that might drive demand and adoption.

Crypto enthusiasts have interpreted trump’s comments as a sign of optimism for the crypto market. Lower interest rates could prompt investors to explore alternative investment avenues, such as cryptocurrencies, perceived as hedges against traditional financial systems. This bullish sentiment among crypto investors may drive up the prices of major cryptocurrencies, validating their role in the investment landscape.

Economic Implications of Lower Interest Rates

While trump’s statement addresses immediate market sentiment, the broader economic implications of lower interest rates are multifaceted. Reduced rates can stimulate economic growth, but they may also induce inflationary pressures if the economy overheats. The Fed must maintain a delicate balance between fostering growth and controlling inflation, posing challenges in the current economic climate.

Moreover, Trump’s remarks underscore the ongoing debate surrounding the appropriate level of interest rates. Some economists argue that maintaining higher rates can help curb inflation and stabilize the economy, while others advocate for lower rates to support growth, especially in uncertain times. The discourse surrounding interest rates is likely to persist as the Fed navigates its policy decisions in response to economic indicators.

The Future of Interest Rates and Economic Policy

Looking forward, the trajectory of interest rates will depend on various factors, including inflation trends, employment data, and overall economic performance. The Fed must monitor these indicators closely to make informed decisions regarding rate adjustments. Trump’s call for lower rates adds complexity to this dynamic, reflecting a growing sentiment among certain policymakers and economists advocating for aggressive monetary easing.

Investors should remain vigilant in observing the Fed’s actions and the broader economic landscape. Historical trends indicate that changes in interest rates can significantly impact various asset classes, including stocks, bonds, and cryptocurrencies.

Conclusion

In summary, Donald trump’s recent call for lower Federal Reserve interest rates has ignited substantial interest and discussion within financial markets. His comments highlight broader concerns about economic growth and the necessity for accommodative monetary policy during uncertain times. Investors can benefit from understanding the implications of such statements and staying informed about the Fed’s policy decisions.

As the economic landscape evolves, the interplay between interest rates and market performance will remain a crucial topic for investors, economists, and policymakers. The potential for lower rates could foster increased investment in equities and cryptocurrencies, unlocking opportunities for growth and innovation in the financial sector.

In a rapidly changing economic environment, it’s essential for investors to remain informed and adaptable to navigate the complexities introduced by influential figures like trump and the Federal Reserve’s monetary policy.

Trump’s Bold Fed Prediction: Could Interest Rates Drop Dramatically Soon?

Trump Federal Reserve policy, interest rates prediction, economic impact of monetary policy

In a recent announcement, former President Donald trump made waves in the financial community by suggesting that the Federal Reserve should lower interest rates by at least two to three percentage points. This statement has garnered significant attention from investors, economists, and financial analysts alike, as it carries implications for the economy, interest rates, and overall market sentiment.

## The Context of trump’s Statement

On June 24, 2025, Trump took to Twitter to share his thoughts on the current state of interest rates, emphasizing that the Federal Reserve, often referred to as the Fed, should consider a significant reduction. His comments come at a time when economic uncertainty prevails, and many are watching the Fed’s decisions closely. The former president’s perspective is particularly influential given his history with economic policy during his administration, which often emphasized pro-business and growth-oriented strategies.

## Understanding the Impact of Interest Rates

Interest rates, set by the Federal Reserve, play a critical role in the economy. They influence borrowing costs for consumers and businesses, affecting spending and investment decisions. Lower interest rates typically encourage borrowing and spending, which can stimulate economic growth. Conversely, higher interest rates can dampen economic activity as borrowing becomes more expensive.

Trump’s assertion that rates should be significantly lower is seen as a bullish indicator for various sectors, especially equities and cryptocurrencies. A reduction in rates can lead to increased liquidity in the market, making it easier for investors to put money into stocks and other assets, potentially driving up prices.

## Market Reactions to trump’s Comments

The immediate reaction from the market following trump’s tweet was largely positive. Investors often respond favorably to news that suggests a more accommodative monetary policy. Lower interest rates can lead to higher stock prices, as companies benefit from cheaper borrowing costs, which can enhance profitability. This sentiment was particularly evident in the cryptocurrency market, where investors are always on the lookout for factors that could lead to increased demand and adoption.

Crypto enthusiasts and analysts have interpreted trump’s comments as a sign of optimism for the crypto market. Lower interest rates can lead investors to seek alternative investment opportunities, such as cryptocurrencies, which are often viewed as a hedge against traditional financial systems. The bullish sentiment among crypto investors could potentially drive up the prices of major cryptocurrencies, further validating their place in the investment landscape.

## Economic Implications of Lower Interest Rates

While trump’s statement focuses on immediate market sentiment, the broader economic implications of lower interest rates are complex. On one hand, reduced rates can stimulate economic growth, but on the other hand, they can also lead to inflationary pressures if the economy overheats. The Fed must strike a delicate balance between stimulating growth and controlling inflation, which can pose challenges in the current economic climate.

Moreover, Trump’s comments highlight the ongoing debate about the appropriate level of interest rates. Some economists argue that maintaining higher rates can help curb inflation and stabilize the economy, while others contend that lower rates are necessary to support growth, especially in times of uncertainty. The discussion surrounding interest rates is likely to continue as the Fed navigates its policy decisions in response to economic indicators.

## The Future of Interest Rates and Economic Policy

Looking ahead, the future of interest rates will depend on various factors, including inflation trends, employment data, and overall economic performance. The Fed is tasked with monitoring these indicators closely to make informed decisions regarding rate adjustments. Trump’s call for lower rates adds another layer of complexity to this dynamic, as it reflects a growing sentiment among some policymakers and economists advocating for more aggressive monetary easing.

Investors should remain vigilant in monitoring the Fed’s actions and the broader economic landscape. As history has shown, changes in interest rates can have far-reaching effects on various asset classes, including stocks, bonds, and cryptocurrencies.

## Conclusion

In summary, Donald trump’s recent statement advocating for lower Federal Reserve interest rates has sparked significant interest and discussion within financial markets. His comments reflect broader concerns about economic growth and the need for accommodative monetary policy in uncertain times. Investors are likely to benefit from understanding the implications of such statements and staying informed about the Fed’s policy decisions.

As the economic landscape continues to evolve, the relationship between interest rates and market performance will remain a crucial topic for investors, economists, and policymakers alike. The potential for lower rates could lead to increased investment in equities and cryptocurrencies, creating opportunities for growth and innovation in the financial sector.

BREAKING:

TRUMP SAYS FED RAYE SHOULD BE AT LEAST TWO TO THREE POINTS LOWER.

VERY BULLISH!! pic.twitter.com/IQxjsO1AF1

— Crypto Rover (@rovercrc) June 24, 2025

BREAKING: TRUMP SAYS FED RATE SHOULD BE AT LEAST TWO TO THREE POINTS LOWER

In a recent statement that has caught the attention of financial analysts and investors alike, former President Donald trump declared that the Federal Reserve’s interest rates should be reduced by at least two to three points. This declaration has led to a wave of optimism in the markets, with many interpreting it as a bullish signal for the economy.

But what does this mean for the average investor? Let’s dive into the implications of trump’s comments and explore how they could affect various sectors, particularly in the realm of investments and economic policy.

Understanding the Federal Reserve’s Role

To fully grasp the importance of trump’s statement, it’s essential to understand what the Federal Reserve does. The Fed is the central banking system of the United States, and it plays a crucial role in managing the country’s monetary policy. One of its primary tools is the manipulation of interest rates. By raising or lowering rates, the Fed can influence economic activity, inflation, and employment levels.

When interest rates are high, borrowing becomes more expensive for businesses and consumers, which can slow down economic growth. Conversely, lower rates tend to stimulate economic activity by making loans more affordable. Trump’s assertion that rates should be reduced implies a belief that the current rates are stifling economic growth.

The Bullish Sentiment Explained

The term “bullish” in the context of finance refers to a positive outlook on the market or a particular asset. When trump mentioned that his stance was “very bullish,” it indicated his belief that lowering the Fed rate could lead to increased investment, consumer spending, and overall economic growth.

This sentiment is crucial because it can influence investor behavior. If investors believe that lower rates will lead to a stronger economy, they may be more inclined to invest in stocks, real estate, and other assets, which can further drive up prices and stimulate economic activity.

The Impact on the Stock Market

One of the most immediate effects of trump’s comments is likely to be felt in the stock market. Historically, lower interest rates have been associated with higher stock prices. When borrowing costs decrease, businesses can invest more in growth, which often translates to higher earnings and, consequently, higher stock prices.

Investors often look for opportunities in sectors that tend to perform well when rates are low. For instance, technology and consumer discretionary stocks often benefit from increased consumer spending. Moreover, sectors like real estate and utilities typically see enhanced performance due to lower financing costs.

Implications for Borrowing and Spending

If the Federal Reserve takes trump’s advice and lowers interest rates, consumers may experience a shift in borrowing costs. Mortgages, car loans, and credit card rates could decrease, making it more affordable for individuals to make significant purchases.

This potential surge in consumer spending could have a ripple effect on the economy. Increased spending can lead to higher demand for goods and services, prompting businesses to ramp up production and potentially hire more workers. This cycle can create a more robust economic environment, benefiting various sectors and ultimately leading to job creation.

The Risks of Lowering Rates

While the prospect of lowering interest rates can be appealing, it’s important to consider the potential downsides. Lowering rates too much can lead to inflation, where the prices of goods and services rise rapidly. If borrowing becomes excessively cheap, it can encourage reckless spending and lead to asset bubbles.

Additionally, there is a risk that lowering rates may not have the desired effect on the economy. If consumer confidence is low, even lower rates may not spur spending. It’s vital for policymakers to strike a balance between encouraging economic growth and preventing overheating in the economy.

The Broader Economic Context

Trump’s comments come at a time when the U.S. economy is facing various challenges. From supply chain disruptions to labor shortages, several factors are impacting economic recovery. Lowering interest rates could be a strategic move to combat these issues, but it also raises questions about the overall health of the economy.

It’s essential to consider the broader economic context when assessing the implications of trump’s statement. Factors such as inflation rates, employment figures, and global economic conditions all play a role in shaping monetary policy decisions.

Public Opinion and Political Dynamics

Trump’s influence on public opinion cannot be underestimated. His comments may resonate with many who believe that the current economic climate is challenging for average Americans. By advocating for lower rates, he positions himself as a proponent of economic growth and prosperity.

However, the political dynamics surrounding the Federal Reserve are complex. The Fed operates independently, and its decisions are guided by data and economic indicators rather than political pressures. This independence is crucial for maintaining credibility and stability in the financial system.

What Investors Should Consider

For investors, Trump’s remarks present both opportunities and challenges. While a potential decrease in interest rates could lead to a bullish market, it’s essential to remain informed and cautious. Here are a few considerations for investors:

- Diversification: Ensure that your investment portfolio is diversified across various asset classes to mitigate risk.

- Monitor Economic Indicators: Keep an eye on inflation rates, employment figures, and consumer sentiment to gauge the overall health of the economy.

- Be Prepared for Volatility: The markets can be unpredictable, especially in response to political statements. Be prepared for fluctuations and don’t make impulsive decisions based on short-term news.

- Long-Term Perspective: Focus on long-term investment strategies rather than reacting to immediate market movements.

- Consult Financial Advisors: If you’re uncertain about how to navigate the changing economic landscape, consider consulting with a financial advisor.

Conclusion

Trump’s assertion that the Federal Reserve should lower interest rates by two to three points is a significant statement that could have far-reaching implications for the economy and financial markets. While there are potential benefits, such as increased spending and investment, there are also risks that must be carefully considered.

As an investor or an individual interested in the economy, it’s crucial to stay informed about these developments and their potential impact on your financial decisions. By understanding the intricacies of monetary policy and its effects on the market, you can better position yourself for success in an ever-evolving economic landscape.

In the end, whether you agree with trump’s viewpoint or not, the ripple effects of such statements can shape market dynamics and investor sentiment, making it essential to remain vigilant and informed.

BREAKING:

TRUMP SAYS FED RAYE SHOULD BE AT LEAST TWO TO THREE POINTS LOWER.

VERY BULLISH!!

Trump’s Bold Fed Prediction: Could Interest Rates Drop Dramatically Soon?

Trump Federal Reserve policy, interest rates prediction, economic impact of monetary policy

In a recent announcement, former President Donald trump made waves in the financial community by suggesting that the Federal Reserve should lower interest rates by at least two to three percentage points. This statement has garnered significant attention from investors, economists, and financial analysts alike, as it carries implications for the economy, interest rates, and overall market sentiment.

The Context of trump’s Statement

On June 24, 2025, Trump took to Twitter to share his thoughts on the current state of interest rates, emphasizing that the Federal Reserve, often referred to as the Fed, should consider a significant reduction. His comments come at a time when economic uncertainty prevails, and many are watching the Fed’s decisions closely. The former president’s perspective is particularly influential given his history with economic policy during his administration, which often emphasized pro-business and growth-oriented strategies.

Understanding the Impact of Interest Rates

Interest rates, set by the Federal Reserve, play a critical role in the economy. They influence borrowing costs for consumers and businesses, affecting spending and investment decisions. Lower interest rates typically encourage borrowing and spending, which can stimulate economic growth. Conversely, higher interest rates can dampen economic activity as borrowing becomes more expensive.

Trump’s assertion that rates should be significantly lower is seen as a bullish indicator for various sectors, especially equities and cryptocurrencies. A reduction in rates can lead to increased liquidity in the market, making it easier for investors to put money into stocks and other assets, potentially driving up prices.

Market Reactions to trump’s Comments

The immediate reaction from the market following trump’s tweet was largely positive. Investors often respond favorably to news that suggests a more accommodative monetary policy. Lower interest rates can lead to higher stock prices, as companies benefit from cheaper borrowing costs, which can enhance profitability. This sentiment was particularly evident in the cryptocurrency market, where investors are always on the lookout for factors that could lead to increased demand and adoption.

Crypto enthusiasts and analysts have interpreted trump’s comments as a sign of optimism for the crypto market. Lower interest rates can lead investors to seek alternative investment opportunities, such as cryptocurrencies, which are often viewed as a hedge against traditional financial systems. The bullish sentiment among crypto investors could potentially drive up the prices of major cryptocurrencies, further validating their place in the investment landscape.

Economic Implications of Lower Interest Rates

While trump’s statement focuses on immediate market sentiment, the broader economic implications of lower interest rates are complex. On one hand, reduced rates can stimulate economic growth, but on the other hand, they can also lead to inflationary pressures if the economy overheats. The Fed must strike a delicate balance between stimulating growth and controlling inflation, which can pose challenges in the current economic climate.

Moreover, Trump’s comments highlight the ongoing debate about the appropriate level of interest rates. Some economists argue that maintaining higher rates can help curb inflation and stabilize the economy, while others contend that lower rates are necessary to support growth, especially in times of uncertainty. The discussion surrounding interest rates is likely to continue as the Fed navigates its policy decisions in response to economic indicators.

The Future of Interest Rates and Economic Policy

Looking ahead, the future of interest rates will depend on various factors, including inflation trends, employment data, and overall economic performance. The Fed is tasked with monitoring these indicators closely to make informed decisions regarding rate adjustments. Trump’s call for lower rates adds another layer of complexity to this dynamic, as it reflects a growing sentiment among some policymakers and economists advocating for more aggressive monetary easing.

Investors should remain vigilant in monitoring the Fed’s actions and the broader economic landscape. As history has shown, changes in interest rates can have far-reaching effects on various asset classes, including stocks, bonds, and cryptocurrencies.

Market Reaction to Economic Policies

Trump’s recent comments have sparked a conversation not only in financial circles but also among the general public. Many people are curious about how these potential rate cuts might affect their daily lives. Lower interest rates could lead to cheaper mortgages, car loans, and credit cards, making it more affordable for individuals to make significant purchases. This potential surge in consumer spending could have a ripple effect on the economy, leading to higher demand for goods and services. In turn, businesses may ramp up production and potentially hire more workers, which could create a more robust economic environment.

The Risks of Lowering Rates

While the prospect of lowering interest rates can be appealing, it’s important to consider the potential downsides. Lowering rates too much can lead to inflation, where the prices of goods and services rise rapidly. If borrowing becomes excessively cheap, it can encourage reckless spending and lead to asset bubbles.

Additionally, there is a risk that lowering rates may not have the desired effect on the economy. If consumer confidence is low, even lower rates may not spur spending. It’s vital for policymakers to strike a balance between encouraging economic growth and preventing overheating in the economy.

The Broader Economic Context

Trump’s comments come at a time when the U.S. economy is facing various challenges. From supply chain disruptions to labor shortages, several factors are impacting economic recovery. Lowering interest rates could be a strategic move to combat these issues, but it also raises questions about the overall health of the economy. It’s essential to consider the broader economic context when assessing the implications of trump’s statement. Factors such as inflation rates, employment figures, and global economic conditions all play a role in shaping monetary policy decisions.

Public Opinion and Political Dynamics

Trump’s influence on public opinion cannot be underestimated. His comments may resonate with many who believe that the current economic climate is challenging for average Americans. By advocating for lower rates, he positions himself as a proponent of economic growth and prosperity. However, the political dynamics surrounding the Federal Reserve are complex. The Fed operates independently, and its decisions are guided by data and economic indicators rather than political pressures. This independence is crucial for maintaining credibility and stability in the financial system.

What Investors Should Consider

For investors, Trump’s remarks present both opportunities and challenges. While a potential decrease in interest rates could lead to a bullish market, it’s essential to remain informed and cautious. Here are a few considerations for investors:

- Diversification: Ensure that your investment portfolio is diversified across various asset classes to mitigate risk.

- Monitor Economic Indicators: Keep an eye on inflation rates, employment figures, and consumer sentiment to gauge the overall health of the economy.

- Be Prepared for Volatility: The markets can be unpredictable, especially in response to political statements. Be prepared for fluctuations and don’t make impulsive decisions based on short-term news.

- Long-Term Perspective: Focus on long-term investment strategies rather than reacting to immediate market movements.

- Consult Financial Advisors: If you’re uncertain about how to navigate the changing economic landscape, consider consulting with a financial advisor.

Trump Demands Fed Rate Cut: Market Reaction Explodes!

Trump’s assertion that the Federal Reserve should lower interest rates by two to three points is a significant statement that could have far-reaching implications for the economy and financial markets. While there are potential benefits, such as increased spending and investment, there are also risks that must be carefully considered.

As an investor or an individual interested in the economy, it’s crucial to stay informed about these developments and their potential impact on your financial decisions. By understanding the intricacies of monetary policy and its effects on the market, you can better position yourself for success in an ever-evolving economic landscape. In the end, whether you agree with trump’s viewpoint or not, the ripple effects of such statements can shape market dynamics and investor sentiment, making it essential to remain vigilant and informed.

BREAKING:

TRUMP SAYS FED RATE SHOULD BE AT LEAST TWO TO THREE POINTS LOWER.

VERY BULLISH!! pic.twitter.com/IQxjsO1AF1

— Crypto Rover (@rovercrc) June 24, 2025

Final Thoughts

Staying informed about the implications of trump’s comments is crucial for understanding the potential shifts in market dynamics. The relationship between monetary policy and economic performance continues to be a vital focus for investors, policymakers, and economists alike. The potential for lower interest rates could lead to increased investment in various sectors, creating opportunities for growth and innovation in the financial landscape.