Are Boomers Leaving Assets for Gen Z? Japanification Looms!

The Impending Economic Shift: A Look at Asset Transition from Boomers to Gen Z

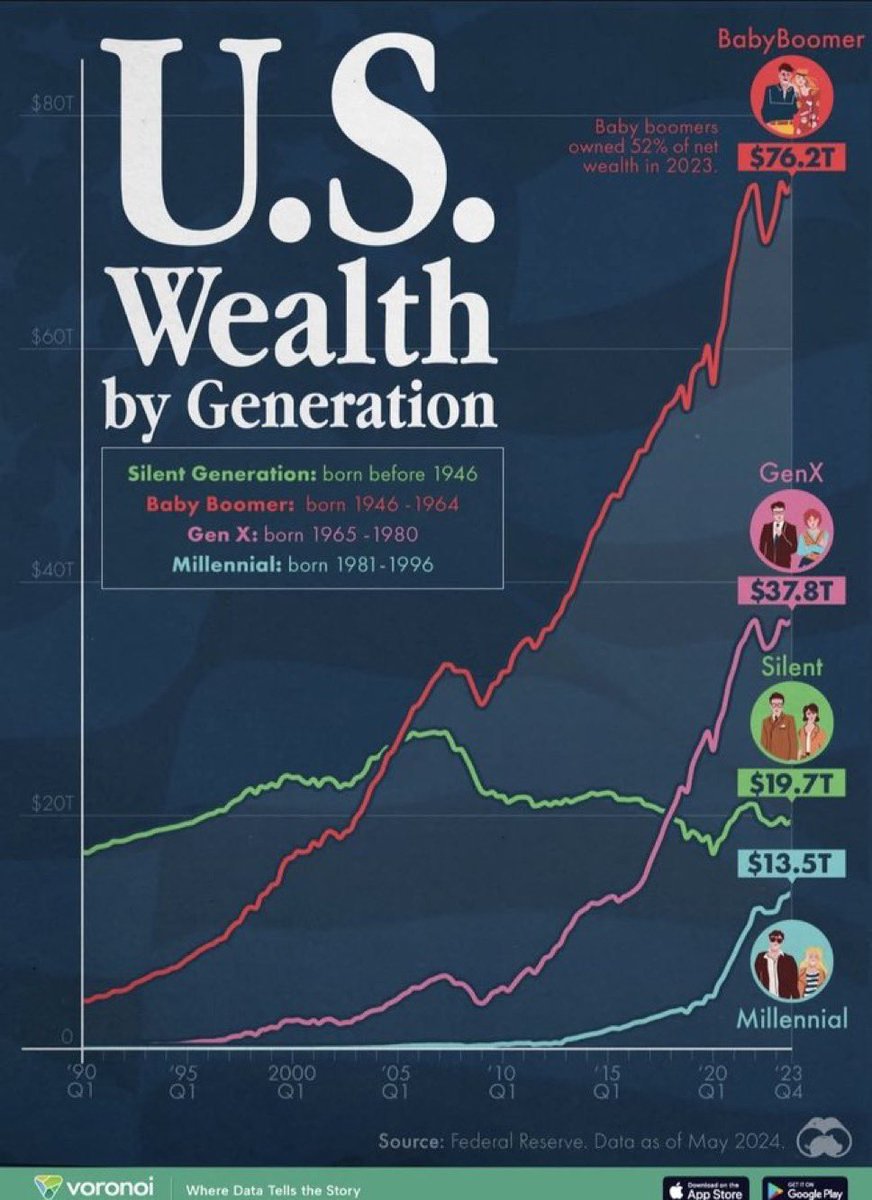

In a thought-provoking tweet by John Smith, the economic landscape of the future is starkly illustrated with the statement, "There aren’t any Uhauls behind a Hearst." This metaphor serves to highlight a critical point: the assets accumulated by the Baby Boomer generation are not simply going to be passed down or sold at market value to the younger generations, particularly Gen Z. As the tweet suggests, with approximately 7,000 Boomers passing away each day, the implications for asset ownership and economic dynamics are profound.

Understanding the Context of Asset Transition

The Baby Boomer generation, born between 1946 and 1964, is on the verge of significant demographic changes as its members age and pass away. This transition raises questions about who will inherit or purchase the assets left behind. The notion that Gen Z and economically-strapped immigrants will absorb these assets at their current market values is increasingly being scrutinized. This phenomenon is reminiscent of the "Japanification" trend observed in Japan, where a stagnant economy and declining population have led to deflationary pressures and an oversupply of assets.

The Economic Reality: A Generational Divide

The economic divide between generations has never been more apparent. Gen Z, characterized by their tech-savvy nature and entrepreneurial spirit, faces unique challenges when it comes to wealth accumulation. With rising student debt, high living costs, and a competitive job market, many members of Gen Z find themselves in precarious financial situations. As such, the expectation that they will purchase the assets left behind by Boomers is unrealistic without addressing the underlying economic pressures they face.

Simultaneously, many immigrants, despite their resilience and determination, often arrive in their new countries with limited financial resources. The burden of purchasing high-value assets from a retiring generation may be insurmountable for them as well, making the idea of a seamless transfer of wealth problematic.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact of Demographics on the Market

The demographic shift caused by the aging Baby Boomer population is set to have significant ramifications on various markets, including real estate, stocks, and personal possessions. As more Boomers pass away, their assets will flood the market. However, the question remains: who will buy these assets, and at what price?

The current market dynamics indicate that many of these assets may not retain their value as expected. There is a growing sentiment that the market is already saturated with properties and investments that younger generations are unable or unwilling to purchase. This oversupply could lead to a decline in asset prices, which would further complicate the transfer of wealth from Boomers to younger generations.

Japanification: A Cautionary Tale

The reference to "Japanification" in the tweet underscores a critical warning about the potential for economic stagnation. Japan has experienced decades of deflation, an aging population, and a significant drop in asset prices. As the Baby Boomer generation exits the stage, the risk of a similar fate looms for other economies, particularly in the West where the demographic trends align closely with those of Japan.

In Japan, the real estate market suffered immensely as older generations passed on their properties without a corresponding demand from younger buyers. This resulted in a significant decline in home values, leading to economic stagnation. If the same scenario unfolds in other countries, the implications for wealth distribution and economic stability could be dire.

Strategies for Adapting to Change

As the economic landscape shifts, both Boomers and younger generations must adapt. For Boomers, it may be prudent to consider alternative strategies for asset liquidation, such as downsizing or selling assets sooner rather than later. This proactive approach could help mitigate potential losses and ensure that their wealth is transferred in a way that benefits their heirs.

For Gen Z and immigrants, focusing on financial literacy and investment education is crucial. Understanding market trends, investment strategies, and financial planning can empower these generations to navigate the complexities of a changing economy. Building wealth through entrepreneurship, strategic investments, and community support can also offer pathways to financial stability.

The Role of Policy and Community Support

The current economic challenges facing younger generations call for a reevaluation of policies aimed at supporting wealth accumulation and economic participation. Governments and communities must consider initiatives that promote affordable housing, access to education, and financial literacy programs. By fostering an environment that encourages economic growth and stability, society can better prepare for the impending shift in asset ownership.

Conclusion: Embracing Change and Planning for the Future

The transition of wealth from the Baby Boomer generation to younger generations presents both challenges and opportunities. As highlighted in John Smith’s tweet, the expectation that Gen Z and immigrants will effortlessly absorb the assets of Boomers may not hold true. A deeper understanding of the economic realities at play is essential for all parties involved.

By recognizing the potential impacts of demographic shifts, educating younger generations, and implementing supportive policies, society can navigate the complexities of this economic transition. The future may be uncertain, but with proactive measures and strategic planning, it is possible to embrace change and build a more equitable and prosperous economic landscape for all.

There aren’t any Uhauls behind a Hearst. Dead people are sellers and 7000 boomers die everyday. Are we really expecting Gen Z and penniless immigrants to buy all the boomer’s assets at current market value? Japanification is well underway. pic.twitter.com/P4uIdKIz0d

— John Smith.USD (@cherrygarciafan) June 18, 2025

There Aren’t Any Uhauls Behind a Hearst

When you take a moment to think about it, the phrase “There aren’t any Uhauls behind a Hearst” really paints a vivid picture. It’s a reminder that when it’s our time to go, we can’t take our possessions with us. But what happens to all those belongings? This is a question that’s becoming increasingly relevant today, especially as we see a significant demographic shift with older generations passing on.

With around **7,000 Boomers dying every day**, it raises a pressing issue: what will happen to their assets? The reality is that many of these assets will hit the market, and the question looms large—who will buy them? Are we really expecting Gen Z and penniless immigrants to step up and purchase all the Boomers’ belongings at current market values? The economic implications of this shift are profound, and it’s something we need to explore.

Dead People Are Sellers

As morbid as it sounds, once someone passes away, their possessions become available for sale. This means a huge influx of assets will soon be entering the market. We’re talking about homes, cars, antiques, and a myriad of other items that the older generation once valued. With this massive transfer of wealth, the market could soon be flooded with goods that may not hold the same value to the younger generations.

The reality is that **Boomers** have accumulated a significant amount of wealth over their lifetimes. However, as they pass on, the question arises: will this wealth transition smoothly to the younger generations? Or will it be a chaotic scramble as assets flood the market, leading to a potential devaluation of many items? With the changing tastes and financial situations of younger generations, we may see a disconnect between what the older generations consider valuable and what the younger ones are willing to pay.

Are We Really Expecting Gen Z and Penniless Immigrants to Buy All the Boomer’s Assets at Current Market Value?

This question really gets to the heart of the matter. The expectation that younger generations will absorb these assets at current market values seems a bit far-fetched. Let’s be honest—many members of Gen Z are still grappling with student debt and high living costs. On top of that, many immigrants are working hard to establish their footing in a new country.

So, the idea that they will be able or willing to buy the assets of the Boomers sounds unrealistic. The economic landscape has changed significantly over the past few decades. With stagnant wages and rising costs of living, many young people simply don’t have the financial freedom to invest in homes or other big-ticket items. Additionally, their priorities may not align with purchasing the types of assets that Boomers are selling.

Japanification is Well Underway

The term “Japanification” refers to the economic stagnation that Japan has faced over the past few decades, including deflation and an aging population. As we look at the current trends in the U.S., there are some alarming similarities. With a growing number of Boomers passing away, we may be facing a prolonged period of economic stagnation where assets lose value because there simply aren’t enough buyers.

Japan’s economic struggles have shown us that an aging population can result in a reduced consumer base, leading to lower demand for goods and services. If we’re not careful, the U.S. could find itself in a similar situation as the Boomers pass on, leaving behind a market that younger generations may not be interested in engaging with.

The Implications for the Real Estate Market

One of the biggest impacts of this demographic shift will be felt in the real estate market. Many older adults own homes that they’ve lived in for decades, and as they pass away, these homes will flood the market. With younger generations struggling to enter the housing market due to high prices, we may see a glut of homes that don’t sell for the prices their owners expect.

Real estate values could decline, leading to feelings of financial insecurity for many Boomers who planned to rely on the sale of their homes for retirement. The expectation that younger generations will swoop in and buy these homes at current market prices may not hold true, leading to a significant imbalance in the housing market.

Rethinking Our Approach to Wealth Transfer

Given these realities, it’s essential to rethink how we approach wealth transfer. For Boomers, it may be wise to consider the legacy they wish to leave behind. Instead of holding onto assets in hopes that younger generations will see their value, perhaps it’s time to evaluate what can be sold now or when they are still alive.

This proactive approach not only allows Boomers to enjoy their wealth but also creates opportunities for younger generations to acquire assets at more reasonable prices. It encourages a sense of community and support rather than a stark divide between generations.

The Role of Financial Education

To bridge the gap between generations, financial education is crucial. Young people need to be equipped with the knowledge and skills to navigate the complexities of wealth, assets, and investments. This will empower them to make informed decisions about purchasing properties and other valuable items from the older generations.

Additionally, Boomers could benefit from understanding the financial landscape of today. By collaborating with financial advisors, they may find strategies to maximize the value of their assets while ensuring a smooth transition to the next generation.

Adapting to Changing Consumer Preferences

As we consider the impact of this demographic shift, it’s essential to recognize that consumer preferences are also changing. What was once valuable to one generation may not hold the same appeal to another.

For instance, many younger people are more inclined to value experiences over material possessions. This could mean that traditional assets like homes and cars may not see the same demand as they once did. Instead, younger generations may prioritize travel, technology, and unique experiences over acquiring physical goods.

As Boomers prepare to pass on their assets, it’s essential for them to understand that the value of these items may not translate to the younger generation. This understanding can help inform the decisions they make regarding what to sell, keep, or donate.

The Future of Asset Ownership

In light of these trends, we may need to reconsider our views on asset ownership altogether. The traditional mindset of owning property and material goods could shift toward more collaborative and shared models. For example, younger generations may prefer to rent or share rather than buy outright.

This shift can provide a new way forward, allowing for a more sustainable approach to asset ownership. It also opens the door for innovative business models that cater to the new economic realities of the younger generations.

Conclusion

As we move forward, it’s essential to have open conversations about these issues. The passing of the Boomers will undoubtedly change the landscape of asset ownership, and we need to be prepared for the implications. By understanding that “Dead people are sellers” and recognizing the economic realities at play, we can work together across generations to navigate this transition more smoothly. The key will be adapting to the changing preferences and financial situations of both Boomers and younger generations, creating a more equitable future for all.

It’s an interesting time to be alive, and while the challenges are significant, the opportunities for growth and change are equally vast. So let’s embrace the conversation and work toward solutions that benefit everyone involved.