JPMorgan’s Shocking Move: Unveils Controversial ‘JPMD’ Stablecoin!

JPMorgan Trademarking a Stablecoin: What You Need to Know

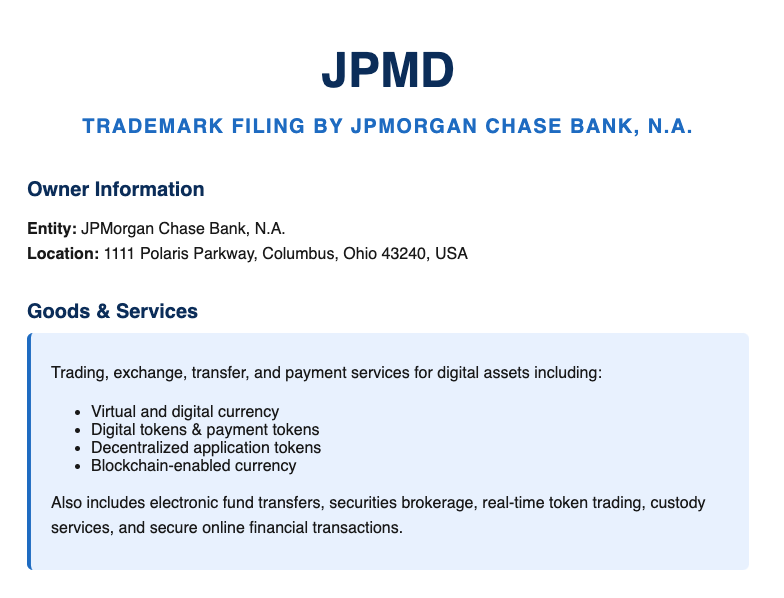

In a recent development that has caught the attention of the financial world, JPMorgan Chase & Co. has reportedly trademarked a new stablecoin named ‘JPMD’. This announcement has been shared widely on social media, particularly through a tweet by the account Unusual Whales, which has garnered significant interest from investors and cryptocurrency enthusiasts alike.

Understanding Stablecoins

Before delving into the implications of JPMorgan’s move, let’s clarify what a stablecoin is. Stablecoins are a type of cryptocurrency designed to maintain a stable value relative to a fiat currency, such as the US dollar. This stability makes them an attractive option for investors and traders who want to avoid the volatility often associated with other cryptocurrencies, such as Bitcoin or Ethereum. Stablecoins can be backed by various assets, including currencies, commodities, or even other cryptocurrencies, and they play a crucial role in the broader cryptocurrency ecosystem by providing a bridge between traditional finance and digital assets.

The Implications of JPMorgan’s Stablecoin

JPMorgan’s decision to trademark ‘JPMD’ signals a significant shift in the traditional banking sector’s approach to cryptocurrency and blockchain technology. As one of the largest financial institutions in the world, JPMorgan’s entry into the stablecoin market could have far-reaching implications. Here are a few key points to consider:

- Increased Legitimacy of Cryptocurrencies: The involvement of a major player like JPMorgan adds a layer of legitimacy to the cryptocurrency market. As traditional banking institutions begin to embrace digital currencies, it may encourage wider acceptance and adoption among businesses and consumers.

- Potential for New Financial Products: With the launch of JPMD, JPMorgan could develop a range of new financial products and services that leverage blockchain technology. This could include payment solutions, lending platforms, and investment vehicles, all designed to make transactions faster, cheaper, and more secure.

- Competition in the Stablecoin Market: JPMorgan’s entry into the stablecoin space puts it in direct competition with existing stablecoins such as Tether (USDT) and USD Coin (USDC). This competition could lead to innovations and improvements within the sector, ultimately benefiting consumers and businesses alike.

- Regulatory Considerations: As major financial institutions like JPMorgan explore stablecoins, regulatory scrutiny will likely increase. Governments and financial regulators around the world are still trying to understand and develop frameworks for cryptocurrencies, and JPMorgan’s move could accelerate this process.

- Impact on Payment Systems: The introduction of ‘JPMD’ could enhance payment systems not just for consumers but also for businesses. It could facilitate faster cross-border transactions, lower transaction fees, and provide a more efficient means of transferring value digitally.

What This Means for Investors

For investors, JPMorgan’s trademarking of a stablecoin is a signal that the financial landscape is evolving. Here are some considerations for investors looking to navigate this changing environment:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Diversification: With the emergence of stablecoins like JPMD, investors may consider diversifying their portfolios to include digital assets. Stablecoins can serve as a hedge against volatility in other cryptocurrencies.

- Monitoring Regulatory Changes: As JPMorgan and other financial institutions push into the stablecoin space, keeping an eye on regulatory developments is crucial. Changes in laws and regulations could impact the value and usability of stablecoins.

- Staying Informed: Following news and updates related to JPMorgan and other fintech developments can provide valuable insights. Being aware of how traditional financial institutions are adapting to digital currencies can inform better investment decisions.

Conclusion

JPMorgan’s trademarking of the stablecoin ‘JPMD’ is a noteworthy event in the evolving intersection of traditional finance and cryptocurrency. As the banking giant takes steps into the stablecoin market, it may pave the way for broader acceptance and integration of digital currencies in everyday financial transactions. For investors, understanding the implications of this development will be key to navigating the future of finance.

In summary, JPMorgan’s move is indicative of a changing landscape where traditional financial institutions recognize the potential of cryptocurrencies and blockchain technology. As the market continues to evolve, staying informed and adaptable will be essential for anyone looking to engage with these new financial products.

JUST IN: JPMorgan, $JPM, has reportedly trademarked a stablecoin called ‘JPMD’ pic.twitter.com/Oz2d5FjNMw

— unusual_whales (@unusual_whales) June 16, 2025

JUST IN: JPMorgan, $JPM, has reportedly trademarked a stablecoin called ‘JPMD’

In an exciting development for the world of finance and cryptocurrency, JPMorgan Chase, one of the largest and most influential banks globally, has taken significant steps towards the future of digital currency. They have reportedly trademarked a stablecoin named ‘JPMD.’ This news has certainly stirred up conversations in both banking and crypto circles.

What Is a Stablecoin?

Before diving deeper into JPMorgan’s latest move, let’s break down what a stablecoin actually is. Stablecoins are cryptocurrencies designed to minimize price volatility by pegging their value to a reserve of assets, like the US dollar or gold. This makes them an attractive option for those looking to enjoy the benefits of cryptocurrency without the wild price swings typically associated with digital currencies like Bitcoin or Ethereum.

By maintaining a stable value, stablecoins have become essential tools for traders and investors, offering a reliable medium of exchange and store of value within the crypto ecosystem. Now, with JPMorgan entering this space, the implications could be significant, not just for the bank but for the entire market.

Why Did JPMorgan Decide to Launch ‘JPMD’?

The decision to trademark ‘JPMD’ is a clear indication that JPMorgan sees a substantial future in the realm of digital currencies. As the financial landscape continuously evolves, traditional banks are increasingly recognizing the importance of adapting to new technologies and consumer preferences.

JPMorgan has been at the forefront of blockchain technology for years, having developed its own blockchain network, Quorum. By launching a stablecoin, the bank could streamline financial transactions, enhance payment systems, and potentially offer new services to its clients. This move could also pave the way for innovations in areas like cross-border payments, which often involve high fees and lengthy processing times.

What Could ‘JPMD’ Mean for Consumers and Businesses?

So, what does this mean for everyday consumers and businesses? If executed well, ‘JPMD’ could provide a seamless way for individuals and companies to transact without the complications often seen in traditional banking systems. Imagine being able to send money across borders instantly, with minimal fees, all while knowing that your funds are secure and stable.

Moreover, businesses could benefit from faster transaction times and reduced costs associated with payment processing. The stablecoin could also make it easier for businesses to manage their cash flow and financial planning, adding another layer of efficiency to operations.

The Regulatory Landscape for Stablecoins

While the launch of ‘JPMD’ offers numerous potential benefits, it’s essential to consider the regulatory environment surrounding stablecoins. As these digital assets gain popularity, regulators worldwide are beginning to scrutinize their implications for financial stability and consumer protection.

JPMorgan will need to navigate this complex regulatory landscape carefully. The bank’s long history and expertise in financial services could give it an advantage, but challenges still remain. It’s crucial for them to engage with regulators and ensure compliance to foster trust and transparency in their new stablecoin offering.

Competitors in the Stablecoin Arena

JPMorgan isn’t the first major financial institution to explore the world of stablecoins. Other players, such as Facebook with its Diem project (formerly Libra), have made headlines with their ambitions in this space. Additionally, various cryptocurrencies like Tether (USDT) and USD Coin (USDC) have already established themselves as frontrunners in the stablecoin market.

With the introduction of ‘JPMD,’ JPMorgan is entering a competitive landscape. However, the bank’s reputation, resources, and existing client base could provide it with a unique edge. It will be interesting to see how they position ‘JPMD’ against these established players and what innovative features they might offer.

How Will ‘JPMD’ Integrate with Existing Financial Services?

One of the most intriguing aspects of JPMorgan’s trademarking of ‘JPMD’ is how it will integrate with the bank’s existing financial services. The potential for cross-platform functionality could revolutionize how clients engage with both traditional and digital banking.

Imagine being able to use ‘JPMD’ for everyday transactions, savings, and investments, all while leveraging the bank’s resources and support. Such integration could simplify the user experience, allowing consumers to manage their finances more effectively.

Public Reaction and Market Impact

The announcement of ‘JPMD’ has already begun to generate buzz on social media and among financial analysts. Many are curious to see how this stablecoin will be received by the public and whether it will gain traction among consumers and businesses alike.

Market analysts are watching closely, as the introduction of ‘JPMD’ could have significant implications for the broader cryptocurrency market. If JPMorgan successfully launches and promotes its stablecoin, it could lead to increased adoption of digital currencies among traditional investors and institutions.

What’s Next for JPMorgan and ‘JPMD’?

As JPMorgan moves forward with its plans for ‘JPMD,’ it will be essential to keep an eye on upcoming developments. The bank will likely release more information about its strategy, features, and timeline for launch in the coming months. Engaging with consumers, understanding their needs, and addressing any concerns will be crucial for the success of this stablecoin.

Moreover, JPMorgan’s entry into the stablecoin arena might inspire other banks to explore similar opportunities, potentially leading to a more significant shift in the financial landscape towards digital currencies.

Conclusion

The trademarking of ‘JPMD’ by JPMorgan is a significant step into the world of stablecoins, showcasing the bank’s commitment to innovation and adaptation in an evolving financial landscape. With the potential for increased efficiency and new services for consumers and businesses, JPMorgan is well-positioned to make a substantial impact. As the situation develops, it will be fascinating to see how ‘JPMD’ shapes the future of digital finance.