Breaking: Stablecoins Set to Dominate U.S. Treasury! — stablecoin market growth, US Treasury investment trends, digital currency future 2025

stablecoin market growth, digital currency investment strategies, treasury bond purchasing trends

BREAKING:

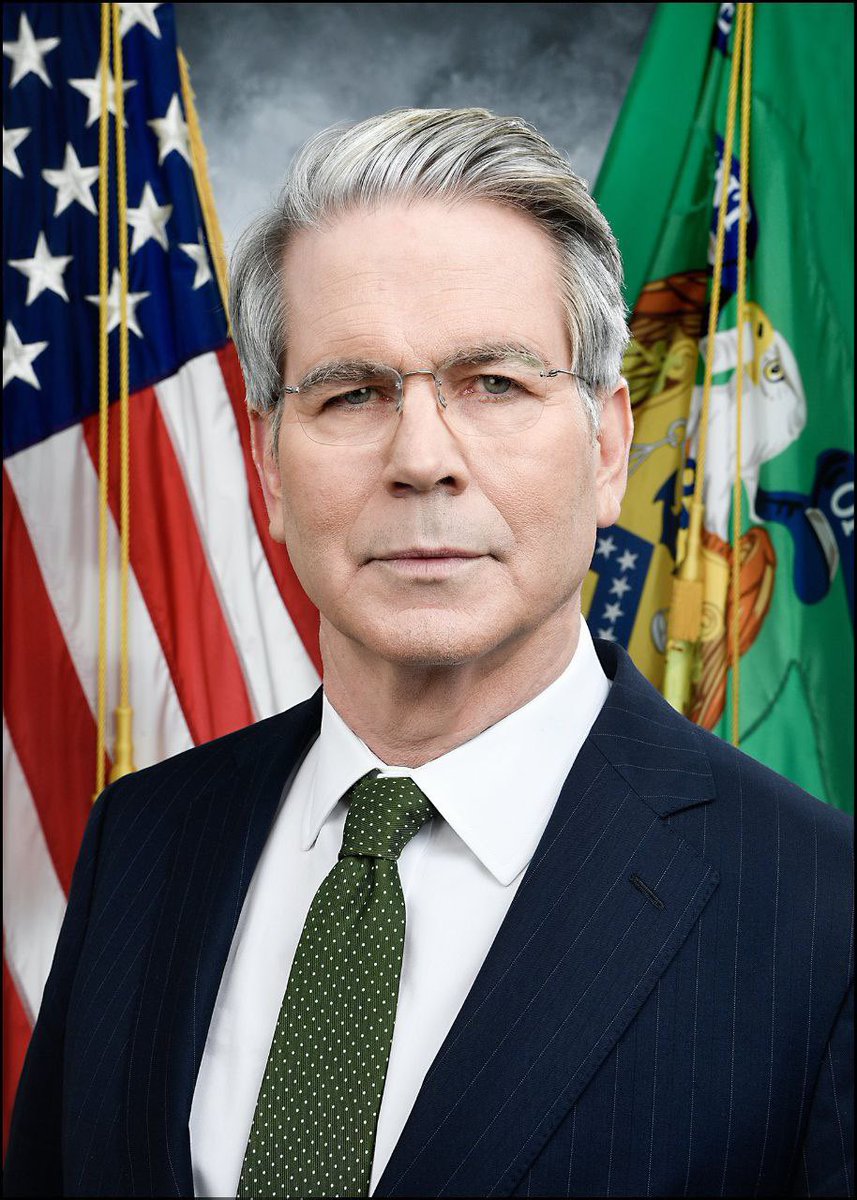

TREASURY SECRETARY SCOTT BESSENT EXPECTS STABLECOINS TO REACH $2 TRILLION & BECOME MAJOR TREASURY BUYERS. pic.twitter.com/bIlR3oLF3H

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Ash Crypto (@Ashcryptoreal) August 20, 2025

TREASURY SECRETARY SCOTT BESSENT EXPECTS STABLECOINS TO REACH $2 TRILLION & BECOME MAJOR TREASURY BUYERS

Recently, Treasury Secretary Scott Bessent made a significant announcement regarding the future of stablecoins. He predicts that these digital assets will soar to a whopping $2 trillion and emerge as key buyers for the U.S. Treasury. This news has caught the attention of investors and financial analysts alike, as it marks a pivotal moment for the integration of cryptocurrencies into mainstream finance.

Stablecoins have gained traction due to their ability to maintain a stable value, often pegged to traditional currencies like the U.S. dollar. Unlike more volatile cryptocurrencies, stablecoins provide a sense of security for investors looking to dip their toes into the digital asset space. With Bessent’s optimistic forecast, the role of stablecoins is poised to evolve dramatically in the coming years.

The potential for stablecoins to become major Treasury buyers suggests a shift in how financial institutions will interact with digital currencies. This could lead to increased legitimacy and regulatory clarity for the cryptocurrency market, making it more appealing for traditional investors. As stablecoins become more integrated into the financial system, we might see new investment strategies emerge, leveraging their stability to mitigate risks.

For those interested in the latest developments, this announcement highlights the growing importance of stablecoins in the financial landscape. Keeping an eye on these trends can provide valuable insights into future investment opportunities. The wave of enthusiasm surrounding Bessent’s prediction may just be the beginning of a new era in finance, where digital currencies play an integral role in shaping economic policies and market dynamics.

Stay informed and adaptable to these changes, as they could have significant implications for your investment strategies moving forward.