BREAKING: Bitcoin’s Future at Stake Amid 51% Threat! — Bitcoin mining centralization, cryptocurrency security risks, decentralized mining solutions

Bitcoin mining decentralization, cryptocurrency security risks, Kaspa mining advantages

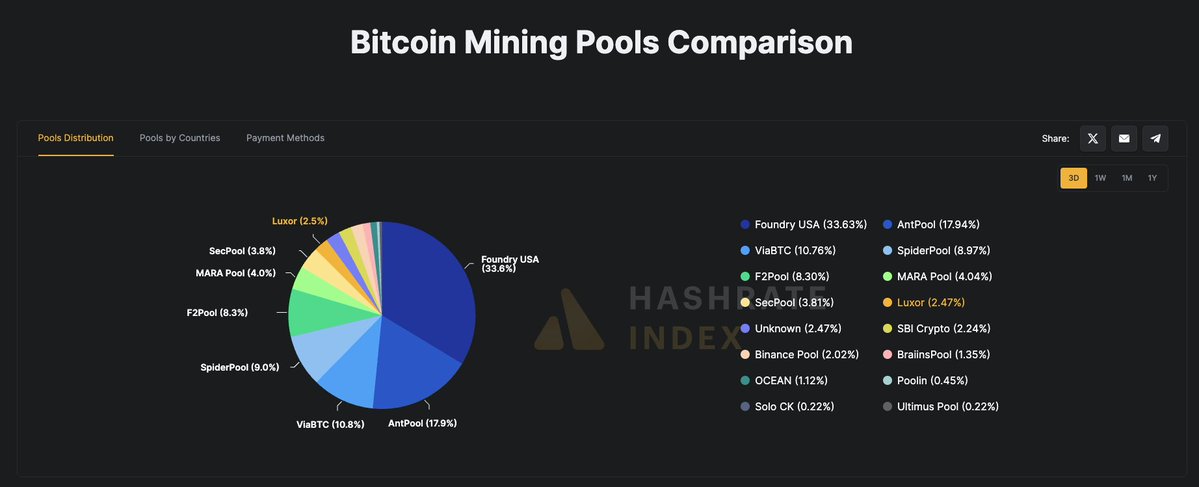

JUST IN: #Bitcoin is now at risk of a 51% attack because two mining pools (Foundry USA and Antpool) control over 51% of the hash power.

Bitcoin today: 2 pools (Foundry + Antpool) >51% → de facto centralization.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Kaspa today: 85% unknown miners (individual)→ de facto… pic.twitter.com/BoptfOkGUy

— 𝐂𝐫𝐲𝐩𝐭𝐨 𝐏𝐫𝐨𝐬𝐞𝐥𝐲𝐭𝐞 (@Crypt0Proselyte) August 20, 2025

Bitcoin at Risk of a 51% Attack

Bitcoin is currently facing a significant threat of a 51% attack, primarily due to two major mining pools, Foundry USA and Antpool, controlling over 51% of the hash power. This concentration of power in just two entities raises serious concerns about the decentralization and security of the Bitcoin network. When a single group controls the majority of hash power, they can potentially manipulate transactions and undermine the integrity of the blockchain.

De Facto Centralization

With Foundry and Antpool surpassing the 51% threshold, Bitcoin’s network is experiencing what can be termed as de facto centralization. This situation puts the very foundation of Bitcoin at risk, as decentralization is a core principle that maintains its reliability and trust. The implications of such centralization could be dire, leading to increased vulnerability to attacks and a loss of faith among users and investors.

Kaspa’s Advantage with Unknown Miners

In contrast, Kaspa stands out with approximately 85% of its miners being unknown individuals. This diversity in mining power helps maintain a decentralized network, reducing the risk of a single entity gaining control. The decentralized approach of Kaspa offers a stark contrast to Bitcoin’s current predicament, showcasing the importance of having a distributed mining ecosystem that can enhance security and resilience.

What This Means for Bitcoin Investors

Investors should be aware of the potential risks associated with Bitcoin’s current mining landscape. The concentration of power within Foundry and Antpool could lead to instability and a loss of confidence in Bitcoin as a secure investment. As the situation evolves, staying informed about the developments in the mining sector will be crucial for making sound investment decisions.

For more insights, you can follow the discussion on platforms like Twitter and join the conversation about Bitcoin’s future.