Wall Street Bets Big: $8B ETH Short Squeeze Looms! — HEDGE FUND SHORT POSITIONS ETH, ETH SHORT SELLING TRENDS, SHORT SQUEEZE PREDICTIONS 2025

hedge funds cryptocurrency strategies, Ethereum market analysis, short selling trends in digital assets

BREAKING:

WALL STREET HEDGE FUNDS ARE SHORTING $ETH

$8 BILLION IN SHORTS ARE BETTING AGAINST ETH

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

THE BIGGEST SHORT SQUEEZES IS COMING https://t.co/6mrOwIA0I8

BREAKING: WALL STREET HEDGE FUNDS ARE SHORTING $ETH

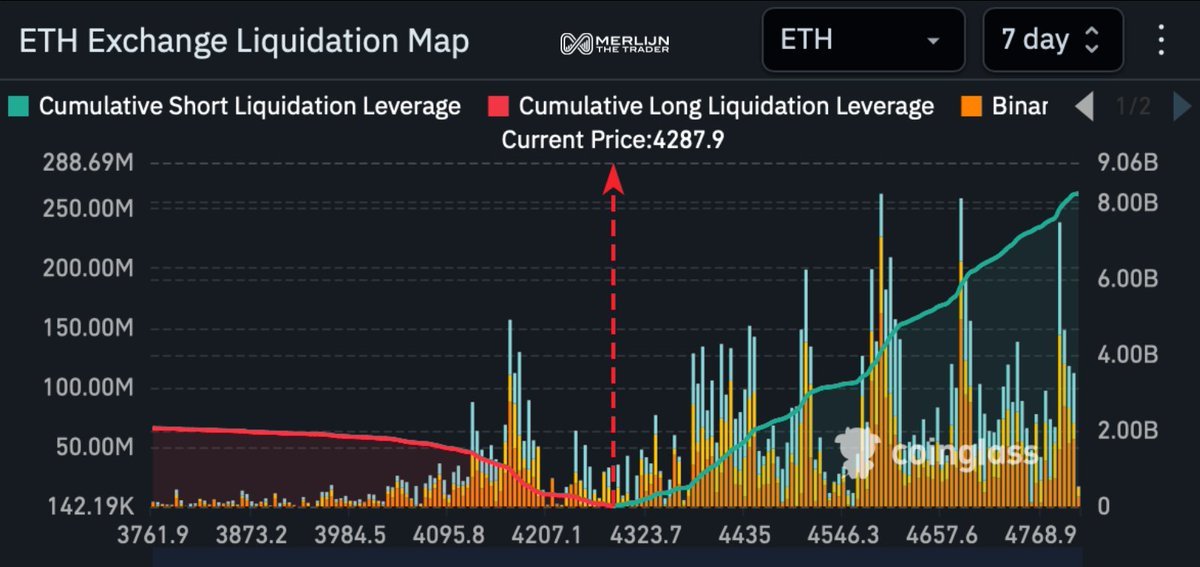

Recently, the cryptocurrency landscape has taken an interesting turn as Wall Street hedge funds are heavily shorting Ethereum ($ETH). This move has raised eyebrows, especially considering the sheer volume involved. Hedge funds are betting against Ethereum with a staggering $8 billion in shorts. This financial strategy typically indicates a lack of confidence in Ethereum’s future performance, prompting many investors to wonder what this means for the crypto market.

$8 BILLION IN SHORTS ARE BETTING AGAINST ETH

The $8 billion in shorts against Ethereum is a significant indicator of market sentiment. Many traders are speculating that Ethereum’s price will decline in the short term. However, this massive positioning can also lead to one of the most noteworthy phenomena in trading: the short squeeze. A short squeeze occurs when a heavily shorted asset’s price rises sharply, forcing short sellers to buy back shares to cover their positions, which in turn drives the price even higher. If you’re an Ethereum holder, this could present a unique opportunity.

THE BIGGEST SHORT SQUEEZES IS COMING

As the market adjusts to these short positions, analysts are predicting that one of the biggest short squeezes in recent history may be on the horizon. If Ethereum’s price begins to rally, those who have taken short positions could find themselves in a precarious situation, potentially leading to a rapid price increase. This volatility can create opportunities for savvy traders looking to capitalize on the market’s movements.

Stay informed and keep an eye on Ethereum’s price action. You might just witness a historic moment in the crypto world. For more insights, check out this detailed analysis.