Trump’s July Asset Moves: A Bold Gamble or Risky Play? — Trump investment news, equity market updates, July asset purchases 2025

Trump equity investments, July market activity, asset purchase trends

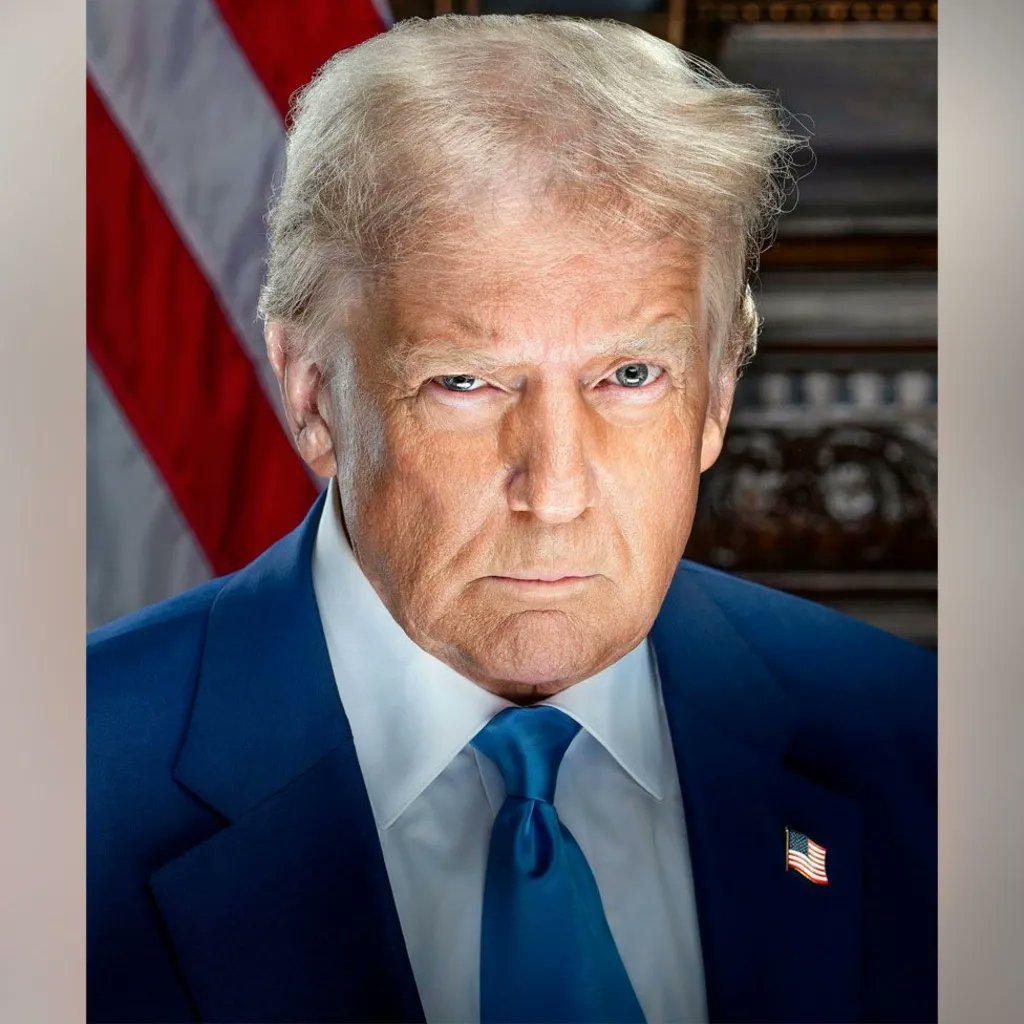

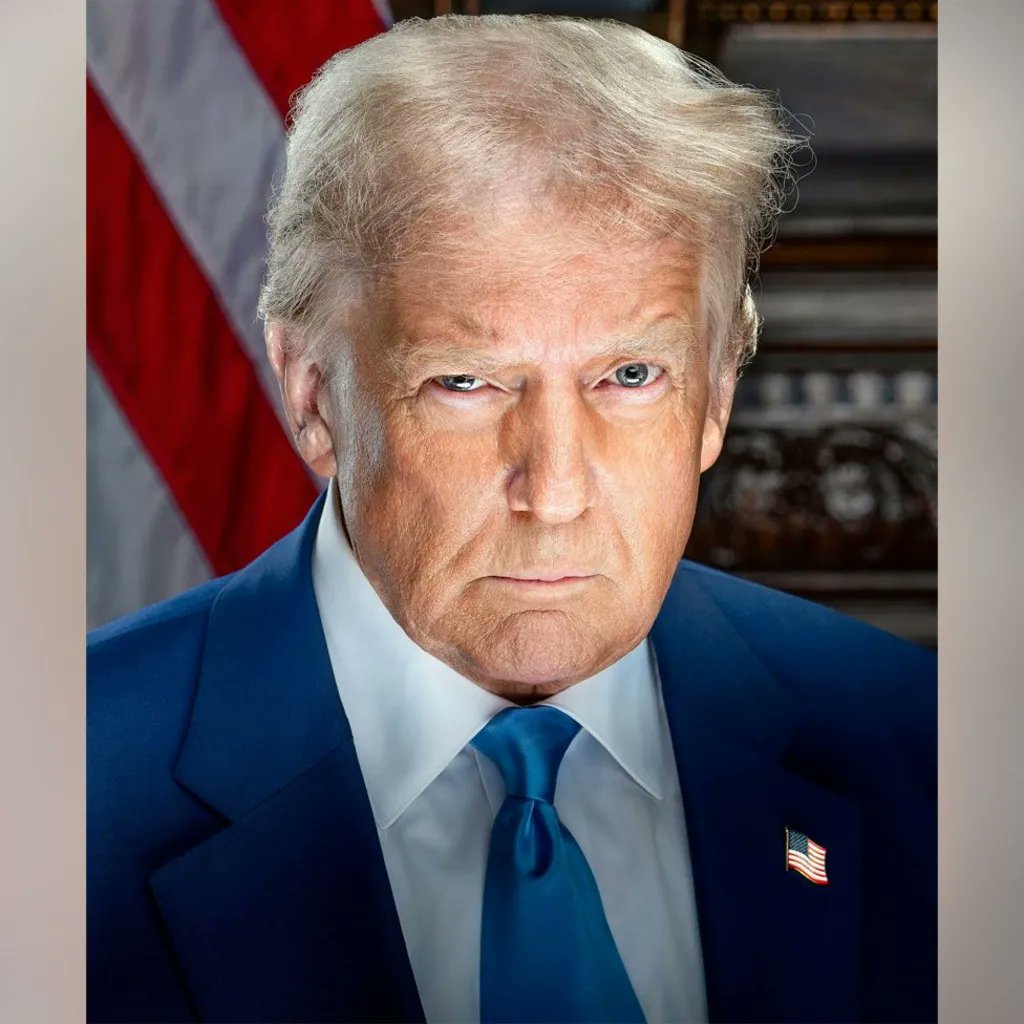

BREAKING: President Donald Trump has just released millions of purchases in July in equities and other assets. pic.twitter.com/broHT55D8n

— unusual_whales (@unusual_whales) August 19, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: President Donald Trump has just released millions of purchases in July in equities and other assets

In a surprising announcement, former President Donald Trump revealed that he made significant investments in July, focusing on equities and other assets. This news, shared by the Twitter account @unusual_whales, has sparked interest and speculation in both political and financial circles. The implications of such moves by a high-profile figure like Trump could influence market trends and investor behavior.

Investing in equities is a common strategy for those looking to grow their wealth, and Trump’s decision to dive into this market could signal various intentions. Whether he aims to secure his financial future or make a statement about the economy, it’s clear that these purchases warrant attention. Investors and analysts are keen to dissect what this means for the current market landscape.

What This Means for Investors

For everyday investors, Trump’s moves could serve as a barometer for market confidence. If a former president is actively investing in equities, it may encourage others to consider similar strategies. However, it’s essential to approach such news with caution. Trends based on celebrity or political figures can often lead to volatility, so it’s wise to conduct thorough research or consult with financial advisors before making investment decisions.

The Broader Impact on the Market

The timing of Trump’s purchases also raises questions about the broader economic environment. As markets react to political news, many are left wondering how these investments might affect stock prices and economic stability. Understanding the relationship between high-profile investments and market performance is crucial for those looking to navigate these waters successfully.

In summary, Trump’s recent equity purchases are more than just a personal financial decision; they represent a potential shift in market dynamics that could affect various stakeholders. Keeping an eye on these developments will be vital for anyone interested in the intersection of politics and finance.