Trump Blasts Powell: ‘Too Late’ for Housing Market! — Trump Powell housing crisis, mortgage availability 2025, interest rate cut predictions

housing market trends, mortgage approval challenges, interest rate predictions

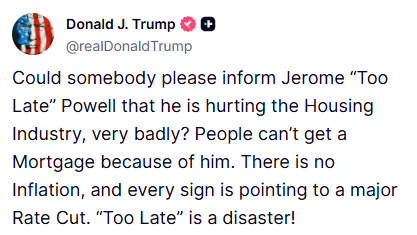

JUST IN: President Trump says “Too Late” Powell is “hurting the Housing Industry, very badly.”

“People can’t get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut. “Too Late” is a disaster!” https://t.co/vFSMtwZMcM

JUST IN: President Trump says "Too Late" Powell is "hurting the Housing Industry, very badly."

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In a bold statement, President Trump has criticized Federal Reserve Chairman Jerome Powell, claiming that his policies are severely impacting the housing industry. Trump emphasized that many potential homeowners are struggling to secure mortgages due to Powell’s decisions. The former president believes that the current economic climate is not conducive to such hurdles, arguing that the housing market should be thriving instead of suffering.

Trump’s comments reflect a growing frustration among many in the real estate sector who feel that rising interest rates have made home buying increasingly difficult. The housing market is a crucial part of the economy, and when people can’t get mortgages, it undermines overall growth.

"People can’t get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut. "Too Late" is a disaster!"

In his remarks, Trump pointed out what he perceives as a disconnect between Powell’s policies and the current economic indicators. He claimed there is no inflation to justify the current interest rates, suggesting that a significant rate cut could be on the horizon. This sentiment resonates with many economists who argue that lower rates could stimulate the housing market and boost economic activity.

The debate around interest rates and their impact on the housing industry is crucial as many potential buyers remain on the sidelines. As discussions about monetary policy continue, the housing market will be a key focus for both policymakers and homebuyers alike.

For more insights on these developments, you can check out the full statement on Twitter.