Trump Blasts Powell: Is the Housing Market Doomed? — Housing Market Crisis, Mortgage Approval Challenges, Federal Reserve Rate Cuts 2025

housing market trends, mortgage approval challenges, interest rate predictions

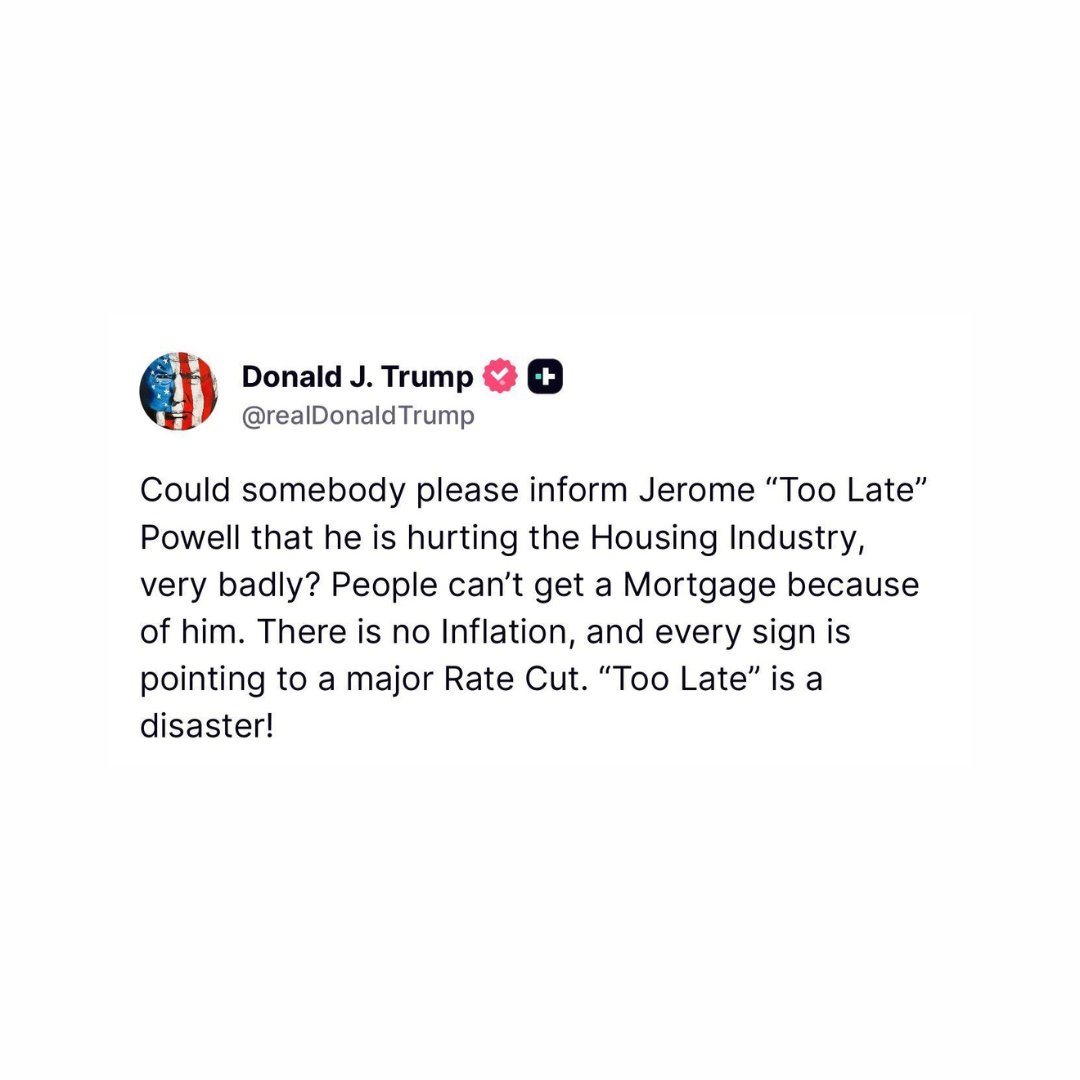

BREAKING: President Trump accuses Jerome Powell of “hurting the Housing Industry very badly”

“People can’t get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut. “Too Late” is a disaster!”

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

TIME TO CUT THE RATES. pic.twitter.com/xnEF1qdDIU

— Eric Daugherty (@EricLDaugh) August 19, 2025

President Trump Accuses Jerome Powell of Hurting the Housing Industry

In a recent statement, President Trump has voiced strong criticism against Federal Reserve Chairman Jerome Powell, claiming he is “hurting the Housing Industry very badly.” This assertion comes amid rising concerns among potential homebuyers who are struggling to secure mortgages due to current interest rate policies.

Impact on Mortgages and Inflation

Trump emphasized that people can’t get a mortgage because of Powell’s decisions, suggesting that the current economic climate is not conducive to home purchases. He pointed out that “there is no inflation,” which raises questions about the necessity of maintaining high interest rates. The President’s comments reflect a growing frustration among many Americans who feel that access to affordable housing is being compromised.

Calls for a Rate Cut

The crux of Trump’s argument is a call for a significant rate cut. He believes that every sign indicates it’s time for the Federal Reserve to take action. “Too late” is a disaster, he warns, indicating that delaying a rate cut could have severe repercussions for the housing market. A major reduction in interest rates could provide the relief needed for potential buyers and stimulate the economy.

What This Means for Homebuyers

For homebuyers, Trump’s remarks might signal a change on the horizon. If the Federal Reserve takes heed and implements a rate cut, it could open doors for many who have been sidelined due to high borrowing costs. Those interested in the housing market should stay tuned for upcoming developments, as they could significantly impact their purchasing power.

For more insights, you can view the original tweet [here](https://twitter.com/EricLDaugh/status/1957937372005544116).