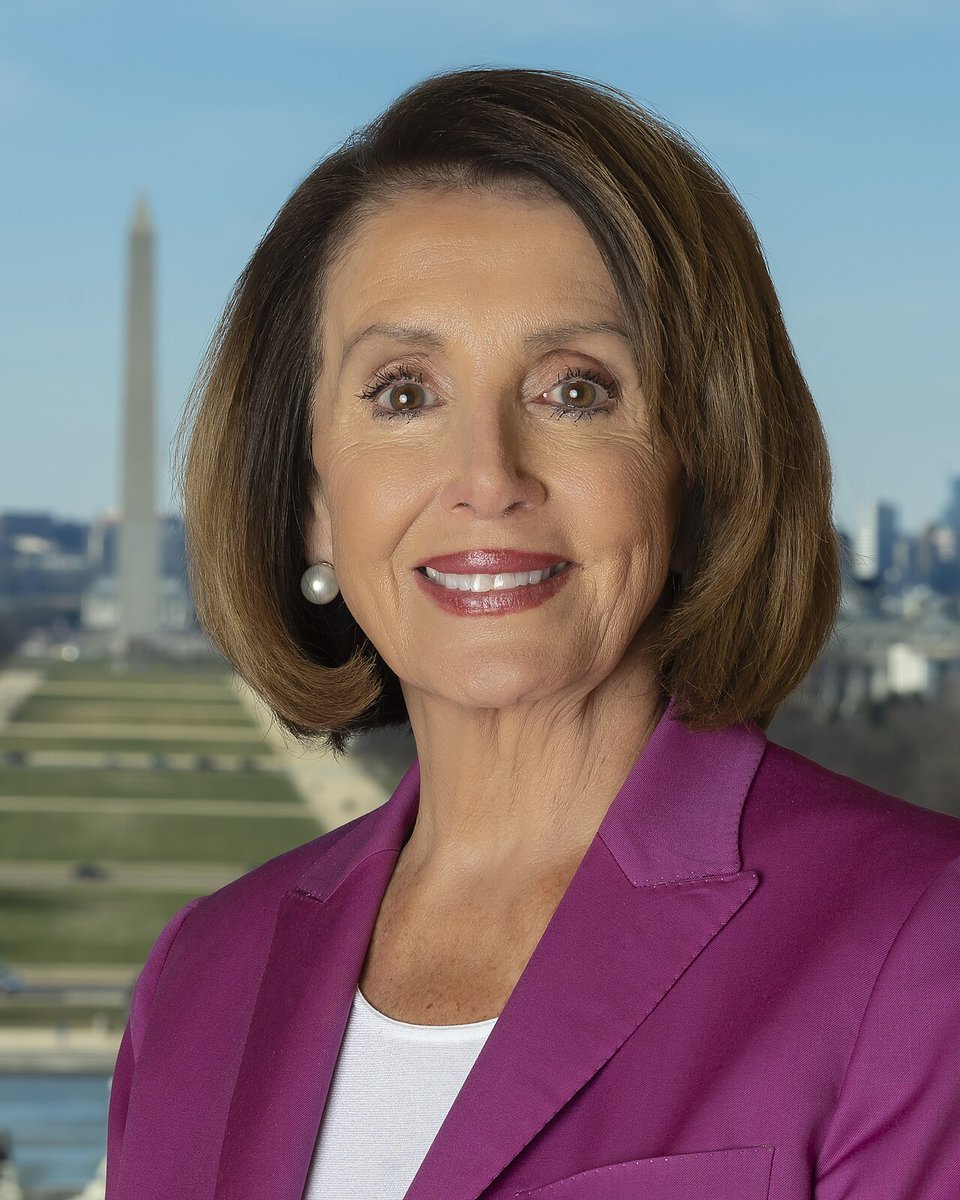

JUST IN: Pelosi’s Shocking $2M Stock Market Plunge! — Nancy Pelosi stock market losses, Pelosi investment strategy 2025, market downturn impact on politicians

Nancy Pelosi stock market loss, investment strategies political figures, market volatility impact on investors

JUST IN: Nancy Pelosi is down almost $2,000,000 in the stock market today, per our estimates.

Track live on Quiver: pic.twitter.com/t0mg5gPzbc

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Quiver Quantitative (@QuiverQuant) August 19, 2025

JUST IN: Nancy Pelosi is down almost $2,000,000 in the stock market today, per our estimates.

In recent news, Nancy Pelosi, the former Speaker of the House, has faced a significant downturn in her stock market investments, reportedly losing nearly $2 million. This staggering figure has drawn attention across social media, particularly on platforms like Twitter. If you’re interested in tracking these developments, you can follow live updates on platforms like Quiver Quantitative, which provides real-time data on stock performance and investment trends.

Many investors are keenly watching these developments, as Pelosi’s investment strategies often make headlines. Her portfolio has been a subject of analysis and interest, given her influential political position and experience in navigating the financial markets. This recent loss may raise questions about the volatility of the current market and how it impacts even seasoned investors.

The stock market has been unpredictable lately, influenced by various factors such as economic indicators, geopolitical tensions, and shifts in consumer behavior. For those looking to invest or track market trends, it’s essential to stay informed about both prominent figures like Pelosi and broader market movements.

If you’re intrigued by the intersection of politics and finance, keep an eye on updates from reliable sources. The impact of political decisions on market dynamics is profound, and understanding this relationship can help you make more informed investment choices.

To stay ahead in the game, consider using platforms that provide comprehensive market analysis and insights. By doing so, you can better navigate the complexities of investing, even in uncertain times.