Goldman Sachs’ Shocking $600M Bet on $ETHA! — Goldman Sachs cryptocurrency investment, Wall Street Ethereum surge, $ETHA stock acquisition news

Goldman Sachs investment strategy, Ethereum market trends, Wall Street cryptocurrency adoption

BREAKING:

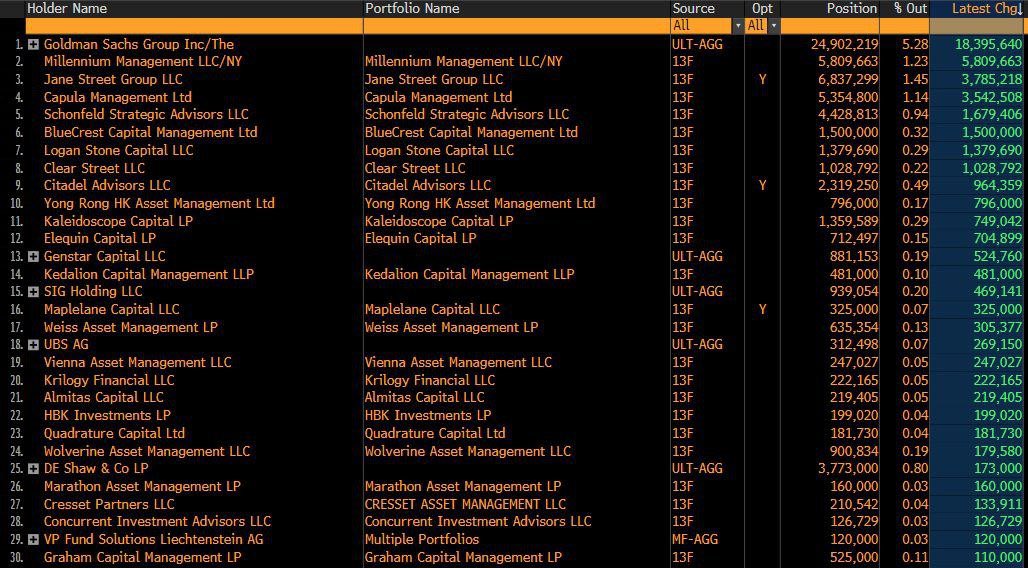

Goldman Sachs bought $600M worth of $ETHA shares in Q2 2025.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

WALL STREET IS BUYING $ETH. pic.twitter.com/kBGqG4qTn6

— Crypto Rover (@rovercrc) August 19, 2025

Goldman Sachs Buys $600M Worth of $ETHA Shares

In a significant move that has caught the attention of the financial world, Goldman Sachs recently acquired $600 million worth of $ETHA shares in Q2 2025. This investment highlights a growing trend among institutional investors embracing cryptocurrencies, particularly Ethereum and its associated assets. As the market evolves, the actions of major financial institutions like Goldman Sachs can influence broader market sentiments and trends.

Goldman Sachs’ investment is a clear indication that Wall Street is increasingly buying into the cryptocurrency narrative. Many investors are looking beyond traditional assets and exploring the potential of digital currencies. The acquisition of $ETHA shares showcases a strategic interest in Ethereum-based assets, which have gained traction due to their utility and widespread adoption.

The growing acceptance of cryptocurrencies by established financial institutions is a game-changer. It signals to retail investors that cryptocurrencies are becoming more mainstream and may provide new investment opportunities. As more firms like Goldman Sachs engage in cryptocurrency investments, it could pave the way for regulatory clarity and greater legitimacy in the sector.

Investors should pay close attention to these developments. The purchase of $ETHA shares by Goldman Sachs could suggest future growth in the Ethereum market and related assets. With Wall Street now actively participating in the crypto space, the landscape for digital currencies is rapidly changing.

For those interested in cryptocurrency investments, keeping abreast of institutional moves is crucial. Follow the latest news and market analysis to ensure you’re making informed decisions. The crypto world is dynamic, and understanding the implications of major purchases like that of Goldman Sachs can help you navigate this exciting landscape.

Stay informed and consider how such significant investments might affect your crypto strategy.