BlackRock’s Shocking $82.7M Ethereum Fire Sale! — BlackRock crypto investment trends, Ethereum market analysis 2025, institutional investors Ethereum sales

BlackRock Ethereum investment, cryptocurrency market trends, institutional crypto sales

JUST IN: BlackRock sells 19,504.95 $ETH worth $82.7 million. pic.twitter.com/drfiJ4GELk

— Whale Insider (@WhaleInsider) August 19, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BlackRock Sells $ETH Worth $82.7 Million

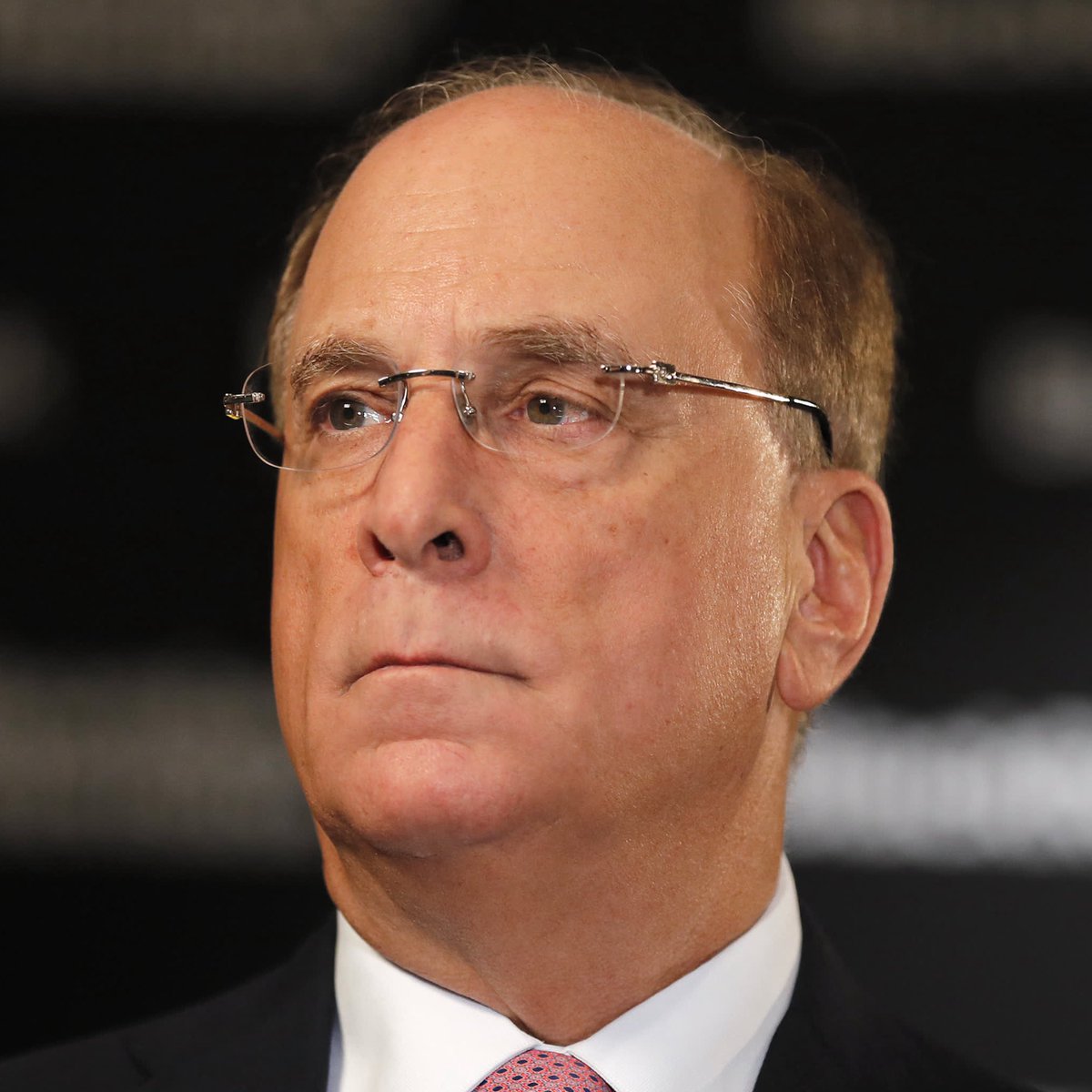

In a significant move that has caught the attention of the cryptocurrency community, BlackRock recently sold a staggering 19,504.95 $ETH, which is valued at approximately $82.7 million. This transaction was reported by Whale Insider and has sparked discussions around the implications for Ethereum and the broader crypto market.

What Does This Sale Mean for Ethereum?

BlackRock’s decision to sell such a substantial amount of Ethereum raises questions about its future price trajectory. As one of the world’s largest asset management firms, BlackRock’s actions are often seen as indicative of market trends. This sale could suggest a strategic shift in their approach to cryptocurrency investments. Investors and enthusiasts alike are monitoring how this sell-off will influence Ethereum’s market dynamics in the coming weeks.

The Impact of Institutional Investors

Institutional investors like BlackRock play a crucial role in the cryptocurrency landscape. Their buying and selling behaviors can significantly sway market sentiment. With BlackRock’s recent sale of $ETH, many are curious about what this could mean for retail investors. Will this lead to a drop in confidence among smaller investors, or could it be a buying opportunity for those looking to enter the market at a lower price?

Keeping an Eye on the Market

As the crypto market remains volatile, it’s essential to stay informed about major transactions like BlackRock’s sale of $ETH. Monitoring these movements can provide valuable insights into market trends and potential investment strategies. Whether you’re a seasoned trader or a newcomer to the crypto space, understanding the implications of such large-scale transactions can help you navigate this dynamic environment.

For continuous updates on cryptocurrency movements, you can follow sources like Whale Insider for the latest news and analysis.