Mortgage Rates Plunge: Is a Housing Boom Coming? — Mortgage Rate Trends 2025, Home Loan Rates Drop, 30-Year Fixed Mortgage Update

mortgage market trends, home loan rates, fixed-rate mortgage advantages

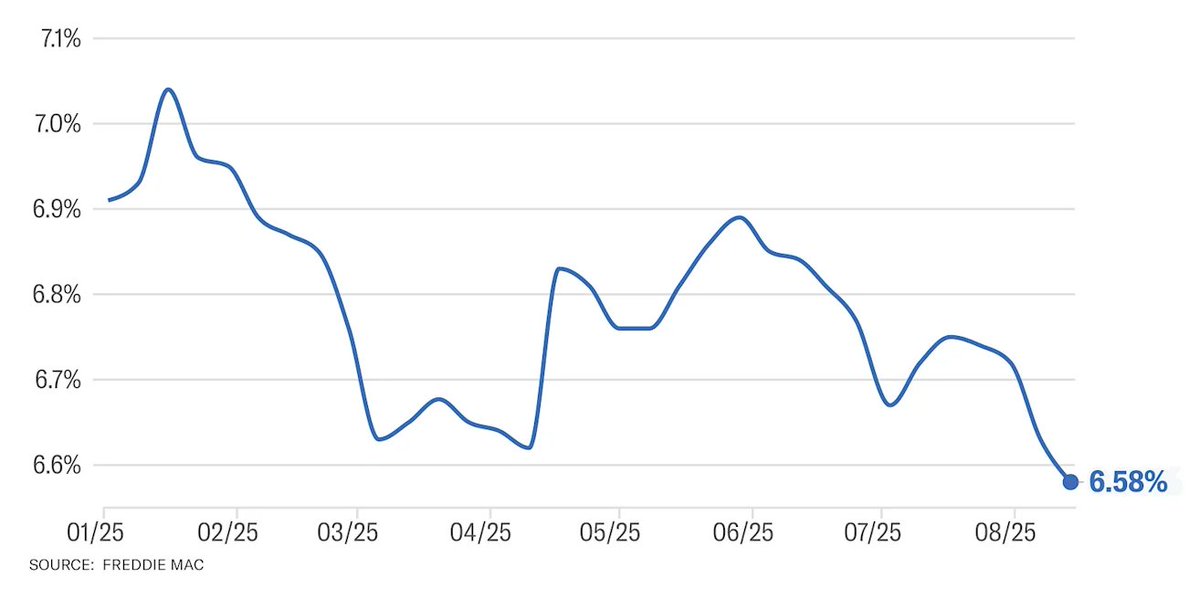

JUST IN: MORTGAGE RATES FALL TO 2025 LOW: 30-YEAR FIXED AT 6.58%, LOWEST SINCE OCTOBER 2024 pic.twitter.com/28XBcHuTFR

— blockchaindaily.news (@blckchaindaily) August 17, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

MORTGAGE RATES FALL TO 2025 LOW

Exciting news for homebuyers! Mortgage rates have just dipped to a 2025 low, with the 30-year fixed rate now standing at an impressive 6.58%. This rate marks the lowest level we’ve seen since October 2024, making it a favorable time for those considering purchasing a home or refinancing their existing mortgage.

The recent decline in mortgage rates can provide significant savings for homeowners. A lower rate means reduced monthly payments, allowing buyers to stretch their budgets further or invest in a more desirable property. As rates fluctuate, it’s essential to stay informed about the market trends that could impact your financial decisions.

For those looking to enter the housing market, this could be an ideal moment. With rates at a low point, it’s wise to act quickly. Consider locking in your mortgage rate now to take advantage of this opportunity. The housing market can be unpredictable, and rates may rise again soon.

If you’re unsure about the mortgage process or how to secure the best rates, consulting with a financial advisor or a mortgage specialist can be beneficial. They can provide personalized guidance to help you navigate this landscape and find the best option for your situation.

In conclusion, the current mortgage rates are a beacon of hope for many potential homeowners. With the 30-year fixed rate at 6.58%, now is the time to explore your options. Don’t miss out on this chance to save and make your dream of homeownership a reality.

Stay updated with the latest financial news by checking reputable sources, and keep an eye on Blockchain Daily News for more updates and insights on mortgage rates and the housing market.