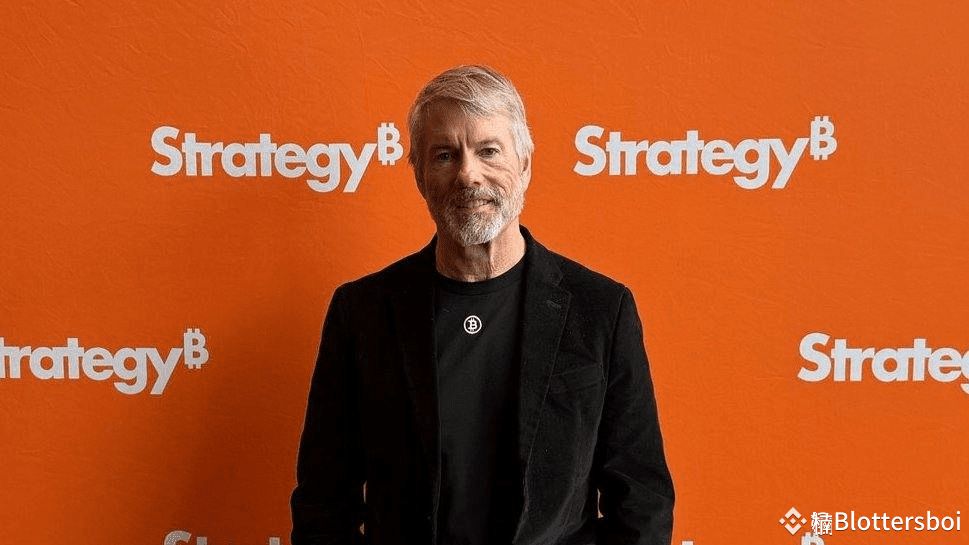

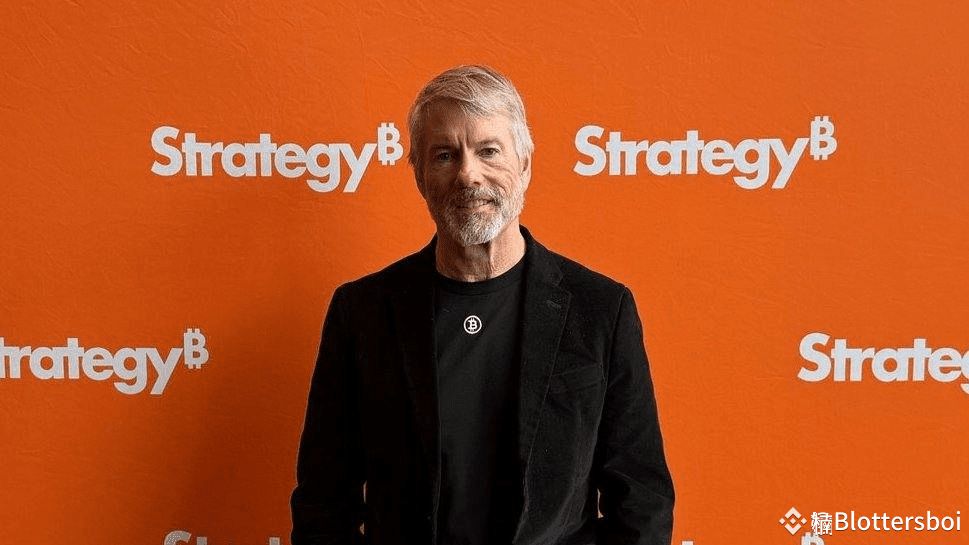

Michael Saylor’s Bold Move: Bitcoin in the S&P 500? — Michael Saylor Bitcoin strategy, S&P 500 cryptocurrency impact, passive Bitcoin investment portfolios

Michael Saylor Bitcoin strategy, S&P 500 cryptocurrency inclusion, passive investment Bitcoin exposure

JUST IN: Michael Saylor’s STRATEGY could join the S&P 500 as early as September, according to Strive.

S&P inclusion means passive Bitcoin exposure in trillions worth of portfolios. pic.twitter.com/CwsgfkOdIY

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Bitcoin Archive (@BTC_Archive) August 17, 2025

Michael Saylor’s STRATEGY Could Join the S&P 500

Recent news suggests that Michael Saylor’s innovative strategy could soon make its way into the S&P 500 as early as September, according to a statement from Strive. This potential inclusion is significant for investors looking to gain exposure to Bitcoin through traditional investment vehicles.

S&P Inclusion Means Passive Bitcoin Exposure

What does this mean for investors? Inclusion in the S&P 500 could provide passive exposure to Bitcoin in portfolios worth trillions. This is an exciting prospect for those who are looking to diversify their investments without directly buying cryptocurrency. By being part of this prestigious index, Michael Saylor’s strategy may attract a broader range of investors, including those who have been hesitant to dive into the crypto market directly.

The Impact on Bitcoin and Traditional Stocks

As Bitcoin continues to gain traction in mainstream finance, the potential inclusion of Bitcoin-related strategies in established indices like the S&P 500 signals a broader acceptance of digital assets. This could also lead to increased stability in Bitcoin pricing, as more institutional money flows into the space. For those who believe in the long-term viability of Bitcoin, this could be a game-changer.

In summary, if Michael Saylor’s strategy joins the S&P 500, it could pave the way for a new era of investment opportunities. Investors would benefit from passive Bitcoin exposure, which could enhance portfolio performance while minimizing the risks associated with direct cryptocurrency investments. Keep an eye on this developing story, as it might reshape how we think about both stocks and digital currencies in the near future.