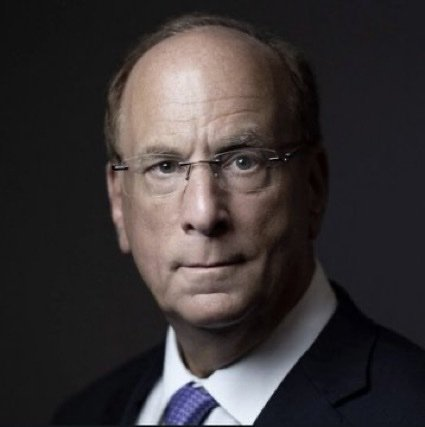

BlackRock’s Fink: Wall Street’s Grip on Davos Tightens! — Larry Fink WEF leadership, BlackRock Bitcoin ETF 2025, Wall Street influence Davos

Larry Fink influence, BlackRock cryptocurrency holdings, World Economic Forum leadership

DEVELOPING : BlackRock’s Larry Fink is now interim co-chair of the WEF.

He controls Wall Street.

Now he controls Davos.

And his ETF already hoards 700,000+ BTC.

This is dangerous. https://t.co/0tIFjNyKjx

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

DEVELOPING : BlackRock’s Larry Fink is now interim co-chair of the WEF.

Big news is coming out of Davos! Larry Fink, the CEO of BlackRock, has stepped into the role of interim co-chair of the World Economic Forum (WEF). This is a significant shift in power dynamics on the global stage. Fink, who already plays a pivotal role on Wall Street, now has a stronger influence over international economic discussions and policies. As the leader of one of the world’s largest asset management firms, his decisions can shape financial markets and economic trends worldwide.

He controls Wall Street.

With BlackRock managing trillions in assets, Fink’s control over Wall Street is undeniable. His strategies dictate not only investment flows but also the direction of corporate governance. This level of influence raises concerns about the concentration of power in the financial sector. As Fink takes on more responsibilities at the WEF, many are questioning how his interests will align with global economic priorities and what this could mean for the future of global finance.

Now he controls Davos.

Fink’s position at the WEF puts him at the forefront of discussions that impact economies around the world. His ability to influence key decision-makers and shape policy discussions at the annual meeting in Davos is unprecedented. The intersection of Wall Street and global policymaking can lead to conflicts of interest and calls for greater transparency regarding financial regulations and practices.

And his ETF already hoards 700,000+ BTC.

Perhaps most alarming is the fact that Fink’s ETF already holds over 700,000 Bitcoin (BTC). This massive accumulation of cryptocurrency by a traditional financial institution signals a dramatic shift in investment strategies and poses risks to market stability. As Bitcoin continues to gain traction, Fink’s control over such a significant amount raises questions about the potential for manipulation and market dominance.

This is dangerous.

The concentration of financial power in the hands of one individual poses risks not just to the market, but to the principles of democracy and economic equity. As Larry Fink takes on this pivotal role, it’s crucial for investors and policymakers alike to remain vigilant about the implications of this shift in power.