ETH ETFs Surge: Is Smart Money Betting Big? — Ethereum ETF Surge 2025, Crypto Investment Boom, Record Trading Activity

Ethereum ETFs trading surge, cryptocurrency investment strategies, institutional interest in digital assets

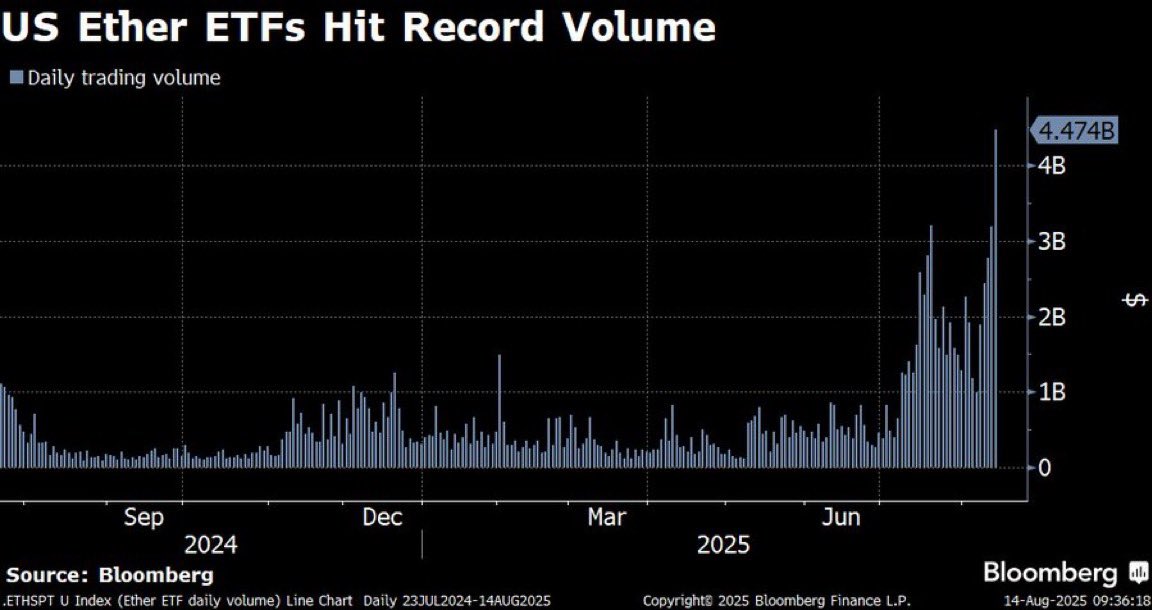

BREAKING:$ETH ETFS SEE RECORD-BREAKING TRADING VOLUME!

SMART MONEY = FLOODING IN. pic.twitter.com/lDFcJxGJDS

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Crypto Rover (@rovercrc) August 15, 2025

BREAKING: $ETH ETFs See Record-Breaking Trading Volume!

The cryptocurrency market is buzzing with excitement as the recent tweet from Crypto Rover reveals that $ETH ETFs are experiencing record-breaking trading volume. This surge indicates that “smart money” is flooding into Ethereum, a sign that institutional investors are increasingly recognizing the potential of this leading cryptocurrency.

What Does This Mean for Ethereum?

As trading volume skyrockets, it suggests that more investors are actively buying and selling Ethereum ETFs, which are designed to track the performance of Ethereum. This influx of investment could lead to increased price stability and potential growth for Ethereum in the long term. When smart money enters the market, it often brings credibility and can attract even more retail investors, amplifying price movements.

The Impact of Increased Trading Volume

Record trading volumes can have several implications. First, it indicates heightened interest and confidence in Ethereum and its underlying technology. Second, it could lead to improved liquidity, making it easier for investors to enter or exit their positions without causing significant price fluctuations.

Why Now?

The timing of this surge in trading volume is critical. With ongoing developments in the Ethereum network, including upgrades and enhancements, many believe that Ethereum is well-positioned for future growth. Furthermore, the rise of decentralized finance (DeFi) applications and non-fungible tokens (NFTs) built on Ethereum adds to its allure as a digital asset.

Get Involved

For those looking to capitalize on this trend, now might be a great time to explore investing in Ethereum ETFs. As always, do your own research and consider your financial goals before diving in. Keep an eye on market trends, and you might find yourself riding the next wave of cryptocurrency success!

Stay updated by following relevant discussions and news on platforms like Twitter to gain insights from industry experts.