Crypto Titans Demand Trump to Halt Bank Fees! — crypto leaders petition, fintech regulation impact, consumer data access fees

banking data fees, consumer choice in fintech, crypto industry regulations

BREAKING:

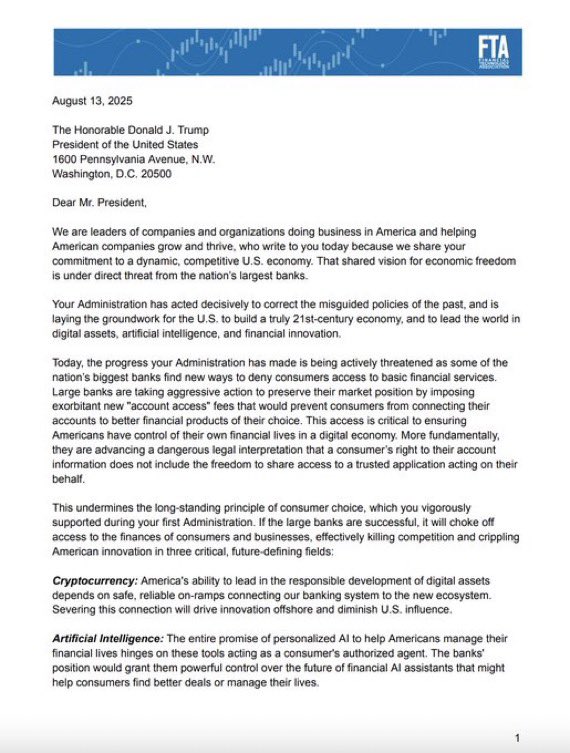

80+ crypto and fintech leaders urge Trump to block bank data access fees, warning it harms consumer choice. pic.twitter.com/xhxI2T4y1s

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Crypto Rover (@rovercrc) August 15, 2025

80+ Crypto and Fintech Leaders Urge Trump to Block Bank Data Access Fees

In a bold move, over 80 prominent leaders in the crypto and fintech sectors have come together to urge former President Donald Trump to take action against bank data access fees. This collective call highlights a growing concern that these fees negatively impact consumer choice and hinder innovation in financial services.

These industry experts believe that imposing fees on accessing bank data could create barriers for new and emerging financial technologies. This could stifle competition, which is crucial for providing consumers with a variety of options in how they manage their finances. The letter sent to Trump emphasizes that protecting consumer choice should be a priority, especially as the financial landscape continues to evolve rapidly.

The implications of bank data access fees are significant. Consumers may end up paying more for services or finding fewer options available to them. This is particularly concerning in a time when financial technology aims to enhance accessibility and affordability for everyone. The leaders argue that reducing these fees will promote a more competitive environment, ultimately benefiting consumers.

As the debate around bank data access fees unfolds, it’s essential for consumers to stay informed about how these changes could affect their financial choices. The collaboration among crypto and fintech leaders showcases a united front advocating for a fairer financial system.

For those interested in the evolving landscape of fintech and crypto, staying updated on this issue is crucial. You can read more about this impactful plea in detail on platforms like Twitter, where discussions on consumer rights and financial innovation are becoming increasingly relevant.