JUST IN: $6B Bitcoin Shorts Face Liquidation Threat! — Bitcoin liquidation news, cryptocurrency market volatility, Bitcoin price surge predictions 2025

Bitcoin liquidation news, cryptocurrency market trends, Bitcoin short selling risks

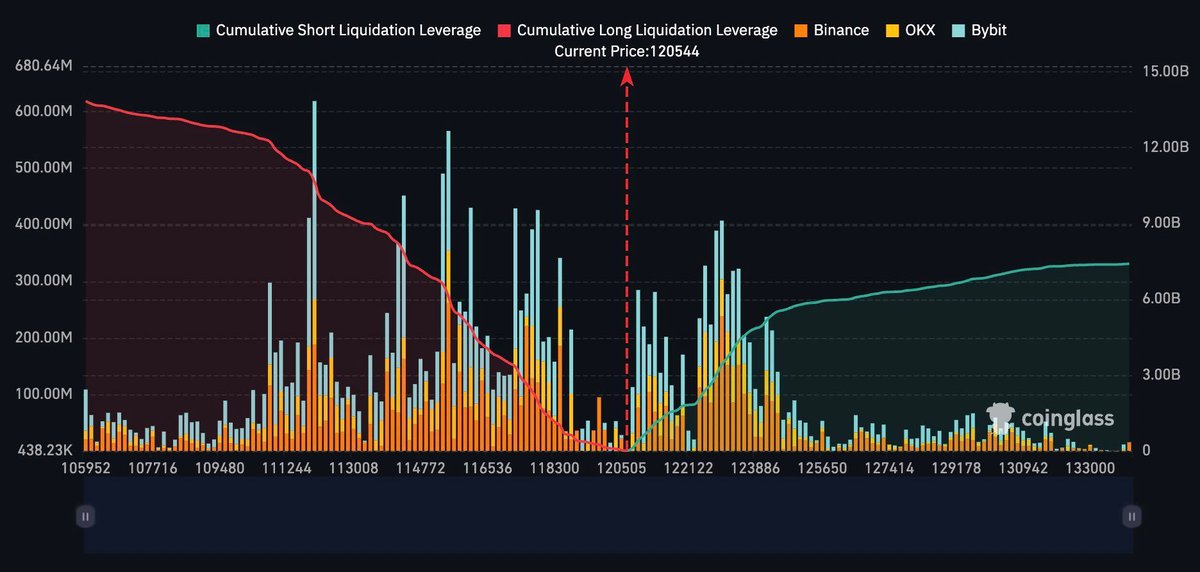

JUST IN: $6 Billion Bitcoin shorts to be liquidated at $125,000. pic.twitter.com/ncD3XYzA1Z

— Fiat Archive (@fiatarchive) August 14, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

JUST IN: $6 Billion Bitcoin Shorts to Be Liquidated at $125,000

Bitcoin traders are buzzing with excitement as recent news breaks that a staggering $6 billion worth of Bitcoin shorts could be liquidated if the price hits $125,000. This significant event could lead to a major market shift, making it essential for investors to stay informed about the implications.

In the cryptocurrency world, shorting is a strategy where traders bet against an asset, anticipating that its price will fall. However, if Bitcoin’s price surges, as it might towards $125,000, these positions could be liquidated, causing traders to buy back into the market, potentially driving prices even higher. If you’re curious about how these dynamics work, you can find more insights on Bitcoin trading strategies here.

Understanding the Impact of Liquidation

When shorts are liquidated, it forces traders to cover their positions, which can create a buying frenzy. This scenario isn’t just a theoretical exercise; it has happened before in the crypto space. The relationship between short positions and market movements can create significant volatility, which is both a risk and an opportunity for savvy investors.

As we approach this critical price point, monitoring market sentiment and trading volumes will be crucial. If you want to dive deeper into the technical analysis behind Bitcoin’s price movements, check out this comprehensive guide.

What Traders Should Consider

For those in the market, it’s vital to approach this situation with caution. While the potential for gains is enticing, the risks involved in trading Bitcoin, especially with such large short positions at stake, cannot be ignored. Keeping up to date with real-time market data and expert analyses can help traders make informed decisions.

Stay tuned for developments as the situation unfolds, and be prepared to adapt your strategies according to market changes.