Interest Rate Cut Confirmed: What’s Next for Your Wallet? — interest rate forecast September 2025, central bank policy update, monetary policy changes 2025

interest rate forecast, monetary policy analysis, economic growth implications

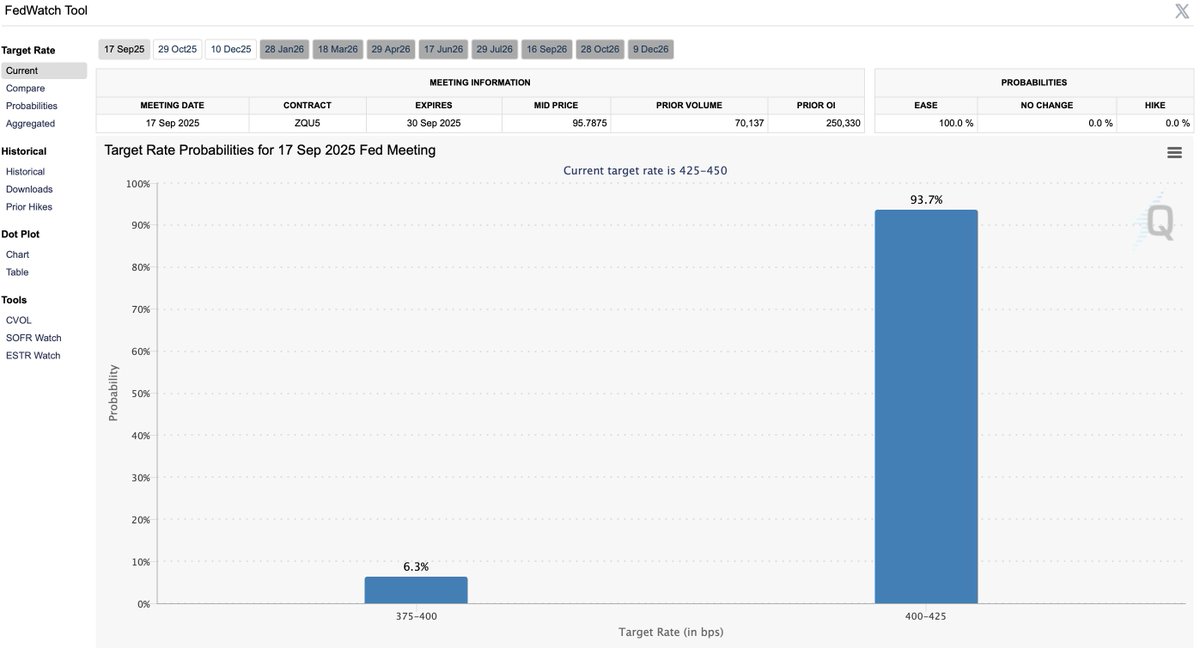

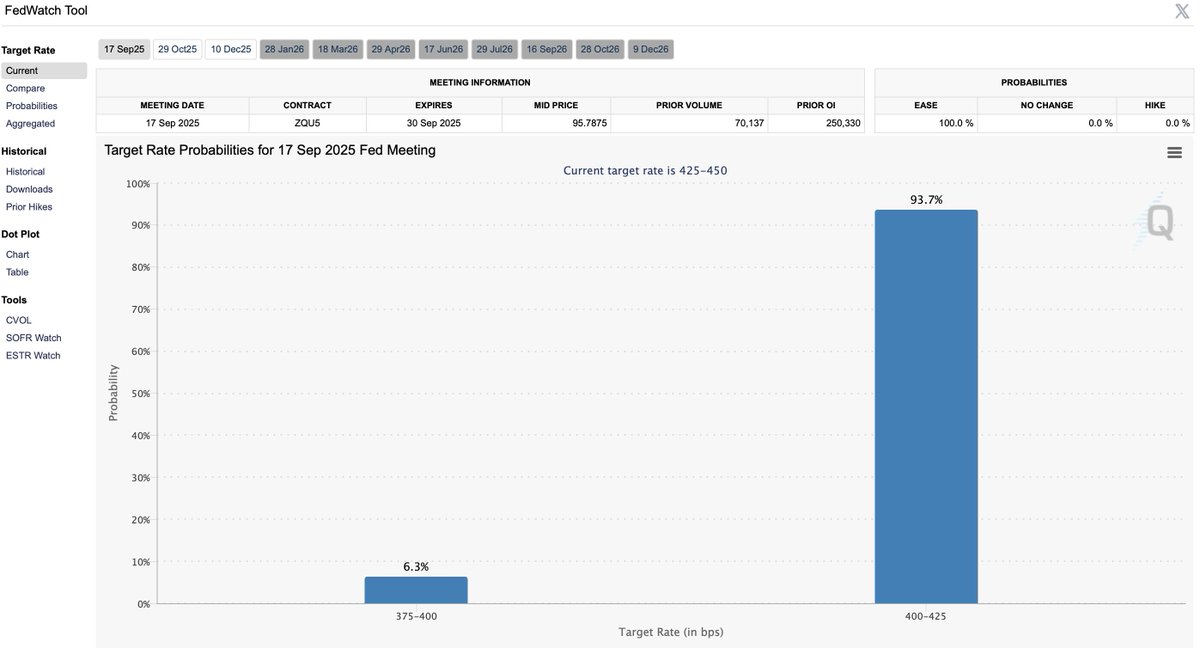

JUST IN : There is now a 100% chance of an interest rate cut at the September meeting pic.twitter.com/RFDf7F5UYi

— Barchart (@Barchart) August 13, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

JUST IN : There is now a 100% chance of an interest rate cut at the September meeting

The financial landscape is buzzing with the latest news from Barchart, which reports a 100% chance of an interest rate cut at the upcoming September meeting. This significant development could have far-reaching implications for consumers, businesses, and investors alike. Lowering interest rates is often seen as a strategy to stimulate economic growth, making borrowing cheaper and encouraging spending.

With the economy facing various challenges, including inflationary pressures and slowing growth rates, the decision to cut rates could provide a much-needed boost. For those looking to purchase homes or finance major purchases, this might be the perfect opportunity to secure lower mortgage rates and personal loans.

What This Means for You

For everyday consumers, the prospect of an interest rate cut means more favorable loan conditions. If you’ve been contemplating a major purchase or refinancing your existing loans, now could be the time to act. Lower rates typically translate to lower monthly payments, which can ease financial burdens and enhance purchasing power.

Impacts on the Market

Investors should also pay close attention to this development. Interest rate cuts often lead to increased market activity, as lower borrowing costs can spur business expansion and consumer spending. Stock markets may react positively, and sectors such as real estate and consumer goods could see notable gains.

Stay Informed

As we approach the September meeting, staying updated on economic indicators and Federal Reserve announcements will be crucial. Understanding how these changes affect your financial decisions can help you navigate the shifting economic landscape. For more insights, check out Barchart’s official Twitter for real-time updates and analysis.

In summary, the anticipated interest rate cut could be a game changer for many. Whether you’re a consumer, investor, or business owner, now is the time to consider how this news might impact your financial strategies and goals.