BREAKING: $6B Bitcoin Shorts Face Liquidation at $125K! — Bitcoin liquidation news, cryptocurrency market alert, Bitcoin price surge prediction 2025

Bitcoin liquidation risks, cryptocurrency market volatility, Bitcoin short selling strategy

BREAKING:

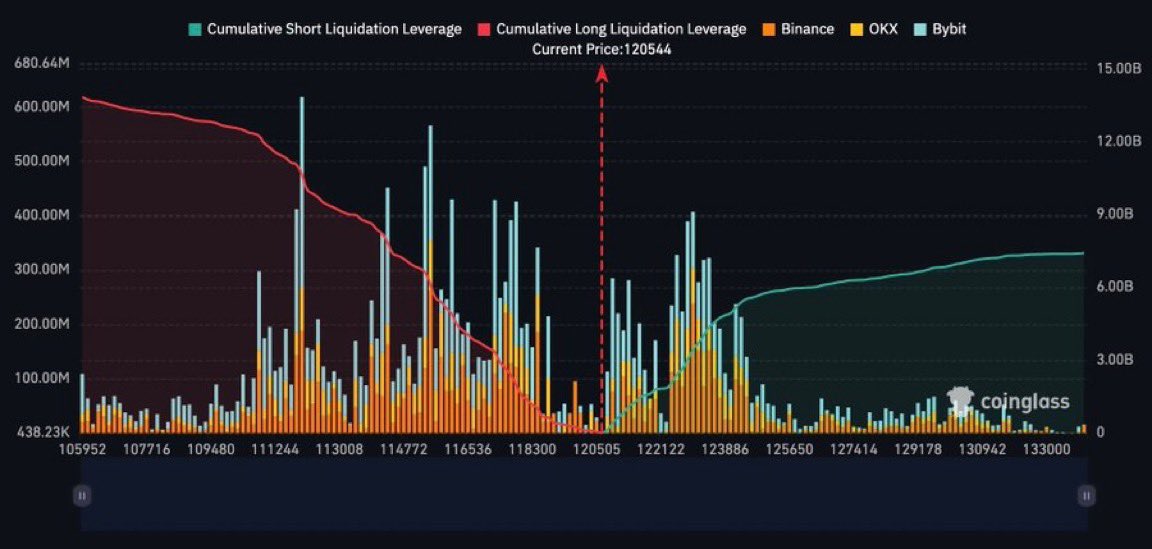

$6 BILLION BITCOIN SHORTS TO BE LIQUIDATED AT $125,000. pic.twitter.com/N0WX6qDmUc

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Crypto Rover (@rovercrc) August 14, 2025

BREAKING: $6 BILLION BITCOIN SHORTS TO BE LIQUIDATED AT $125,000

The cryptocurrency market is buzzing with excitement following the announcement that $6 billion in Bitcoin shorts could be liquidated at a price point of $125,000. This significant development was shared by Crypto Rover on Twitter and has caught the attention of traders and investors alike.

So, what does this mean for the market? When a short position is liquidated, it typically indicates that traders who bet against Bitcoin are forced to cover their positions as the price rises, further fueling upward momentum. This could lead to a surge in Bitcoin’s value, potentially making the $125,000 mark a critical price level to watch.

Understanding Bitcoin Shorts

For those unfamiliar, a short position is when traders borrow Bitcoin and sell it at the current market price, hoping to buy it back at a lower price in the future. If Bitcoin’s price continues to rise, those holding shorts face increasing losses, leading to liquidations. This cycle can create a powerful upward price movement, as more short positions are closed in response to rising prices.

Market Implications

The potential liquidation of such a massive amount of shorts could have a dramatic impact on Bitcoin’s price. If traders rush to cover their positions, we could see Bitcoin breaking through previous resistance levels, attracting even more investors. With the growing institutional interest in Bitcoin, the market may be poised for a significant rally.

Stay tuned for updates as this situation develops. The cryptocurrency landscape is unpredictable, and movements like these can lead to rapid changes in market sentiment. If you’re looking to get involved, now might be the time to strategize and consider your next moves.

For more information and real-time updates, check out Crypto Rover’s original tweet here.