Shocking Prediction: 25 BPS Fed Rate Cut Imminent? — CME interest rate forecast, Federal Reserve rate decision, monetary policy analysis

Federal Reserve interest rate prediction, CME Group rate cut forecast, economic impact of monetary policy

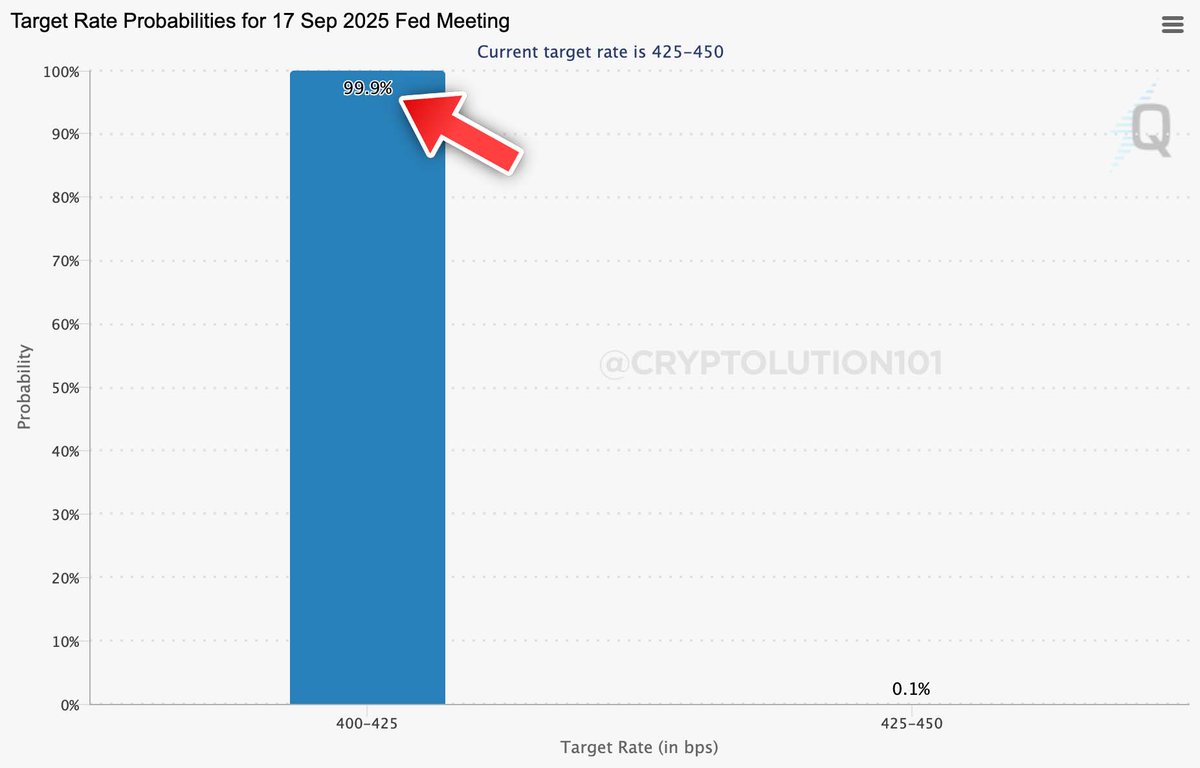

JUST IN: @CMEGroup watch tool predicts 99.9% chance FED will announced 25 BPS rate cut on September 17th, 2025 pic.twitter.com/QVh02eZgin

— Vincent (Cryptolution) (@cryptolution101) August 13, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

JUST IN: CME Group Predicts 99.9% Chance of FED Rate Cut

The financial world is buzzing with exciting news! According to the latest update from the CME Group, there’s a staggering 99.9% chance that the Federal Reserve (FED) will announce a 25 basis points (BPS) rate cut on September 17th, 2025. This prediction has sent ripples through the markets, and many investors are keenly watching how this potential rate cut could impact the economy.

Understanding the Implications of a Rate Cut

A 25 BPS rate cut can significantly affect borrowing costs, making loans cheaper for both consumers and businesses. Lower interest rates typically encourage spending and investment, which can stimulate economic growth. So, if the FED indeed makes this move, it could lead to a more favorable environment for economic expansion.

This prediction is a crucial indicator for investors and analysts alike. When the CME Group releases such forecasts, it is often based on complex market data and trends. This makes their outlook highly regarded in the financial community.

What to Expect Next

As we approach September 2025, keep an eye on further announcements and economic indicators. If you want to stay updated on the latest financial news, following credible sources like the CME Group can provide invaluable insights.

The anticipation around this potential rate cut reflects broader economic trends and investor sentiment. Stay informed, as this could be a pivotal moment for both the markets and the economy at large.

For more details on the prediction and to follow the conversation, check out the original tweet from Vincent (Cryptolution) on Twitter.