Shocking Move: $27B ETH Purchase Sparks Supply Crisis! — ETH INVESTMENT STRATEGY, CRYPTO MARKET SUPPLY CRUNCH, INSTITUTIONAL ETH DEMAND 2025

Ethereum investment trends, cryptocurrency market analysis, digital asset supply dynamics

JUST IN:

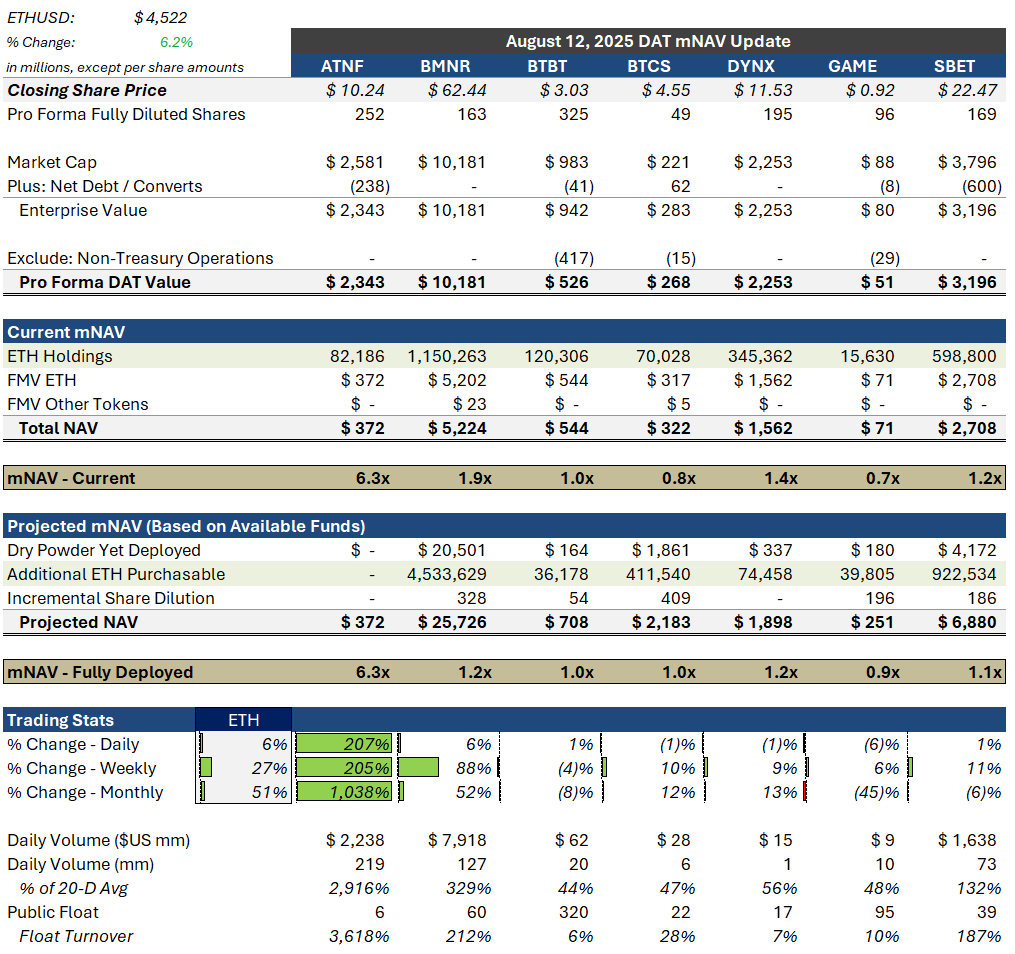

ETH TREASURY COMPANIES ARE GETTING READY TO BUY $27B ETH

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

THIS IS 40% OF ALL ETH ON EXCHANGES

A massive supply shock is coming pic.twitter.com/Q1USchLpg3

— Rekt Fencer (@rektfencer) August 13, 2025

ETH TREASURY COMPANIES ARE GETTING READY TO BUY $27B ETH

Exciting news is circulating in the crypto community as ETH treasury companies prepare to purchase a staggering $27 billion worth of Ethereum (ETH). This move represents a significant 40% of all ETH currently available on exchanges. Such a massive acquisition is poised to create a substantial supply shock in the market, prompting discussions among investors and enthusiasts alike.

The implications of this potential buyout are immense. With ETH treasury companies moving to secure such a large portion of the circulating supply, we could witness a dramatic increase in ETH’s value. Investors are keenly watching, as this kind of market activity can lead to heightened volatility and changes in price dynamics. Historical trends suggest that significant buying pressure often correlates with price surges, making this an opportune moment for traders and long-term holders.

A MASSIVE SUPPLY SHOCK IS COMING

The anticipated supply shock is drawing attention to the fundamentals of Ethereum and its utility within the blockchain ecosystem. As more ETH is taken off exchanges, the available supply decreases, which can lead to increased demand. This scenario could solidify Ethereum’s position as a leading digital asset, especially with the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs).

Market analysts are already speculating about the potential effects on Ethereum’s price, suggesting that if the buy goes through as planned, we might see unprecedented growth. It’s essential for investors to stay informed and consider the potential opportunities that may arise from this significant market shift.

In the coming weeks, keep an eye on how this situation unfolds, as it could redefine the landscape of cryptocurrency investment and trading. If you’re interested in following this development, check out the original tweet from Rekt Fencer for further insights.