Shock! Treasury Secretary Demands Massive Rate Cuts! — Federal Reserve interest rate decision, Treasury Secretary Bessent economic policy, interest rate cuts impact 2025

interest rate reduction, Federal Reserve policies, economic growth strategies

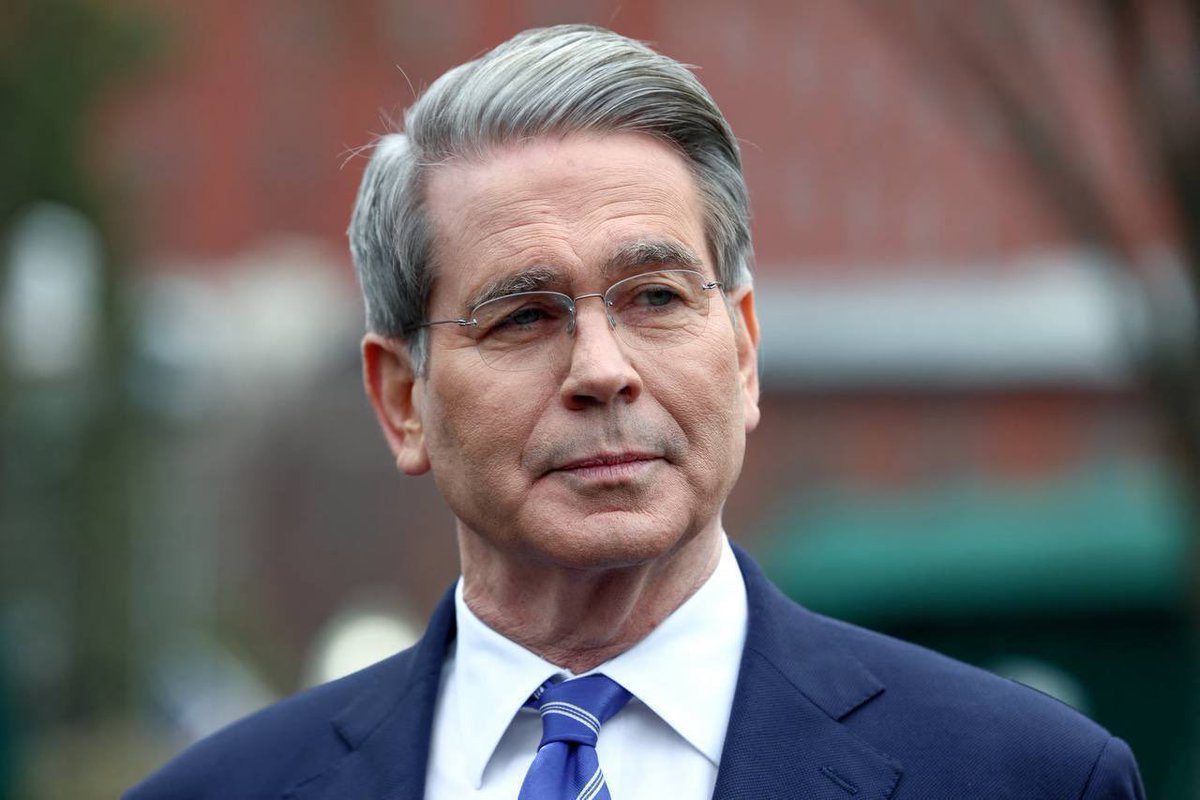

JUST IN: Treasury Secretary Bessent calls for the Federal Reserve to lower interest rates.

“Rates should be 150, 175 basis points lower.” pic.twitter.com/UEfqBKgStt

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Bitcoin Junkies (@BTCjunkies) August 13, 2025

Treasury Secretary Bessent Calls for Lower Interest Rates

In a recent statement, Treasury Secretary Bessent urged the Federal Reserve to consider lowering interest rates significantly. He suggested that rates should be reduced by 150 to 175 basis points, a move that could have substantial implications for the economy. Such a reduction aims to stimulate economic growth by making borrowing cheaper for consumers and businesses alike.

The Implications of Lower Interest Rates

Lowering interest rates can lead to a more favorable economic environment. When rates decrease, it often encourages spending and investing, allowing businesses to expand and consumers to make larger purchases. This can be particularly beneficial in times of economic uncertainty, as it can help to boost consumer confidence and drive demand. Bessent’s call for reduced rates aligns with a growing sentiment that the economy could benefit from a more accommodative monetary policy.

The Federal Reserve’s Role

The Federal Reserve plays a crucial role in determining interest rates in the U.S. economy. By adjusting rates, the Fed can influence inflation, employment, and overall economic growth. Bessent’s recommendation puts additional pressure on the Fed to act, especially in light of current economic conditions. If the Fed decides to follow through on this advice, it could lead to a significant shift in monetary policy.

What This Means for You

For individuals, lower interest rates can mean lower mortgage rates and cheaper loans, making it easier to finance a home or a car. It can also result in better credit card rates, reducing the cost of borrowing. If you’re considering making a significant purchase or investment, keeping an eye on these developments will be essential.

For more details on Bessent’s statement, check out the original tweet from Bitcoin Junkies.