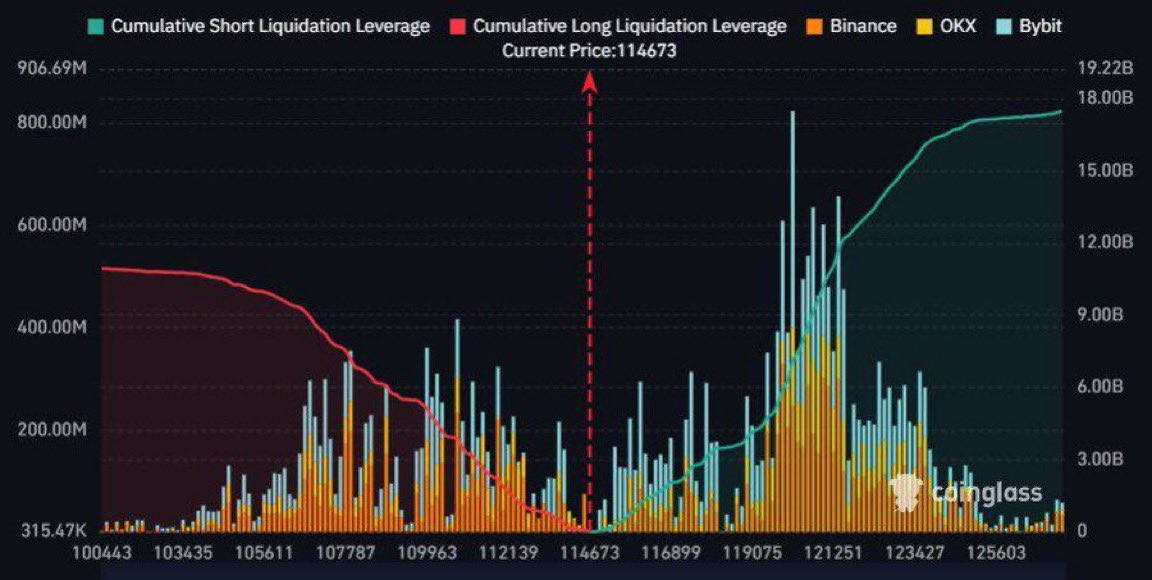

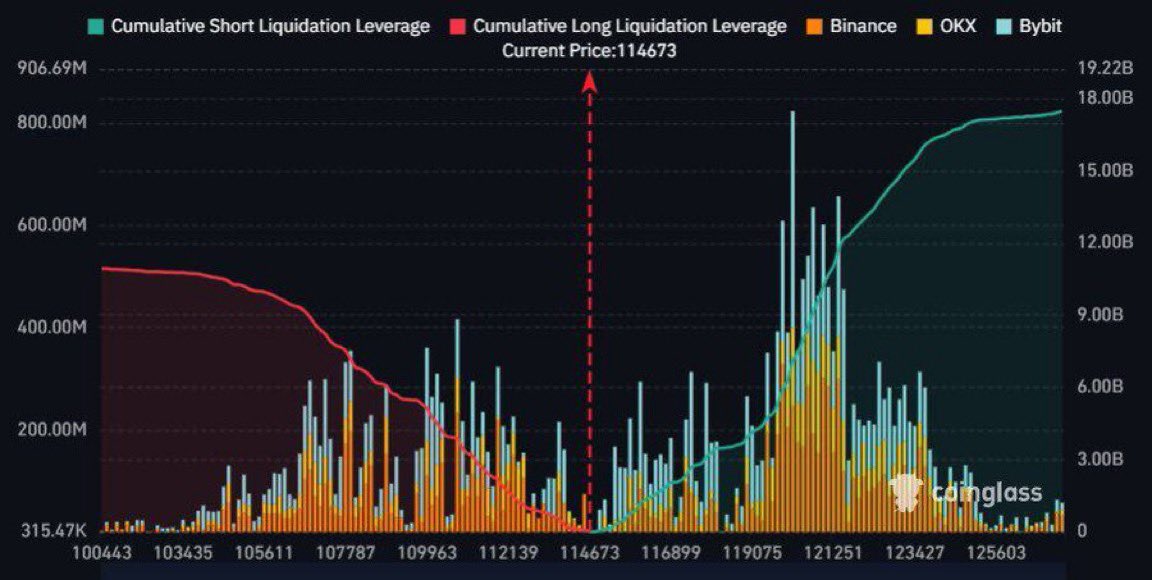

Bitcoin’s Surge: $18B in Shorts on the Edge of Collapse! — Bitcoin liquidation risk, cryptocurrency market surge, Bitcoin price prediction 2025

Bitcoin Short Positions at Risk of Liquidation

In a significant market update, over $18 billion in Bitcoin short positions could face liquidation if the price of Bitcoin ($BTC) reaches $125,000. This news was shared by Crypto Rover on Twitter, highlighting the potential volatility in the cryptocurrency market. Investors and traders should stay informed about these developments, as they could impact market dynamics and trading strategies. The looming risk for short positions emphasizes the importance of risk management in cryptocurrency trading. As Bitcoin’s price fluctuates, traders must prepare for possible market shifts that could affect their positions. Stay tuned for further updates on Bitcoin’s performance.

BREAKING:

OVER $18 BILLION WORTH OF BITCOIN SHORT POSITIONS ARE AT RISK OF LIQUIDATION IF $BTC REACHES $125,000. pic.twitter.com/RxggCWPOsG

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Crypto Rover (@rovercrc) August 6, 2025

BREAKING:

OVER $18 BILLION WORTH OF BITCOIN SHORT POSITIONS ARE AT RISK OF LIQUIDATION IF $BTC REACHES $125,000.

The cryptocurrency market is always buzzing with excitement, but recent news has taken that excitement to a whole new level. A staggering amount of over $18 billion in Bitcoin short positions could face liquidation if the price of Bitcoin ($BTC) climbs to $125,000. This is a significant moment for traders and investors alike, making it essential to understand what this means for the crypto landscape.

So, what exactly does it mean for Bitcoin short positions? For those who may not be familiar, short selling is a trading strategy that allows investors to profit from a decline in the price of an asset. However, if the market goes against those positions, it can lead to substantial losses and, ultimately, liquidation. Liquidation happens when a trader’s losses exceed their account balance, forcing a broker to close their position to prevent further losses. In this case, if Bitcoin surges to $125,000, those holding short positions could be in a precarious situation.

Why is the $125,000 mark so crucial? It’s not just another round number; it represents a psychological barrier for traders. Breaking through this price point could trigger a wave of buying activity, causing further upward momentum. This dynamic can create a domino effect, where the liquidation of short positions adds fuel to the fire, pushing Bitcoin prices even higher.

What Factors Could Drive Bitcoin to $125,000?

Several factors could contribute to Bitcoin reaching this critical price point. First, the ongoing institutional interest in cryptocurrencies is significant. Major financial institutions are increasingly recognizing Bitcoin as a legitimate asset class, which could lead to more investments. Additionally, geopolitical uncertainties and economic instability often drive investors toward Bitcoin as a “safe haven” asset, similar to gold.

Moreover, the halving event, which occurs approximately every four years, reduces the rewards for mining new blocks and has historically led to price increases. If the next halving event aligns with growing institutional demand, we could see Bitcoin prices soar.

The Impact on Traders and Investors

For traders, especially those involved in short selling, this news is a wake-up call. The risk of liquidation can be daunting, and it’s essential to stay informed about market movements. If you’re considering short positions on Bitcoin, now may be the time to reassess your strategy.

For long-term investors, this situation could present unique opportunities. If Bitcoin does break through the $125,000 barrier, it could signal a new bull run. Understanding the market dynamics at play will be crucial in making informed decisions.

Final Thoughts

The cryptocurrency market is known for its volatility, and the potential for over $18 billion in Bitcoin short positions to be liquidated adds another layer of intrigue. Keeping an eye on market trends, institutional investments, and critical price points like $125,000 will be essential for anyone looking to navigate these waters successfully.

In a space where fortunes can change overnight, understanding the implications of breaking news like this can make all the difference. Happy trading!