SEC Shocks Wall Street: Liquid Staking Isn’t a Security! — cryptocurrency regulation update, liquid staking compliance 2025, SEC ruling on crypto assets

SEC Clarifies Staking Regulations

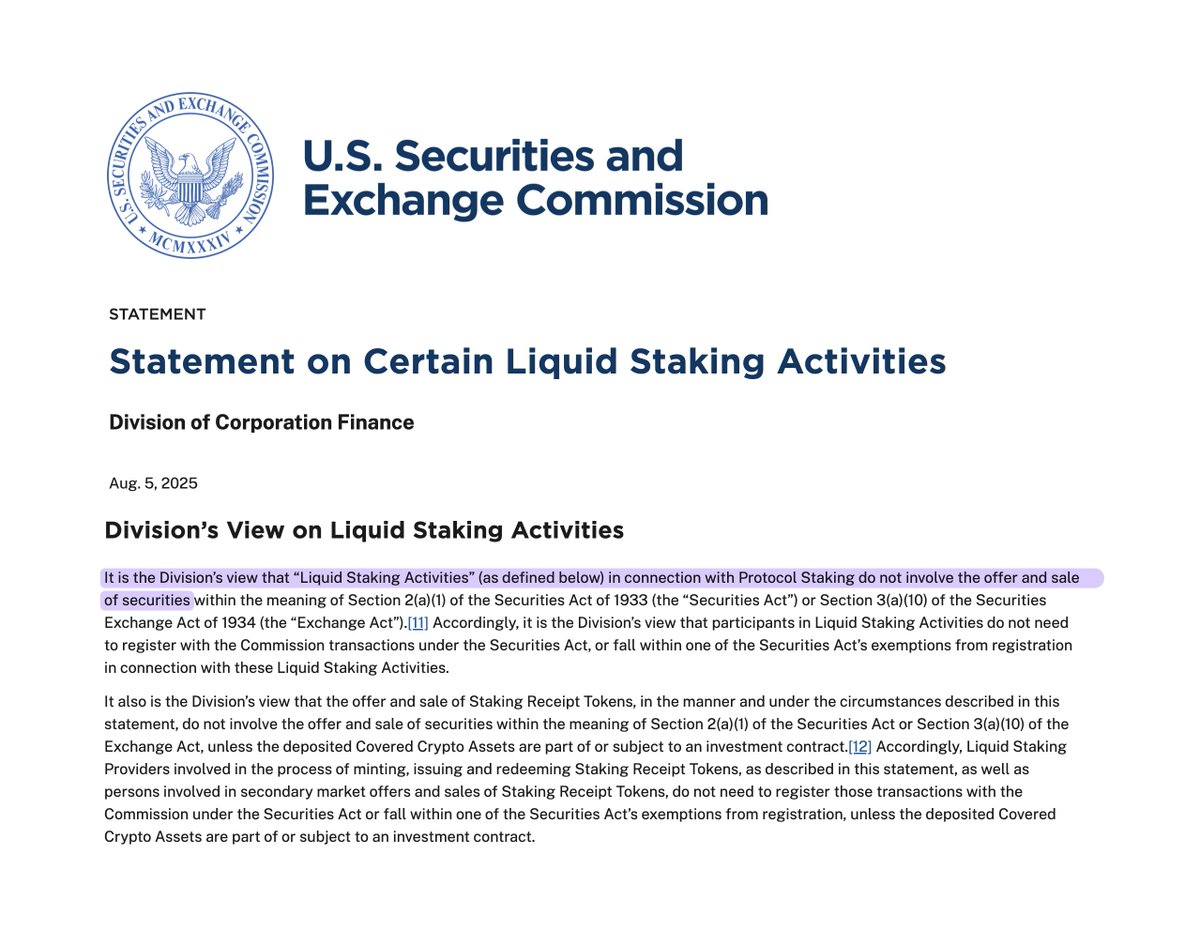

The U.S. Securities and Exchange Commission (SEC) has officially clarified its stance on liquid staking activities, stating that certain practices do not qualify as securities under U.S. law. This announcement is significant for the cryptocurrency community, as it provides much-needed guidance for investors and companies involved in staking. The SEC’s ruling aims to foster innovation while ensuring regulatory compliance. Stakeholders in the crypto space can now navigate the landscape with a clearer understanding of legal frameworks surrounding staking activities. For more updates, follow Coin Bureau on Twitter for the latest insights on cryptocurrency regulations.

BREAKING: SEC CLEARS THE AIR ON STAKING

The SEC says some liquid staking activities are not securities under U.S. law. pic.twitter.com/1cvRvC0MFq

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Coin Bureau (@coinbureau) August 5, 2025

BREAKING: SEC CLEARS THE AIR ON STAKING

If you’ve been following the cryptocurrency world, you probably heard the recent buzz about the SEC’s latest announcement regarding staking. This is a big deal, especially for those involved in liquid staking activities. Many were left wondering how these activities fit into the regulatory landscape of the U.S. Well, the SEC has finally stepped in to clarify things, stating that some liquid staking activities are not classified as securities under U.S. law. This is a significant development for investors and companies alike.

The SEC Says Some Liquid Staking Activities Are Not Securities Under U.S. Law

So, what does this mean for crypto enthusiasts and investors? In simple terms, the SEC’s ruling helps to demystify the legal status of liquid staking. For starters, liquid staking allows users to stake their cryptocurrency while maintaining liquidity, meaning they can trade or use their assets without having to unlock them. The SEC has acknowledged that not all staking activities fall under their jurisdiction, which opens up a world of possibilities for crypto users.

Why is this important? Well, clear regulations can lead to greater innovation in the crypto space. Many projects rely on staking to boost their ecosystems, and understanding the legal framework can encourage more players to enter the market. This clarity can also help protect investors, as they can make informed decisions based on the SEC’s guidelines.

Implications for Investors and Crypto Companies

For investors, the SEC’s announcement is a breath of fresh air. If liquid staking isn’t classified as a security, it means fewer regulatory hurdles for users who want to participate in these activities. This could lead to increased interest and participation in staking, thereby boosting the overall market. If you’re looking to dive into liquid staking, now might be a good time to explore your options.

For crypto companies, this ruling could mean the difference between success and failure. With clearer guidelines from the SEC, companies can better navigate the regulatory landscape, ensuring they’re compliant while still being innovative. This is crucial, especially in a space that’s constantly evolving. The SEC’s position could encourage more startups to develop staking platforms that align with these regulations, ultimately benefiting the entire ecosystem.

What’s Next for the Crypto Community?

As the dust settles from the SEC’s announcement, the crypto community is left to ponder the next steps. Will this ruling inspire more regulatory clarity in other areas of cryptocurrency? It’s hard to say, but one thing is for sure: the SEC is slowly but surely beginning to embrace the complexities of the crypto world.

The SEC’s recent statements signify a shift in how regulatory bodies view cryptocurrency activities. As the industry continues to grow and evolve, it’s crucial for everyone involved—investors, developers, and regulators—to engage in ongoing discussions about the future of crypto regulation.

In summary, the SEC’s clarification on liquid staking is a significant win for the crypto community. It paves the way for innovation and growth while ensuring that legal frameworks are in place to protect investors. Whether you’re an experienced crypto enthusiast or just dipping your toes into the world of staking, this is a moment worth celebrating. Remember, keeping up with these developments can help you make the best decisions for your investments.