SEC Shocks Market: Crypto Liquid Staking Not Securities! — crypto regulations 2025, liquid staking news, SEC crypto policy updates

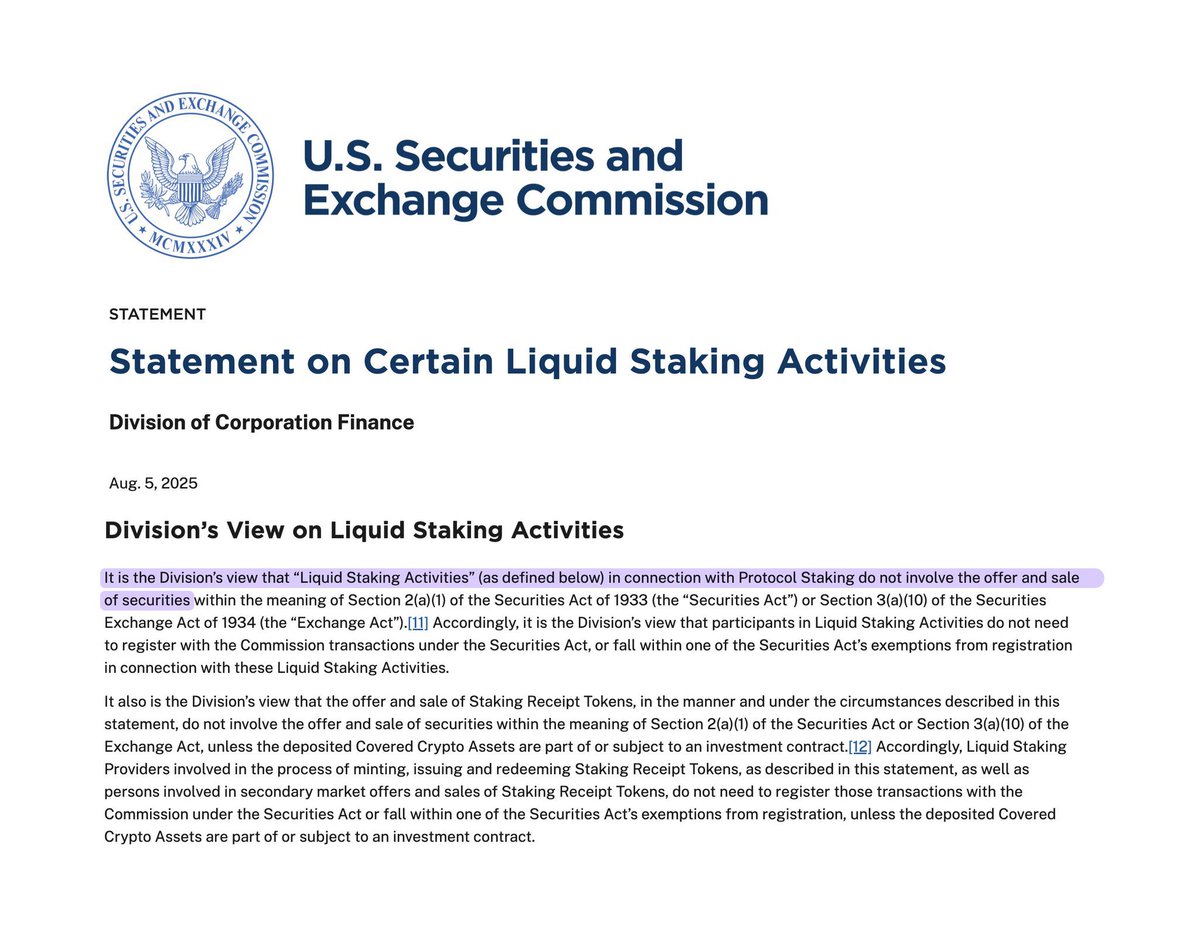

On August 5, 2025, the SEC announced a significant ruling regarding cryptocurrency, declaring that liquid staking activities do not qualify as securities. This decision is pivotal for the crypto market, as it clarifies the regulatory landscape for liquid staking, a popular method for earning rewards on staked assets. The implications of this ruling may encourage further innovation and investment in the crypto space. Investors and stakeholders should stay informed about these developments, as they could affect future regulations and the overall market dynamics. For more insights on the latest crypto news, follow Altcoin Daily.

BREAKING: SEC declares crypto liquid staking activities are not securities. pic.twitter.com/hcro6n5hDo

— Altcoin Daily (@AltcoinDaily) August 5, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: SEC declares crypto liquid staking activities are not securities.

In a significant development for the cryptocurrency landscape, the U.S. Securities and Exchange Commission (SEC) has officially declared that liquid staking activities are not classified as securities. This announcement is a game-changer for many participants in the crypto space, as it clarifies the regulatory stance on a practice that has been gaining traction among investors and developers alike.

Understanding Liquid Staking

Liquid staking is a relatively new concept in the world of cryptocurrencies. It allows users to stake their tokens while still retaining liquidity, meaning they can trade or use those tokens without waiting for the staking period to end. This method has become popular among Ethereum users, especially since the transition to Ethereum 2.0, where staking plays a crucial role in securing the network.

Before this SEC announcement, many in the crypto community were uncertain about how regulators would view liquid staking. The fear was that it might be categorized as a security, which would impose stricter regulations and compliance requirements. Fortunately, the SEC’s decision has alleviated those concerns, allowing users to continue engaging with these activities without the added burden of regulatory scrutiny.

The Implications of the SEC’s Decision

With the SEC declaring that liquid staking activities are not securities, this opens up a world of opportunities for crypto investors. It enables broader participation in staking without the risk of falling afoul of securities laws. This clarity is particularly beneficial for new investors who may have been hesitant to enter the staking game due to regulatory fears.

Moreover, this decision could encourage more innovation in the crypto space. Developers may feel more comfortable creating new products and services around liquid staking, knowing that they won’t be subject to the same regulatory hurdles as traditional securities. This could lead to a surge in new liquid staking platforms and solutions, enriching the overall ecosystem.

Community Reaction to the SEC’s Announcement

The reaction from the crypto community has been overwhelmingly positive. Many enthusiasts and traders took to social media to express their excitement about the SEC’s announcement. The news was shared widely on platforms like Twitter, where influencers and analysts highlighted how this move could propel the entire crypto market forward.

For instance, the popular crypto news outlet, Altcoin Daily, broke the news, garnering significant attention and sparking discussions about the future of liquid staking. It’s clear that this announcement has energized the community, with many looking forward to what’s next in the regulatory discussions surrounding crypto.

The Future of Liquid Staking

As the dust settles from this announcement, it’s important to keep an eye on how liquid staking evolves. The SEC’s ruling could pave the way for more detailed guidelines and regulations surrounding crypto activities, which could further legitimize the industry. Investors should stay informed about developments in this space, as ongoing regulatory changes could impact investment strategies and opportunities.

In summary, the SEC’s declaration that liquid staking activities are not securities marks a positive shift in the regulatory landscape for crypto. It boosts confidence among investors and encourages innovation, paving the way for a more robust and dynamic crypto market.