SEC Declares Liquid Staking Tokens Not Securities—Shockwaves Ahead! — Liquid Staking Regulations, Injective Protocol ETF, TradFi Access for Crypto 2025

SEC Declares Liquid Staking Tokens Non-Securities

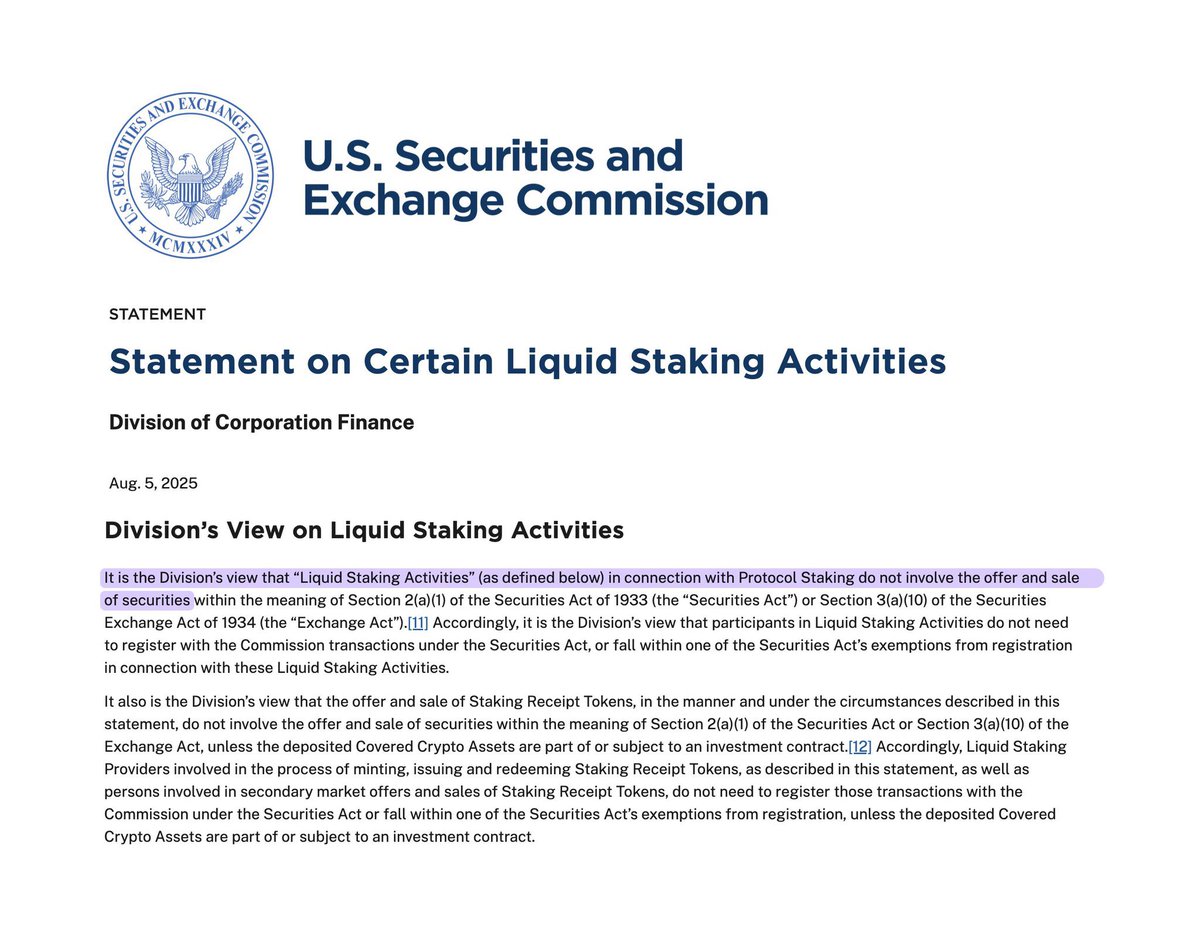

In a significant ruling, the SEC announced that Liquid Staking activities and tokens, including $INJ, are not classified as securities. This decision paves the way for the upcoming Staked $INJ ETF by Canary Capital, which will provide institutions and users with seamless access to Injective through traditional financial systems. This development marks a crucial step for the crypto market, enhancing its legitimacy and accessibility. With promises being fulfilled, the regulatory clarity surrounding Liquid Staking is set to encourage broader adoption and innovation in the cryptocurrency space. Stay informed about these developments in the evolving landscape of digital finance.

BREAKING: The @SECGov has declared that Liquid Staking activities and tokens are not securities.

Soon you will see the Staked $INJ ETF by Canary Capital which enables institutions and users to access Injective through TradFi rails.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Promises made. Promises kept. pic.twitter.com/UJb0IixV3m

— Injective (@injective) August 5, 2025

BREAKING: The @SECGov has declared that Liquid Staking activities and tokens are not securities.

In a groundbreaking announcement, the @SECGov has officially clarified its stance on Liquid Staking. This declaration is significant as it redefines how these activities and tokens are perceived within the regulatory landscape. By stating that Liquid Staking activities are not classified as securities, the SEC has opened the door for more innovation and participation in the crypto space. This is a win for both developers and users who have been eager for clearer guidelines!

Soon you will see the Staked $INJ ETF by Canary Capital

Exciting times are ahead with the upcoming launch of the Staked $INJ ETF by Canary Capital. This product will allow both institutions and individual users to access Injective seamlessly through traditional finance (TradFi) channels. Imagine being able to invest in a cryptocurrency project while enjoying the same ease of access as traditional stock markets! This ETF aims to bridge the gap between the crypto world and traditional finance, making it easier for everyone to get involved.

Promises made. Promises kept.

Injective has emphasized that this move is not just a promise but a commitment to its community. The phrase “Promises made. Promises kept.” resonates deeply in the crypto world, where trust and reliability are paramount. As more institutions look to invest in crypto, having clear regulatory guidelines is crucial, and this announcement from the SEC provides just that. It strengthens the foundation upon which new financial products like the Staked $INJ ETF can be built.

The Impact of SEC’s Decision on Liquid Staking

The SEC’s ruling on Liquid Staking is a game-changer. By not classifying these tokens as securities, it encourages a more dynamic and innovative environment within the blockchain and cryptocurrency sectors. Developers can now focus on creating better staking solutions without the looming fear of regulatory issues. This could lead to an influx of new projects and offerings that enhance user experience and investment opportunities.

What This Means for Investors

For investors, this announcement is an encouraging sign. With clearer regulations, there’s less uncertainty. Knowing that Liquid Staking activities are not securities allows for more confidence in participating in these opportunities. Additionally, the launch of the Staked $INJ ETF means that more sophisticated investment products are becoming available, making it easier for average investors to get involved without needing to navigate complex cryptocurrency exchanges.

The Future of Liquid Staking and ETFs

The future looks bright for liquid staking and ETFs in the crypto space. As more regulatory clarity emerges, we can expect to see innovative financial products that cater to a growing audience of crypto enthusiasts. With the SEC paving the way, it’s an exciting time to stay informed and engaged in the evolving landscape of cryptocurrency investments.