BREAKING: SEC Declares Liquid Staking Tokens Non-Securities! — Liquid staking news, SEC regulatory updates, cryptocurrency compliance 2025

The SEC has made a significant announcement regarding liquid staking activities and tokens, declaring they are not classified as securities. This groundbreaking decision has sparked excitement within the crypto community, particularly among platforms like Solana. The clarification could pave the way for more innovative staking solutions and enhance the growth of decentralized finance (DeFi). As the regulatory landscape evolves, understanding these distinctions becomes crucial for investors and developers alike. Stay updated on the latest developments in crypto regulations to navigate this rapidly changing environment effectively. For more insights on liquid staking and its implications, follow updates from trusted sources like @SECGov and @solana.

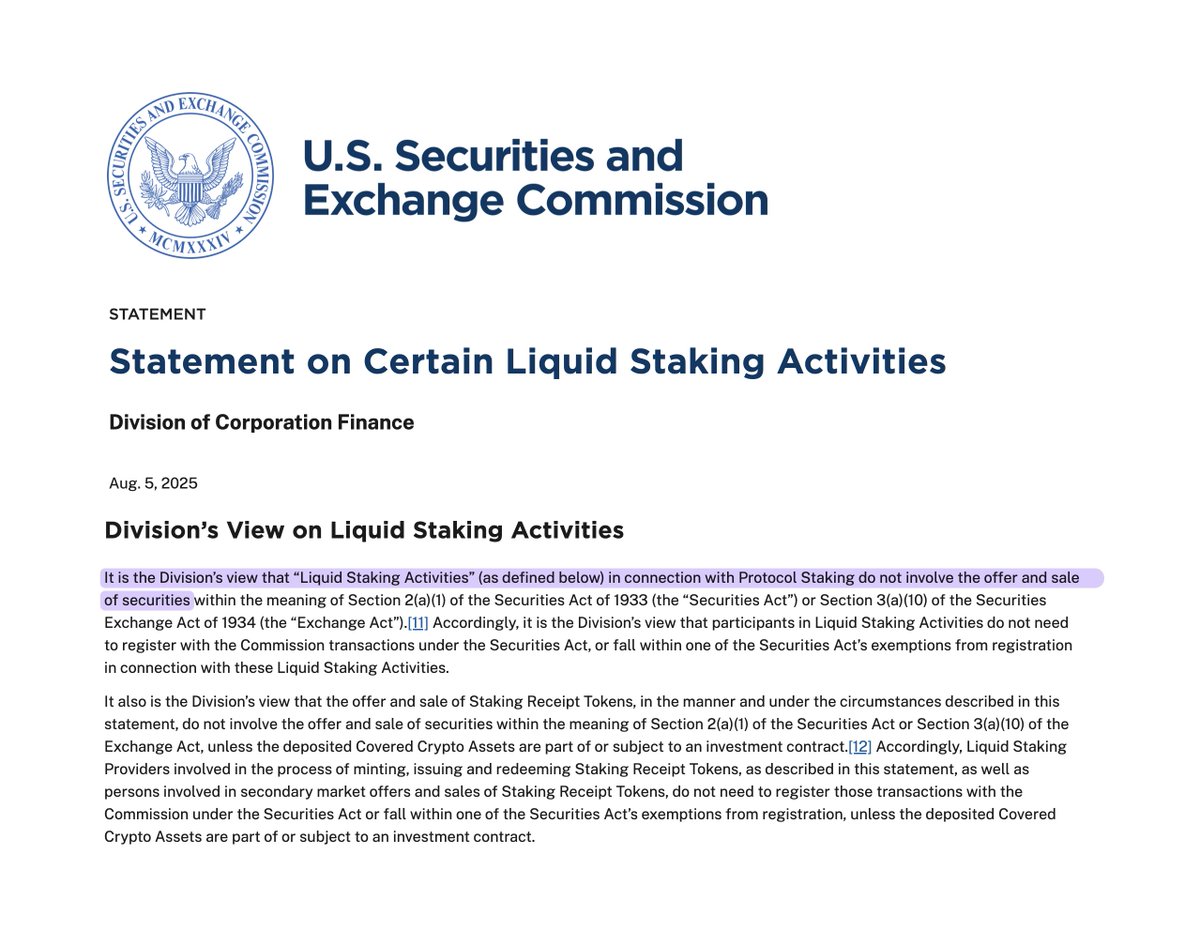

BREAKING from @SECGov:

Liquid staking activities and tokens are not considered securities pic.twitter.com/POcFywU6X7

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Solana (@solana) August 5, 2025

BREAKING from @SECGov:

Exciting news for the cryptocurrency community! The U.S. Securities and Exchange Commission (SEC) has officially stated that liquid staking activities and tokens are not considered securities. This announcement has ignited a wave of enthusiasm among crypto enthusiasts, particularly those invested in platforms like Solana. The implications of this ruling could reshape the landscape for liquid staking and its associated tokens in a big way!

What is Liquid Staking?

Before diving into the significance of this SEC announcement, let’s clarify what liquid staking is. In the world of cryptocurrencies, staking involves locking up tokens to support a network’s operations, such as validating transactions. Liquid staking, however, allows you to stake your tokens while still retaining liquidity. This means that you can use the staked tokens in other transactions or investments, which is a pretty cool feature for traders and investors alike.

Why This Announcement Matters

The SEC’s declaration that liquid staking activities and tokens are not considered securities is a major win for the crypto community. For many, this means that these tokens won’t be subjected to the same regulatory scrutiny as securities, which can often be a cumbersome process. By clarifying this distinction, the SEC is essentially giving liquid staking a green light to flourish without the fear of heavy regulation.

For example, platforms that allow users to engage in liquid staking can continue to innovate and expand their offerings without the constant worry of meeting the securities compliance requirements. This is particularly important for decentralized finance (DeFi) projects that rely on the flexibility and efficiency that liquid staking provides.

Impact on the Market

As news of this announcement spreads, we can expect to see a positive ripple effect across the cryptocurrency market. Investors may feel more confident diving into liquid staking projects, knowing that they won’t face the same potential pitfalls associated with securities. This increased confidence can lead to more investments and, ultimately, a surge in innovation within the sector.

Moreover, this ruling could inspire other regulatory bodies worldwide to follow suit, recognizing the unique nature of cryptocurrencies and their applications. As the market grows, so too does the need for clear guidelines that foster innovation while protecting investors.

Community Reactions

The response from the crypto community has been overwhelmingly positive. Following the announcement, many users took to social media platforms, including Twitter, to express their excitement. The tweet from Solana, which shared the SEC’s statement, has been met with numerous enthusiastic reactions. It’s clear that the community sees this as a pivotal moment for liquid staking and the broader DeFi ecosystem.

Looking Ahead

As we move forward, it will be interesting to see how this announcement influences the regulatory landscape and market dynamics. The SEC’s decision could be a catalyst for further developments in liquid staking, encouraging more users to participate and explore what this innovative financial tool can offer.

In summary, the SEC’s determination that liquid staking activities and tokens are not considered securities opens up new avenues for growth and development in the cryptocurrency space. As the community rallies around this positive news, the future looks bright for liquid staking and its potential to reshape how we interact with digital assets.