BlackRock’s Crypto Fire Sale: What Happens Next? — cryptocurrency market news, BlackRock crypto investment strategy, major cryptocurrency sell-off 2025

BlackRock to Sell $372M in Ethereum and $292M in Bitcoin

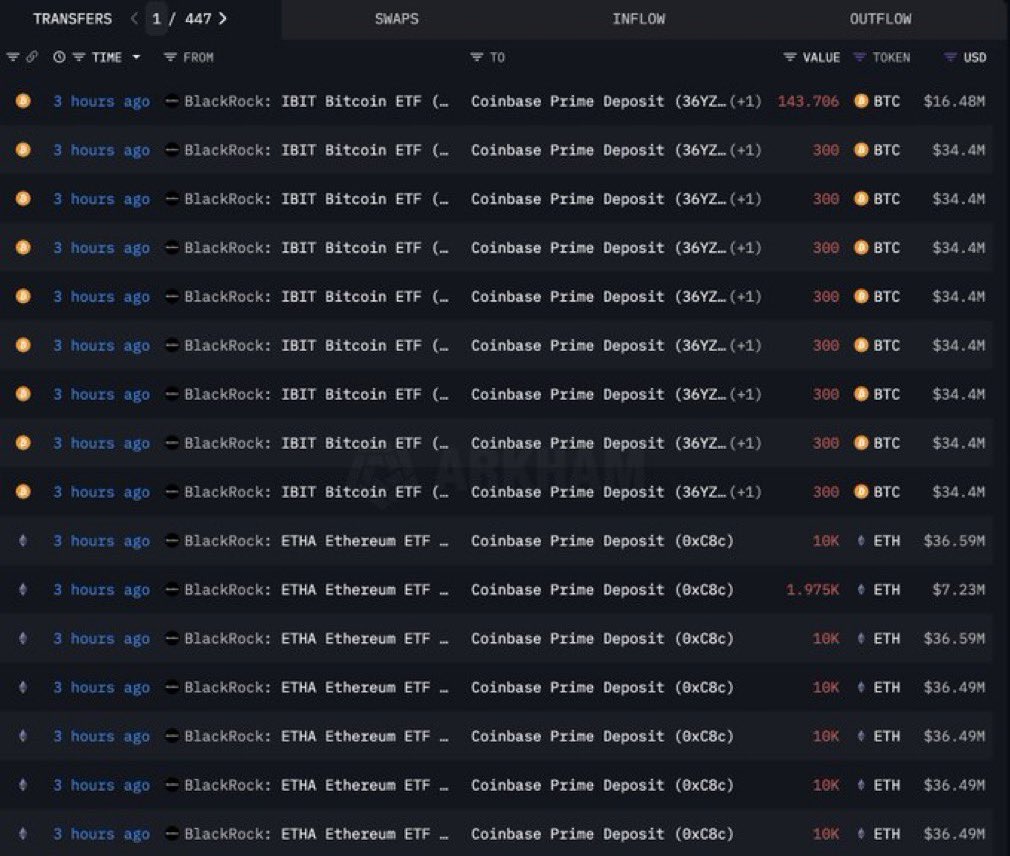

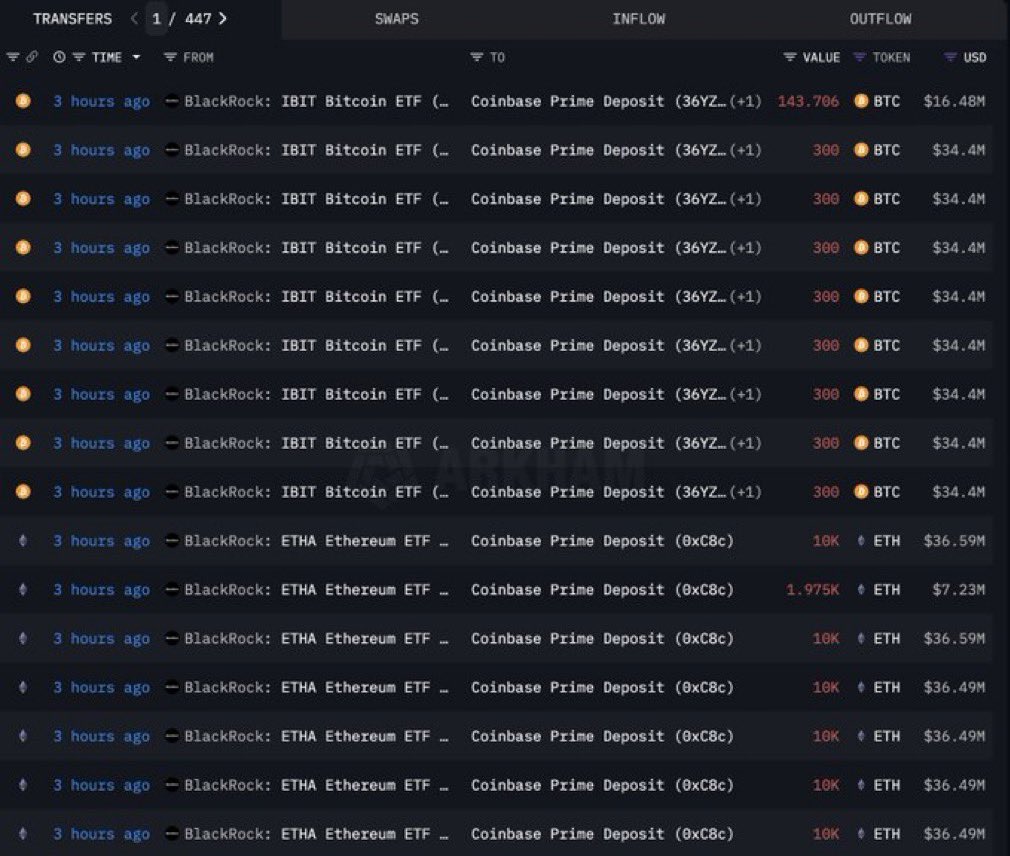

In a significant market development, BlackRock is set to sell 101,975 Ethereum (ETH) valued at approximately $372 million and 2,544 Bitcoin (BTC) worth around $292 million. This move has created waves in the cryptocurrency community, drawing attention to the potential impact on the market. Investors and analysts are closely monitoring the situation, as BlackRock’s actions could influence crypto prices and investor sentiment. As one of the largest asset management firms, BlackRock’s decisions carry weight, making this a crucial moment for both ETH and BTC. Stay updated on the latest crypto news for further insights.

BREAKING:

BLACKROCK IS ABOUT TO SELL 101,975 $ETH ($372M) AND 2,544 $BTC ($292M). pic.twitter.com/2rPQX89wNr

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Crypto Rover (@rovercrc) August 5, 2025

BREAKING:

In a major move that’s sending ripples through the cryptocurrency market, BlackRock is set to sell a staggering 101,975 Ethereum ($372 million) and 2,544 Bitcoin ($292 million). This announcement has caught the attention of investors and crypto enthusiasts alike, raising questions about the potential impact on the market landscape.

BLACKROCK IS ABOUT TO SELL 101,975 $ETH ($372M) AND 2,544 $BTC ($292M).

The reaction to this news has been mixed. On one hand, some market analysts are concerned that such a large sell-off could lead to a decrease in prices for both Ethereum and Bitcoin. After all, when a major player like BlackRock moves significant amounts of cryptocurrency, it can affect supply and demand dynamics. On the other hand, some believe this could be a strategic move by BlackRock to capitalize on current market conditions. They might be looking to reinvest in other assets or even to buy back into crypto at a lower price later on.

The Context Behind BlackRock’s Move

To understand why BlackRock is making such a bold move, it’s important to consider the broader context of the cryptocurrency market. Over the past few years, institutional interest in cryptocurrencies has surged. Companies like BlackRock, which manage trillions of dollars in assets, have started to dip their toes into this volatile yet potentially lucrative market.

By selling off a significant portion of their cryptocurrency holdings, BlackRock could be positioning itself to navigate the market’s ups and downs more effectively. Institutional investment remains a powerful force in the crypto space, and moves like this one can signal shifts in sentiment that may influence retail investors as well.

The Potential Market Impact

Investors are understandably anxious about what this sell-off could mean for prices. If BlackRock’s sale triggers a wave of panic selling among other investors, we could see a significant drop in the value of both Ethereum and Bitcoin. However, if the market absorbs this news without much reaction, it could indicate that the cryptocurrency market has matured and is less susceptible to large trades.

Additionally, some experts argue that BlackRock’s decision to sell might actually create buying opportunities for savvy investors looking to enter the market at a lower price. This could lead to a rebound in prices after an initial dip, especially if demand remains strong.

What’s Next for Crypto Investors?

As the situation unfolds, it’s crucial for crypto investors to stay informed and be prepared for volatility. Watching how the market reacts to BlackRock’s decision will be key. With the crypto landscape constantly evolving, keeping an eye on major institutional moves can provide insights into future trends and potential investment strategies.

In the end, whether you’re a seasoned investor or a newcomer to the crypto scene, understanding the implications of significant transactions like BlackRock’s is essential. So, keep your eyes peeled, and let’s see how this plays out!