Rate Cut Hysteria: Is the Fed’s September Pivot Imminent? — Rate cut predictions, Federal Reserve interest rate outlook, September monetary policy changes

Fed Rate Cut Probability Rises to 89.1%

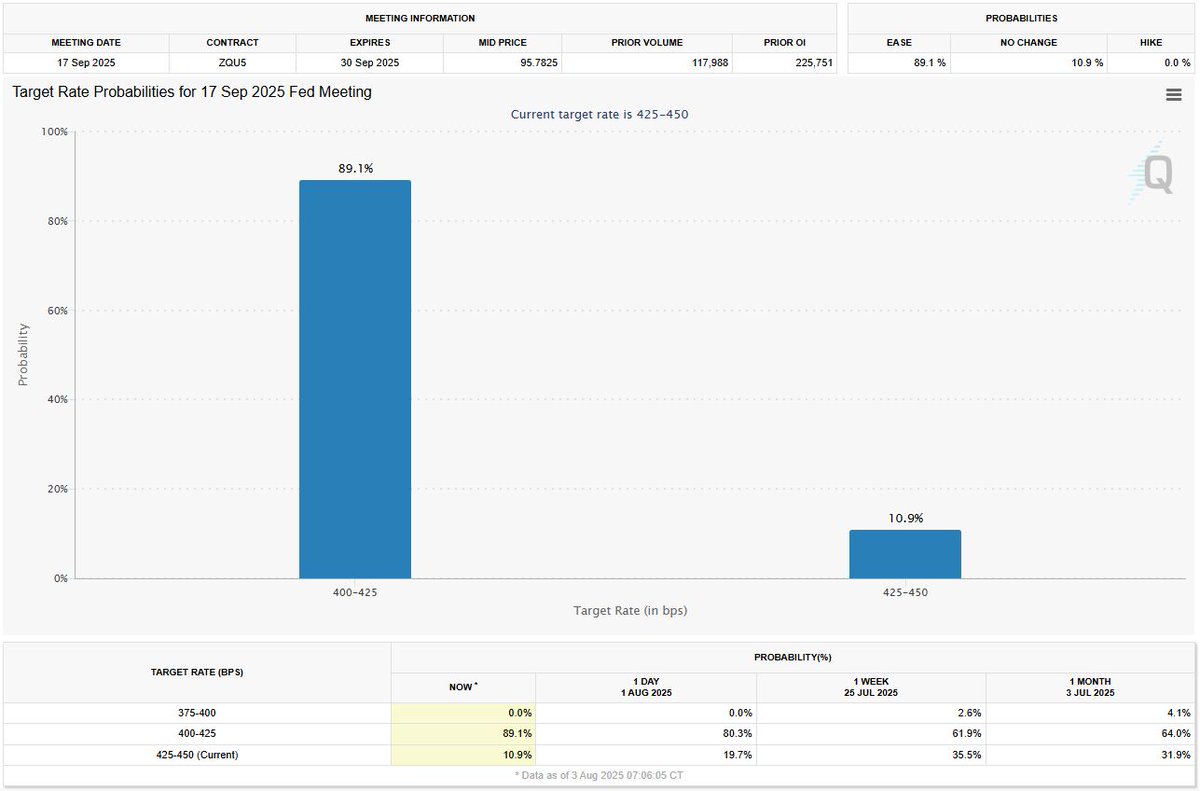

Recent market analysis indicates a significant increase in the likelihood of a Federal Reserve interest rate cut, now standing at 89.1% for September. This marks a notable rise from 80% just a day prior, and a dramatic jump from 62% the previous week. The rapid acceleration in rate cut momentum suggests a renewed focus on potential policy changes, prompting investors to closely monitor the situation. As the financial landscape evolves, the implications of these potential rate cuts could significantly impact market dynamics and investment strategies. Stay informed on the latest developments in monetary policy.

BREAKING: Markets now pricing in an 89.1% chance the Fed cuts rates in September.

That’s a jump from 80% just one day ago and 62% last week.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Rate cut momentum is accelerating fast. The pivot watch is back on. pic.twitter.com/2uTMNbWWE1

— CryptosRus (@CryptosR_Us) August 4, 2025

BREAKING: Markets now pricing in an 89.1% chance the Fed cuts rates in September.

If you’ve been keeping an eye on the markets, you might have noticed some pretty exciting changes lately! With the latest reports indicating an **89.1% chance that the Fed will cut rates in September**, it’s clear that traders are feeling optimistic. This figure is quite a leap from just 80% a day ago and a mere 62% last week. It’s like the market has suddenly woken up and is ready to party!

But what does this mean for you and your investments? Well, when the Fed cuts rates, it often leads to lower borrowing costs. This can stimulate spending and investment, which is great for the economy. If you’re thinking about buying a new home or making a significant investment, lower interest rates can make all the difference.

That’s a jump from 80% just one day ago and 62% last week.

The rapid shift in expectations is a clear indicator that **rate cut momentum is accelerating fast**. Investors are reacting to various economic signals, and it seems that many are betting on a more accommodative monetary policy. The Fed’s decisions can ripple through the economy, affecting everything from consumer confidence to stock market performance. You might want to keep an eye on how these changes could impact your financial decisions.

As you might expect, news like this can lead to increased volatility in the stock market. Traders are trying to anticipate how the Fed will respond to inflation and growth concerns, and that can lead to some wild swings in stock prices. When rates are expected to be cut, stocks generally get a boost as investors feel more confident about the future.

Rate cut momentum is accelerating fast.

What’s particularly fascinating is how quickly sentiment can shift in financial markets. One day, you may see a relatively stable outlook, and the next, traders are all-in on a rate cut. This rapid change shows just how closely the market is watching the Fed’s every move. If you’re invested in stocks or other assets, you might want to stay informed about economic indicators and news that could impact your investment strategy.

Notably, the **pivot watch is back on.** This phrase refers to the market’s anticipation of a shift in the Fed’s policy stance. Traders are keenly aware that every statement from the Federal Reserve can provide clues about future rate cuts or hikes. As we approach September, expect analysts and financial commentators to dissect every word from Fed officials.

The pivot watch is back on.

In conclusion, if you’re trying to navigate this rapidly changing landscape, it’s crucial to stay informed and be proactive. Understanding the implications of a potential rate cut can help you make better investment choices. Whether you’re a seasoned investor or just starting, being aware of these economic shifts can empower you to act strategically.

So, keep your ears to the ground and stay updated. The financial world is buzzing, and with an **89.1% chance of a Fed rate cut** looming, there’s no shortage of opportunities on the horizon!