India’s Hidden Bitcoin Hoard: What Happens Next? — Bitcoin adoption in India, cryptocurrency retail investors, impact of Bitcoin ETFs 2025

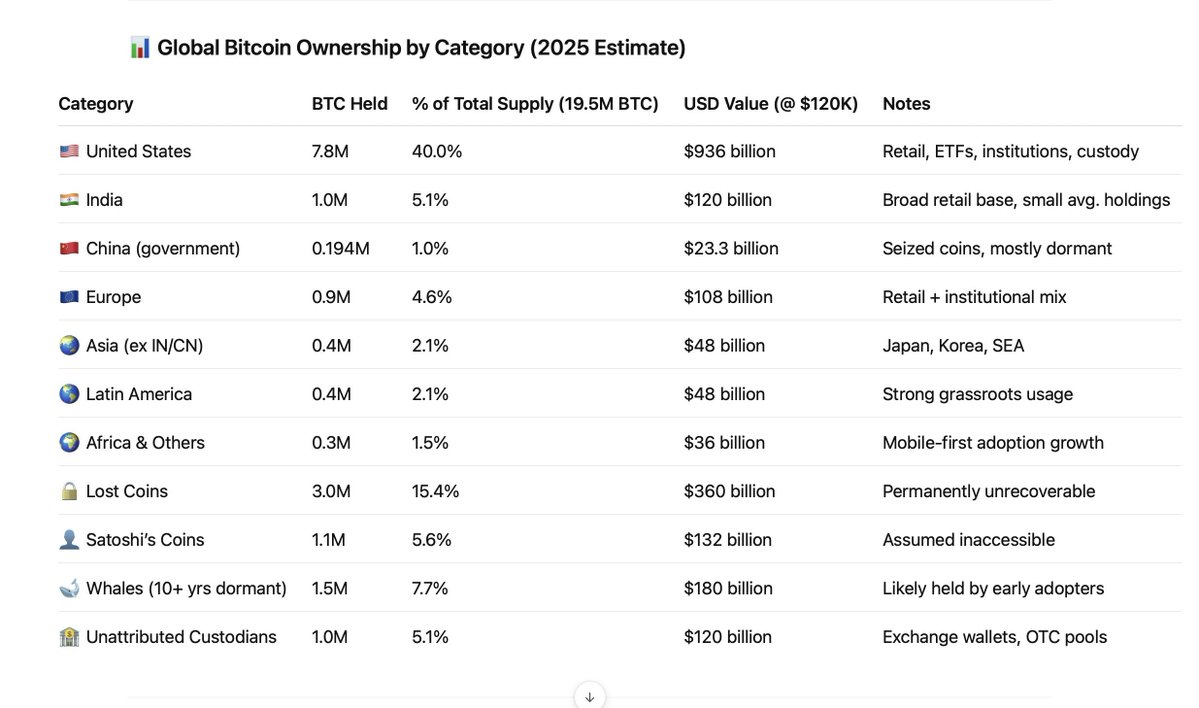

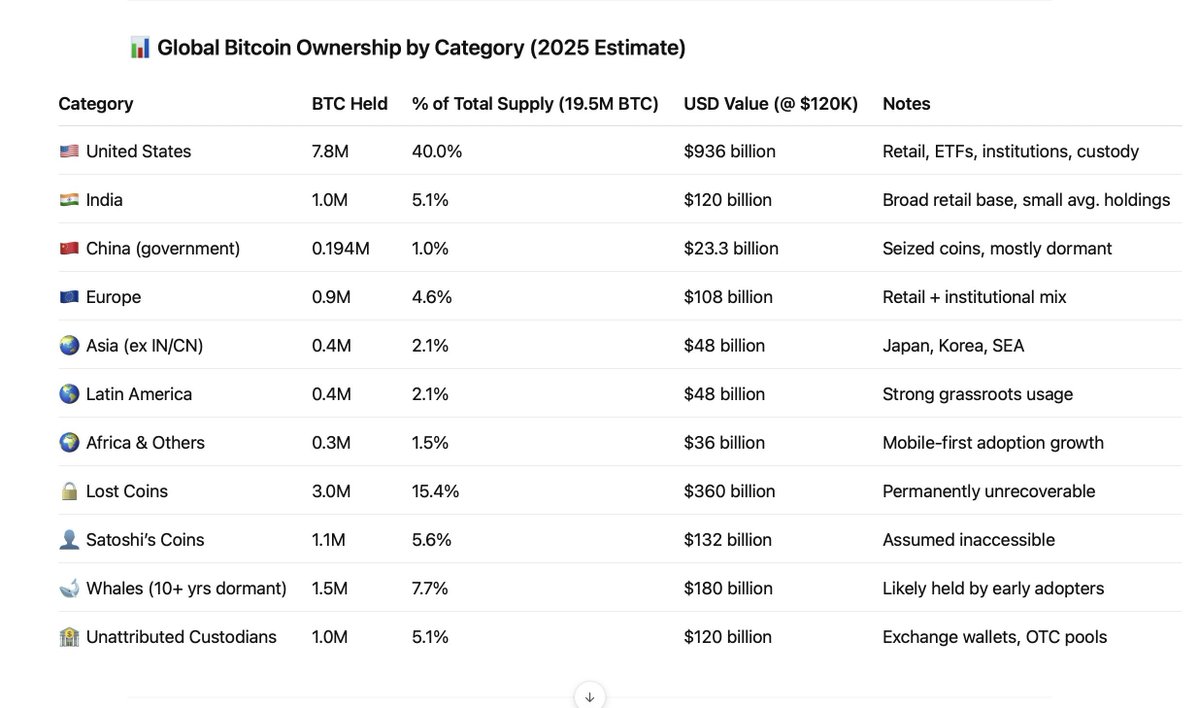

India is making headlines in the cryptocurrency world as it is estimated to hold 1 million Bitcoin, accounting for 5.1% of the global supply, positioning it second only to the United States. This significant holding is primarily concentrated in retail, with average holdings being relatively small. The potential impact of institutional investments and the introduction of Bitcoin ETFs could further boost India’s position in the crypto market. As the landscape evolves, India’s role in the global Bitcoin ecosystem will be pivotal. Stay updated on how these developments could shape the future of cryptocurrency in India and beyond.

BREAKING: India is estimated to hold 1 million Bitcoin, or 5.1% of the total supply, ranking second globally after the US.

Primarily held through retail with small average holdings.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Imagine the impact when ETFs and institutions enter the scene.

[h/t @dotkrueger] pic.twitter.com/M7Tmb7qSsN

— Crypto India (@CryptooIndia) August 4, 2025

BREAKING: India is estimated to hold 1 million Bitcoin, or 5.1% of the total supply, ranking second globally after the US.

Exciting news for crypto enthusiasts! India is now estimated to hold a whopping 1 million Bitcoin, making it the second-largest holder of Bitcoin worldwide, just after the United States. This revelation has sparked conversations across the globe about the future of cryptocurrency in India and its potential impact on the market. With 5.1% of the total Bitcoin supply in its possession, India is definitely making waves in the crypto space.

Primarily held through retail with small average holdings.

The majority of Bitcoin in India is primarily held by retail investors, which is quite fascinating. Most of these holdings come from individuals rather than institutions, resulting in smaller average holdings. This retail-driven market suggests that many everyday people are investing in Bitcoin, perhaps as a hedge against inflation or simply as a speculative investment. It’s interesting to think about how widespread access to Bitcoin trading platforms has made it easier for individuals to dive into cryptocurrency.

Imagine the impact when ETFs and institutions enter the scene.

Now, here’s where it gets even more intriguing. Just imagine the impact when exchange-traded funds (ETFs) and institutional investors begin to take a serious interest in Bitcoin in India. The potential for price growth and market stabilization could be monumental! As institutional money starts to flow into the crypto market, it may not only elevate Bitcoin’s price but also bring with it a level of legitimacy and stability that the market has been craving.

ETFs have already proven to be a game-changer in other markets. They provide a way for investors to gain exposure to Bitcoin without having to buy and store the cryptocurrency directly. If India sees the introduction of Bitcoin ETFs, it could pave the way for a new wave of investment and interest in crypto, making it accessible for even more people.

Moreover, institutional investment could significantly alter the landscape of Bitcoin ownership in the country. With larger players entering the fray, we could see a shift in how Bitcoin is viewed—not just as a speculative asset but as a legitimate part of investment portfolios. This evolving narrative around Bitcoin could attract even more retail investors, creating a virtuous cycle of investment and growth.

As we look ahead, it’s clear that India’s position as the second-largest holder of Bitcoin is just the beginning. The excitement surrounding Bitcoin ETFs and institutional investment brings with it endless possibilities for growth and innovation in the Indian crypto market. The future is bright for Bitcoin in India, and many are eager to see what comes next in this thrilling journey of digital currency.

For those wanting to stay updated on the latest developments, you can follow Crypto India on Twitter for real-time news and insights into the growing world of cryptocurrency.

“`