Gold Rush: Are Central Banks Preparing for Economic Collapse? — World gold purchases surge, Central bank gold buying trends, Record gold demand 2025

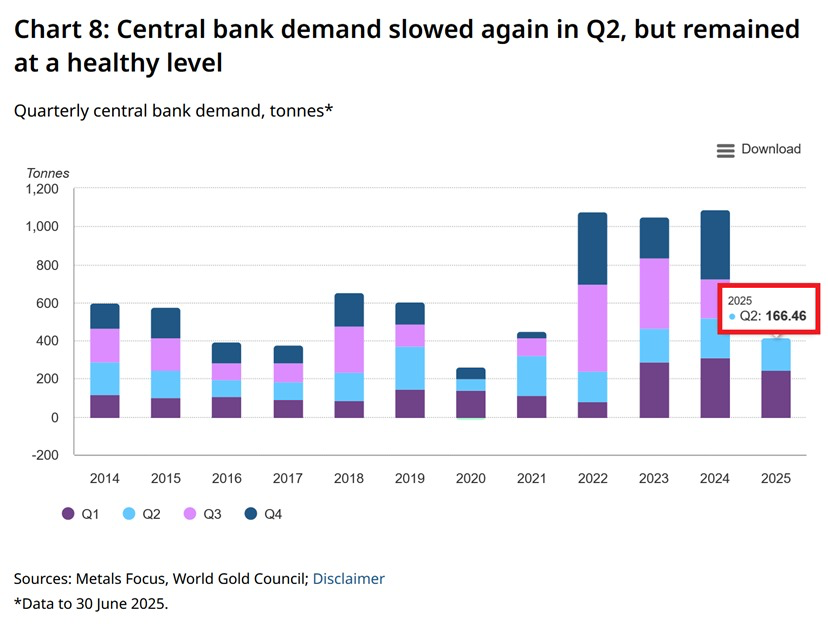

In a significant development, world central banks purchased an impressive 166.5 tonnes of gold in Q2 2025, marking a 41% increase over the average quarterly acquisitions from 2010 to 2021. This surge elevates total gold purchases in the first half of 2025 to 415 tonnes, making it the third-largest first half on record. Such robust demand highlights the ongoing trend of central banks bolstering their gold reserves as a hedge against economic uncertainties. As global financial landscapes evolve, the continued appetite for gold signifies its enduring value as a safe haven investment. Stay updated on gold market trends and central bank activities.

BREAKING: World central banks bought another 166.5 tonnes of gold in Q2 2025.

This is ~41% above the average quarterly purchase between 2010 and 2021.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This also brings total purchases in the first half of 2025 to 415 tonnes, the third-largest H1 on record.

Demand is likely to… pic.twitter.com/nVjY36haMe

— The Kobeissi Letter (@KobeissiLetter) August 4, 2025

BREAKING: World central banks bought another 166.5 tonnes of gold in Q2 2025

The latest news from the global financial scene is nothing short of fascinating. In Q2 2025, world central banks collectively purchased a staggering 166.5 tonnes of gold. This figure is remarkable, marking an increase of approximately 41% compared to the average quarterly purchase between 2010 and 2021. It’s clear that central banks are turning gold into a priority asset, and this trend raises some intriguing questions about the future of global finance.

This is ~41% above the average quarterly purchase between 2010 and 2021

The uptick in gold purchases isn’t merely a blip on the radar; it reflects a significant shift in how central banks view gold. Historically, gold has been a safe haven during turbulent economic times, and with increasing geopolitical tensions and inflation concerns, it’s no wonder that these institutions are investing heavily in it. This recent surge in buying is indicative of a broader strategy to bolster reserves and hedge against potential economic downturns. As financial analysts note, when central banks make such bold moves, it often signals their anticipation of more volatility ahead.

This also brings total purchases in the first half of 2025 to 415 tonnes, the third-largest H1 on record

When you add up the purchases from the first half of 2025, the total reaches an impressive 415 tonnes, making it the third-largest first half on record. This data is a strong indicator of the ongoing demand for gold as a secure investment. The first half of the year has seen central banks across various countries ramping up their buying activities, and this trend is likely to continue. With central banks favoring gold, investors should take note. It’s an opportune moment to consider how these purchases might influence gold prices and market dynamics.

Demand is likely to…

As demand for gold continues to rise, experts predict that this trend will not only persist but could also accelerate. Factors such as economic uncertainty, inflation fears, and even climate change considerations are pushing investors and central banks alike to seek refuge in gold. The precious metal has long been viewed as a reliable hedge against inflation, and with the current economic landscape, it’s becoming increasingly attractive.

With central banks leading the charge, the buying frenzy signifies a shift in investment strategy that could redefine financial norms. Investors are keenly watching how this increased demand impacts gold prices and the overall market. As history shows, when central banks are bullish on gold, it can lead to significant price movements.

For those interested in the implications of these purchases, keeping an eye on future reports and trends will be essential. The data coming from reputable sources like The Kobeissi Letter provides valuable insights into the evolving role of gold in the global economy. If you’re looking for a reliable way to navigate these waters, staying informed is key.

In summary, the substantial purchases of gold by world central banks are reshaping the landscape of financial security. As we look ahead, the implications of these actions will undoubtedly play a crucial role in how investors approach their strategies in the coming months. Keep watching, as this story continues to unfold.