BREAKING: METAPLANET SPENDS $53M ON 460 BITCOIN! Why? — Bitcoin investment news, cryptocurrency market surge, Metaverse financial transactions

MetaPlanet Acquires 460 Bitcoin for $53 Million

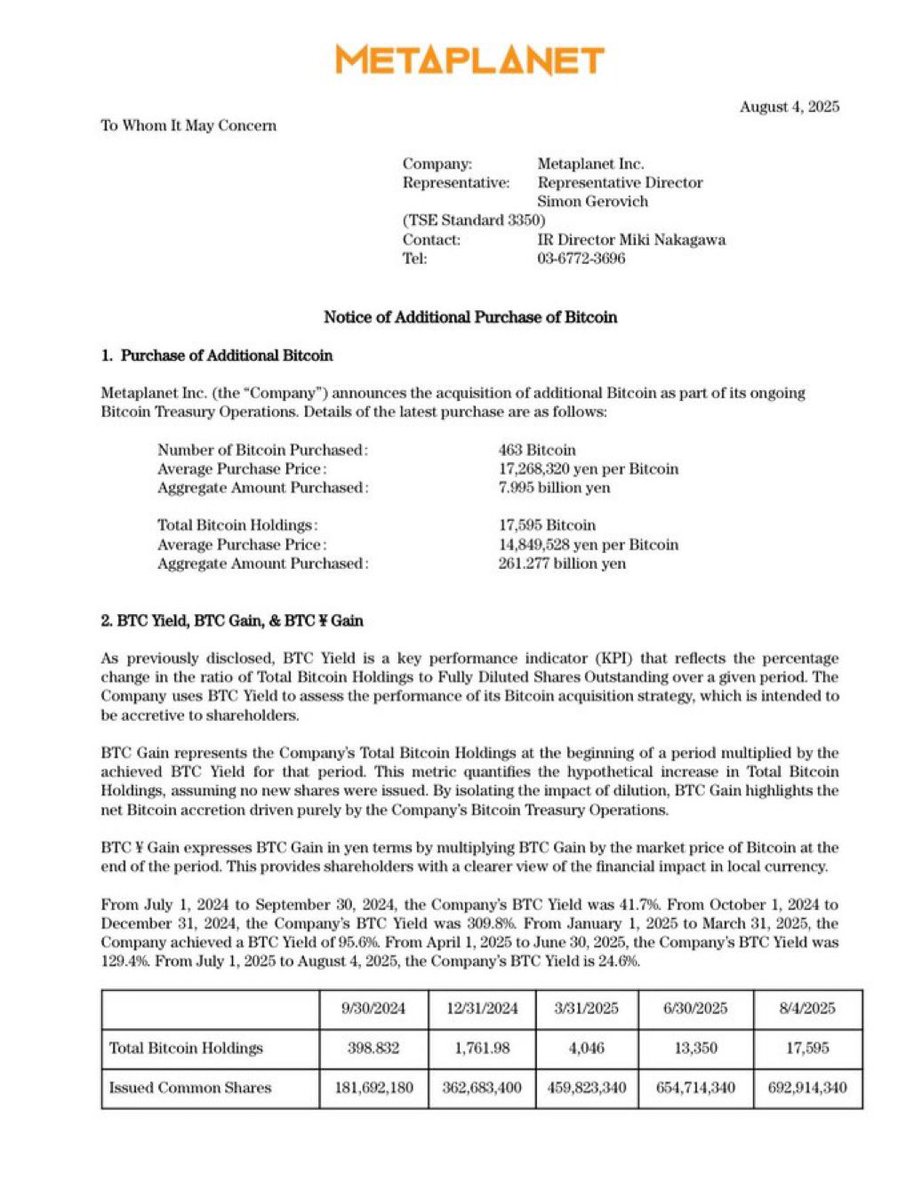

In a groundbreaking move, MetaPlanet has purchased over 460 Bitcoin, totaling an impressive $53 million. This significant acquisition highlights the growing interest in cryptocurrency investments and solidifies MetaPlanet’s position in the digital asset market. With Bitcoin’s continuous rise in popularity, this transaction could have substantial implications for both the company and the broader crypto community. As more entities recognize the value of Bitcoin, the demand for digital currencies is likely to increase. Stay updated on cryptocurrency trends and MetaPlanet’s future endeavors as they navigate this dynamic financial landscape.

BREAKING:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

METAPLANET JUST BOUGHT OVER 460 #BITCOIN FOR $53,000,000. pic.twitter.com/opyXz2kXtt

— Crypto Rover (@rovercrc) August 4, 2025

BREAKING:

Big news in the crypto world! METAPLANET just made headlines by purchasing over 460 BITCOIN for a staggering $53,000,000. This move has sent ripples through the market, sparking interest and speculation about what it means for Bitcoin’s future. The acquisition highlights the ongoing trend of institutional investment in cryptocurrency, which continues to gain momentum.

METAPLANET’s Bold Move

When a company like METAPLANET decides to invest such a significant amount in Bitcoin, it’s essential to consider the implications. This purchase isn’t just a casual investment; it shows confidence in Bitcoin as a long-term asset. With the recent fluctuations in the crypto market, some investors remain cautious, but METAPLANET’s bold move indicates they see potential for growth. The decision to acquire over 460 BTC suggests they believe in Bitcoin’s resilience and its ability to appreciate over time.

The Impact on the Bitcoin Market

With METAPLANET’s recent investment, many are curious about how this will influence the Bitcoin market. Historically, large purchases like this can lead to increased prices as demand rises. Investors often follow the lead of significant players, and METAPLANET’s confidence might encourage others to jump in. Additionally, this kind of investment can attract media attention and spark discussions about Bitcoin’s legitimacy as an asset class. As more institutional players enter the space, it may further legitimize cryptocurrencies in the eyes of the general public.

Why Bitcoin?

So, what’s the allure of Bitcoin? Many investors are drawn to its decentralized nature and the potential for high returns. Bitcoin has been dubbed “digital gold,” and for a good reason. It offers a hedge against inflation and geopolitical instability, making it appealing during uncertain times. Moreover, with a finite supply of 21 million coins, Bitcoin’s scarcity can drive demand and value over time. METAPLANET’s investment reflects a broader trend where companies and individuals alike are recognizing these benefits.

Looking Ahead

As we look towards the future, it’s clear that METAPLANET’s acquisition is just one piece of a much larger puzzle. The cryptocurrency landscape is evolving rapidly, with new players entering the market and existing ones expanding their portfolios. Whether you’re a seasoned investor or just starting, it’s essential to stay informed about these developments. Following trusted sources can help you navigate this exciting but often volatile space. For the latest updates, you can check out insights from cryptocurrency experts like those on @Crypto Rover.

Join the Conversation

The dialogue surrounding METAPLANET’s recent Bitcoin purchase is just beginning. How do you feel about institutional investments in cryptocurrency? Do you think this will influence the market positively? Engaging with fellow crypto enthusiasts can provide valuable insights and enhance your understanding of this dynamic industry. Whether you’re bullish or bearish on Bitcoin, one thing’s for sure: the conversation is far from over!